Buffett's Berkshire Hathaway Has Made A Surprise Bet On Google

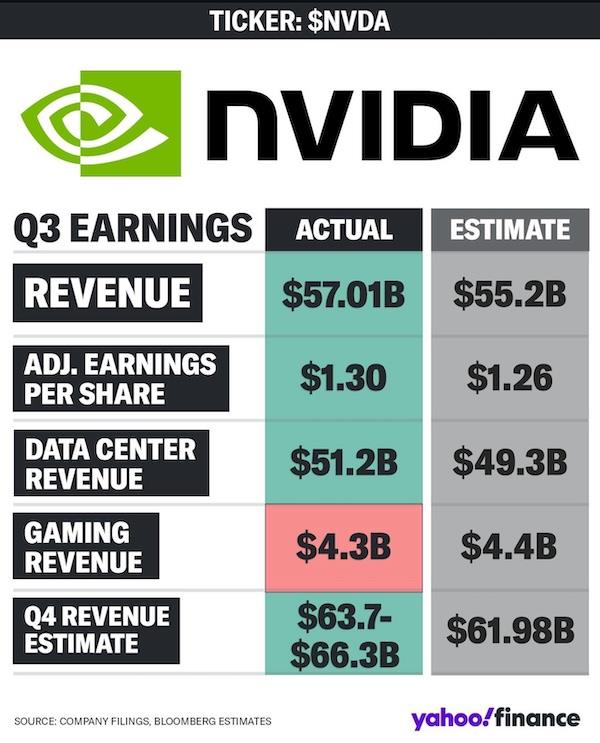

The better than expected results calmed global investors' jitters following a tumultuous week for Nvidia and broader worries about the artificial intelligence (AI) bubble bursting.

Just weeks ago, Nvidia became the first company valued at more than $US5 trillion – surpassing others in the“magnificent seven” tech companies: Alphabet (owner of Google), Amazon, Apple, Tesla, Meta (owner of Facebook, Instagram and Whatsapp) and Microsoft.

Nvidia stocks were up more than 5% to $196 in after-hours trading immediately following the results.

Over the past week, news broke that tech billionaire Peter Thiel's hedge fund had sold its entire stake in Nvidia in the third quarter of 2025 – more than half a million shares, worth around $US100 million.

But in that same quarter, an even more famous billionaire's firm made a surprise bet on Alphabet, signalling confidence in Google's ability to profit from the AI era.

Based in Omaha, Nebraska in the United States, Berkshire Hathaway is a global investing giant, led for decades by 95-year-old veteran Warren Buffett.

Berkshire Hathaway's latest quarterly filing reveals the company accumulated a US$4.3 billion stake in Alphabet over the September quarter.

The size of the investment suggests a strategic decision – especially as the same filing showed Berkshire had significantly sold down its massive Apple position. (Apple remains Berkshire's single largest stock holding, currently worth about US$64 billion.)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment