Softbank's Nvidia Dump Signals Return Of 'The Big Short'

The popular theory is that Japan's richest man is selling his stake - savvily pocketing US$5.8 billion - to bankroll other artificial intelligence (AI) investments.

It follows that Son isn't making a statement about Nvidia's future so much as reacting to SoftBank's constraints. Son, the thinking goes, is merely freeing liquidity to go big on the next boom in the AI capital cycle.

Yet it's hard not to see Son's exit as a statement on the super-pricey valuations of all too many AI-focused companies. Especially since this follows more and more investors questioning if the AI space is experiencing bubble troubles.

The broader market is questioning the dot-com era déjà vu being triggered by the AI craze, as evidenced by recent volatility. Here, Michael Burry's return to the headlines is hardly a welcome development for AI true believers.

The investor made famous by Michael Lewis'“The Big Short” is betting against AI. He's doing so based, in part, on his contention that some top tech companies are padding AI-related profits via creative accounting. Specifically, Burry thinks“hyperscalers,” or tech giant companies building gargantuan data centers, are underestimating depreciation.

“Understating depreciation by extending useful life of assets artificially boosts earnings - one of the more common frauds of the modern era,” Burry wrote on social media.“Massively ramping capex through purchase of Nvidia chips/servers on a 2-3 year product cycle should not result in the extension of useful lives of compute equipment. Yet this is exactly what all the hyperscalers have done.”

Goldman Sachs strategist Dominic Wilson sees uncomfortable echoes with the early 2000s dot-com bubble burst in the early 2000s. Though the AI frenzy might not yet be at 1999 levels, the odds are inflating in real time.

“We see a growing risk that the imbalances that built up in the 1990s will become more visible as the AI investment boom extends,” Wilson says.“There have been echoes of the inflection point in the 1990s boom lately.”

Latest stories

Thai-Cambodia ceasefire collapse shows limits of Trump peacemaking

Bill Gates drops a climate bomb on COP30

Cybernetic bridge between US and China in AI

Looking back two-plus decades, Wilson notes, corporate profits reached a peak around 1997, just before the crash.“Profitability peaked well before the boom ended,” he says.“While reported profit margins were more robust, declining profitability in the macro data in the later years of the boom came alongside accelerating equity prices.”

The combination of“rising investment and falling profitability pushed the corporate sector financial balance - the difference between savings and investment - into deficit,” Wilson notes.

Fast-forward to 2025, says Jared Bernstein, former head of the US Council of Economic Advisers, and the gap between AI earnings potential and spending“certainly looks bubbly.”

David Rosenberg, president of Rosenberg Research, notes that“all of a sudden, we are starting to see some tech heavyweights fail to live up to investor expectations. Even a company like Palantir has seen its share price hammered, even though its results did top expectations - nosebleed valuations got in the way.”

This isn't the conventional wisdom, of course. As Wedbush analyst Dan Ives puts it:“In my view, [the selloff] is short-lived. I don't believe this is a start of a more structural selloff. I think it's just a lot of nervous, sort of white knuckles and the selloff that we saw... along with the selloff that we've seen crypto and others, it was just a massive risk off.”

Alex Karp, CEO of Palantir Technologies, one of the companies Burry's Scion Asset Management is shorting along with Nvidia, called the trade“super weird” and“batsh*t crazy.” Yet, as Burry puts it:“Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.”

