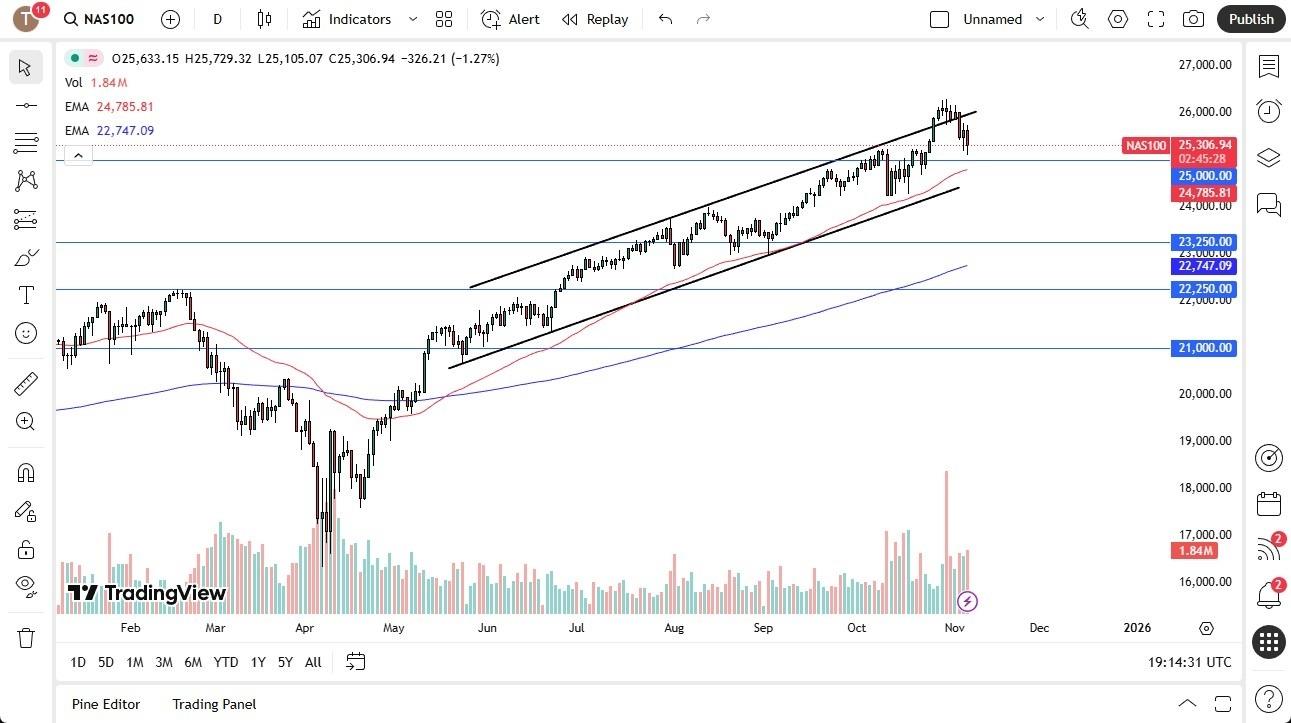

Nasdaq Forecast 07/11: Falls Toward 25,000 (Chart)

- The Nasdaq 100 declined early Thursday, nearing the 25,000 level amid volatility and questions about AI profitability. While short-term choppiness may persist, the speaker remains cautiously bullish, viewing pullbacks as healthy and likely temporary.

If the Nasdaq 100 breaks down below the 50-day EMA, we could see a deeper pullback toward the 24,000 level, though that doesn't seem particularly likely at the moment. I remain somewhat bullish but recognize that the market may need time to stabilize before moving higher. Over the longer term, I still expect the index to climb significantly, but not without challenges along the way.

EURUSD Chart by TradingViewIt's also worth noting that volatility and choppiness are likely to persist-not just for the Nasdaq 100 but across most indices. Global demand concerns, along with ongoing geopolitical tensions and trade war headlines, continue to weigh on sentiment. I'm bullish, but cautiously so, and I believe these pullbacks are both healthy and necessary, unlikely to cause lasting damage in the broader uptrend.Ready to trade our stock market analysis? Here's a list of some of the best CFD trading brokers to check out.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment