Strong Currency Keeps Hungarian Inflation At Bay

| 4.3% |

Headline inflation (YoY)

ING estimate 4.4% / Previous 4.3% |

According to recent data released by the Hungarian Central Statistical Office (HCSO), the average price level remained unchanged in October, as it had been in both August and September. This figure was slightly below market expectations. Not only is the level unchanged, but the year-on-year index also remained at 4.3% in October. This means that the rate of yearly price increases has remained at this level for four straight months.

However, despite the recent stagnation in inflation, the indicator remains above the central bank's 3% price stability target. Consequently, even after three years of economic stagnation and multiple government measures to curb inflation, Hungary continues to grapple with persistent price stability challenges.

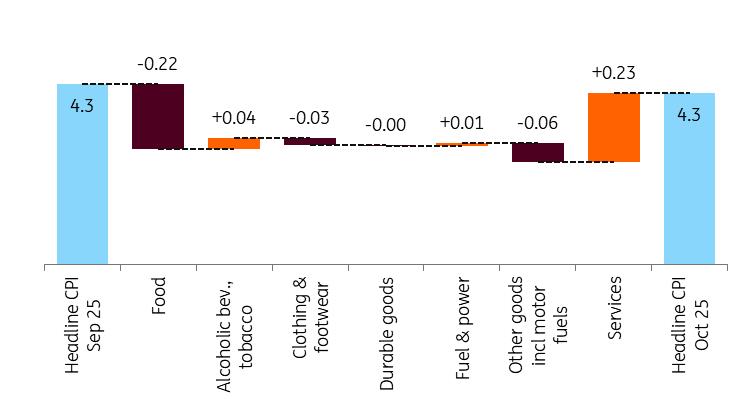

Main drivers of the change in headline CPI (%)

Source: HCSO, ING The details

-

Food prices decreased by 0.1% compared to the previous month. This is particularly interesting given that food inflation caused an unpleasant surprise in October. In our view, this discrepancy may reflect the impact of the strengthening forint.

The strength of the forint is keeping the price of durable consumer goods under control, just as it was one month ago. However, jewellery prices increased significantly due to rising gold and silver prices on the global market.

As in the previous month, clothing prices rose sharply in October due to seasonal trends. The increase in material costs was reflected in the final prices of finished products last month.

As expected, due to usual seasonal price fluctuations, prices for services remained unchanged compared to the previous month. Services remained the main driver of year-on-year inflation, as the low base caused the yearly price increase to rise to 6.7%.

Household energy continues to experience low double-digit inflation, which significantly contributes to overall inflation, as does the year-on-year increase in the price of alcoholic beverages and tobacco products.

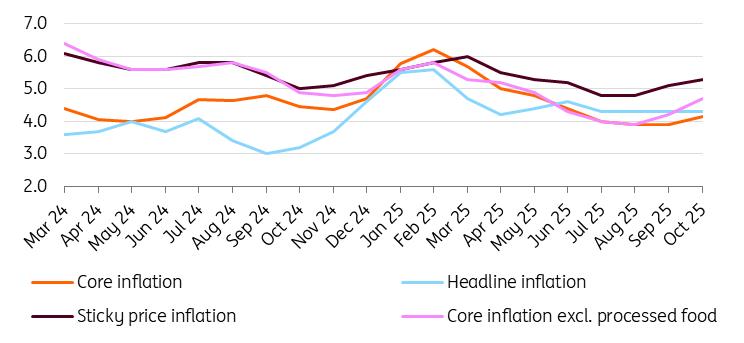

Source: HCSO, ING Core inflation rose above 4%

The overall inflationary picture is not helped by the fact that core inflation has accelerated again on a year-on-year basis, reaching 4.2%. This is partly due to normal monthly repricing (0.2% month-on-month) and partly due to last year's low base. Consequently, this indicator, which captures fundamental price trends, also does not align with the National Bank of Hungary's price stability target. Furthermore, the central bank's own underlying price indicators have also increased.

However, it can still be said that the low monthly price changes seen in recent months do not significantly alter households' inflation expectations. Although there are signs of moderation, these are not enough to be reassuring, and high price expectations make it difficult for the central bank to reach the 3% inflation target in the short term. High expectations are therefore inconsistent with the objective of price stability.

Headline and underlying inflation measures (% YoY)

Source: HCSO, ING Next year will start with a dip, but still no space for cuts

Looking ahead, the inflation rate may fall in the coming months due to base effects. The exact figure at the end of the year will depend largely on the impact of the margin cap expansion, but it will certainly be well below 4%. This year, we can expect an average inflation rate of 4.4–4.5%. The path of inflation over the next two years will be significantly influenced by the existence and anticipated removal of margin caps. While the average inflation rate may be around 3.6% next year, it could be as low as 2% at its lowest point, with the peak at the end of the year expected to be in the range of 4.5–5.0%. Therefore, average inflation in 2027 is expected to rise again to around 4.3%. At the same time, the increased government deficit clearly carries an upward inflation risk for the coming years.

In light of this, the strict monetary policy stance and the unchanged base rate are certain to remain in place in the short term. There is an increasing chance that the benchmark rate will remain at 6.50% for most, if not all, of 2026. This is because the Hungarian economy may be hit by inflationary risks in the next year or two, such as higher deficits, government demand stimulus affecting households' financial situations, the abolition of price shield measures and the impact of double-digit minimum wage increases.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment