(

MENAFN- Daily Forex) Uniswap's UNI token has regained stability after a volatile week, climbing back above $7.20 and showing early signs of a momentum shift. Traders are watching closely to see whether UNI is forming a short-term bottom or simply pausing before another leg lower within its broader mid-term downtrend Price Attempts a Recovery Above $7.20

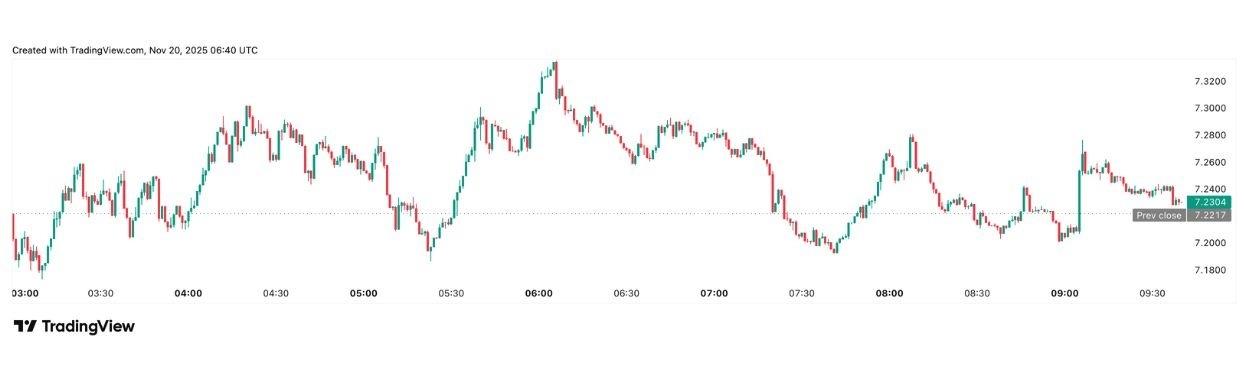

UNI Price | Source: TradingView

After dipping into the $6.80 to $6.90 region earlier this week, UNI has bounced off support and moved back into the mid-$7 range. Today, the token is trading around $7.23, essentially flat on the day, but the price has tightened into a consolidation pattern that often precedes a larger move.

The daily range has stretched from a low near $6.82 to a high near $7.39, showing that volatility has cooled but not disappeared. Volume has also normalized after the heavy sell-off on November 19, indicating panic has subsided and short-term liquidity has returned Holds Above the 20-Day Average and Faces 50-Day Resistance

UNI's trend structure is sending a mixed signal. The price is now holding above the 20-day simple moving average near $7.14, which suggests strengthening short-term momentum.

However, the 50-day simple moving average, sitting around $7.30, remains a firm layer of resistance directly overhead.

Trading above the 20-day average shows that the immediate pressure has eased, but until the price can break above the 50-day average and hold there, the market cannot confirm a meaningful trend reversal.

For many trend-following traders, this mid-term level acts as the dividing line between a corrective bounce and a true shift toward recovery Signals Neutral Momentum

The daily Relative Strength Index is hovering around 55, indicating neutral momentum across the board. This reading shows that neither buyers nor sellers are in control, and the market is in a wait-and-see phase.

An RSI in the mid-50s often appears when conditions are stabilizing after a sell-off. If RSI begins pushing toward the 60s while the price ticks higher, it would signal that bullish momentum is building in a sustainable way rather than emerging from a brief oversold reaction Flattens Near Zero

UNI's MACD is sitting close to the zero line, with the MACD line near –0.015. This nearly stagnant reading shows that the prior bearish momentum has faded, but a bullish reversal has not yet appeared.

When MACD flattens like this, it usually reflects a market preparing for a decisive shift in either direction. Traders will be watching the histogram closely for the first clear expansion in positive or negative territory Levels Define a Potential Breakout Zone

If UNI can maintain its recovery and push higher, the next significant hurdles are concentrated in a tight band. The first test sits around $7.40, which has acted as a notable resistance level during recent swings.

If UNI pushes through that region with conviction, the next challenge emerges near $8.00 to $8.05, an important cluster of structural resistance and a major retracement level from earlier declines.

Top Forex Brokers1 Get Started 74% of retail CFD accounts lose money

A daily close above $8 would be the strongest sign yet that UNI has transitioned from consolidation into a full trend reversal. Traders who follow swing structures often watch this zone for confirmation Levels to Watch if UNI Weakens

If the price fails to advance, the first level that will come under pressure is the 20-day moving average near $7.10. Losing that level would place focus back on the $6.80 to $6.90 region, where buyers stepped in earlier this week.

A deeper decline toward $6.50 would be more significant, as this level has served as a structural floor for the past several sessions. A breakdown below $6.50 would invalidate the current recovery structure and increase the likelihood of a return to lower lows, especially if broader market sentiment deteriorates.

EURUSD Chart by TradingViewFinal Thoughts

Current sentiment around UNI is cautiously constructive. Altcoin activity has improved this week, DeFi liquidity metrics have begun to stabilize, and the broader crypto market appears to be digesting Bitcoin's recent volatility.

However, macro risk remains a factor. Rising Bitcoin dominance or a sudden shift in risk appetite could quickly affect UNI's progress. At a fundamental level, Uniswap continues to be one of the most important pillars in the DeFi ecosystem, and its underlying strength is likely contributing to the formation of a price floor.

Even so, price action remains the final arbiter, and UNI still needs to clear major resistance levels before traders can call this bounce a genuine trend reversal.

Ready to trade our analysis of UniSwap? Here's our list of the best MT4 crypto brokers worth reviewing

.

MENAFN20112025000131011023ID1110375317

Comments

No comment