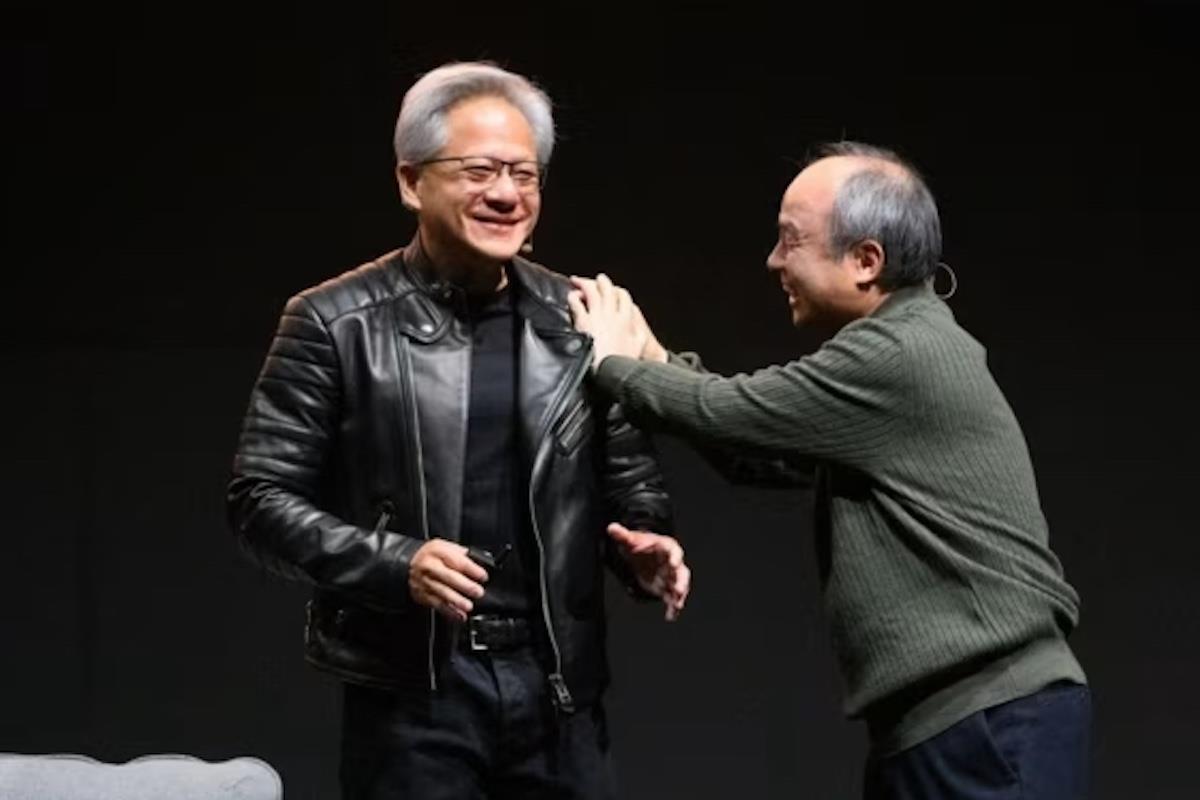

But Son's pivot might be the most interesting about-face of all. Son has long been at the forefront of investing in the“singularity,” or the moment when computers outthink humans, a milestone that's fascinated futurists since the days of Isaac Asimov and Arthur C. Clarke.

This is a tantalizing move by a man who claims to operate on a 300-year time horizon. Son, after all, fancies himself positioning SoftBank for the centuries ahead.

Son has often referred to himself as the“crazy guy who bet on the future.” In February, Son joined US President Donald Trump, Sam Altman of OpenAI and Larry Ellison of Oracle in announcing a $500 billion investment in a project to develop AI called Stargate.

Another way of looking at SoftBank's Nvidia sale, of course, is as a contrarian indicator. In recent years, Son has been better known for his investment misses than his successes. Among Son's biggest misses was being the most extravagant supporter of WeWork.

Son erred spectacularly by giving founder Adam Neumann a blank check for his fanciful strategy of building an office-sharing ecosystem in the image of Apple Inc. Moreover, Son's penchant for overpaying for stakes in undeserving startups warped venture capital incentives everywhere and loaded SoftBank's balance sheet with excessive risk.

By late 2021, SoftBank was suffering its worst decline since 2006. As Son said in November 2021:“We are in the middle of a blizzard” of red ink. It was quite a contrast from a year earlier when Son said the Vision Fund was the goose laying“golden eggs.”

SoftBank's Vision Fund has stabilized since then. Yet Son is still struggling to regain the Warren Buffett vibe on which he's been dining out for the last decade. In 2000, Son had the remarkable foresight to hand $20 million to an obscure English teacher in Hangzhou.

By the time Jack Ma took Alibaba public in New York in 2014, SoftBank's stake was worth more than $50 billion. The feat earned Son a reputation as the Buffett of Japan. The launch of his Vision Fund in 2017 was an attempt to replicate that success over and over again.

The current AI boom would seem to be Son's big moment. His stepping away from Nvidia could indeed herald the next phase of the AI era. Count Paul Golding, head of tech research at Macquarie Bank, among those who are bullish on Son's Nvidia sale, rating SoftBank“outperform.”

Sign up for one of our free newsletters

-

The Daily Report

Start your day right with Asia Times' top stories

AT Weekly Report

A weekly roundup of Asia Times' most-read stories

Golding writes that“this print continues to build on [SoftBank's] growth pivot, investing in leading AI and automation companies, delivering strong underlying fundamentals, and benefiting from thematic/secular tailwinds for its equity holdings, and the resilience of its balance sheet.”

Yet Son also could be smelling big trouble in AI town. One question is where the next wave of opportunities might be found. It could just as easily be in China as in Silicon Valley.

The AI-verse has never been the same since the“DeepSeek shock” back in January. The shockwaves the Hangzhou-headquartered company sent through global markets generated the best headlines Xi Jinping's economy has had in a long while. Then came news that Alibaba is going big on AI.

The sudden arrival of Made-in-China sensation DeepSeek pulled the rug out from under Wall Street's“Trump trade” party. That excitement was based on Trump's enthusiasm for AI, one shared with his benefactor Elon Musk. Then came Alibaba, bursting back onto the global scene with an ambition that's also catching global investors off guard.

The DeepSeek/Alibaba rally may have legs thanks to Xi's decision to, in the words of economist Stephen Jen,“make Chinese equities investible again,” starting with tech platforms.

Jen, CEO of Eurizon SLJ Asset Management, says that“in many ways, this is a call for a continued bounce-back in a long-depressed and unpopular market. For a change, though, there are now many more reasons to be positive than negative on Chinese equities and China in general.”

Can the same be said of SoftBank's prospects as Son steps away from a $4.7 trillion company at the center of what's either a once-in-a-century revolution or an asset bubble for the record books.

Follow William Pesek on X at @WilliamPesek

Sign up here to comment on Asia Times stories Or Sign in to an existing accounThank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

-

Click to share on X (Opens in new window)

Click to share on LinkedIn (Opens in new window)

LinkedI

Click to share on Facebook (Opens in new window)

Faceboo

Click to share on WhatsApp (Opens in new window)

WhatsAp

Click to share on Reddit (Opens in new window)

Reddi

Click to email a link to a friend (Opens in new window)

Emai

Click to print (Opens in new window)

Prin

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment