Better UK Inflation News Brings December Rate Cut Back Into Play

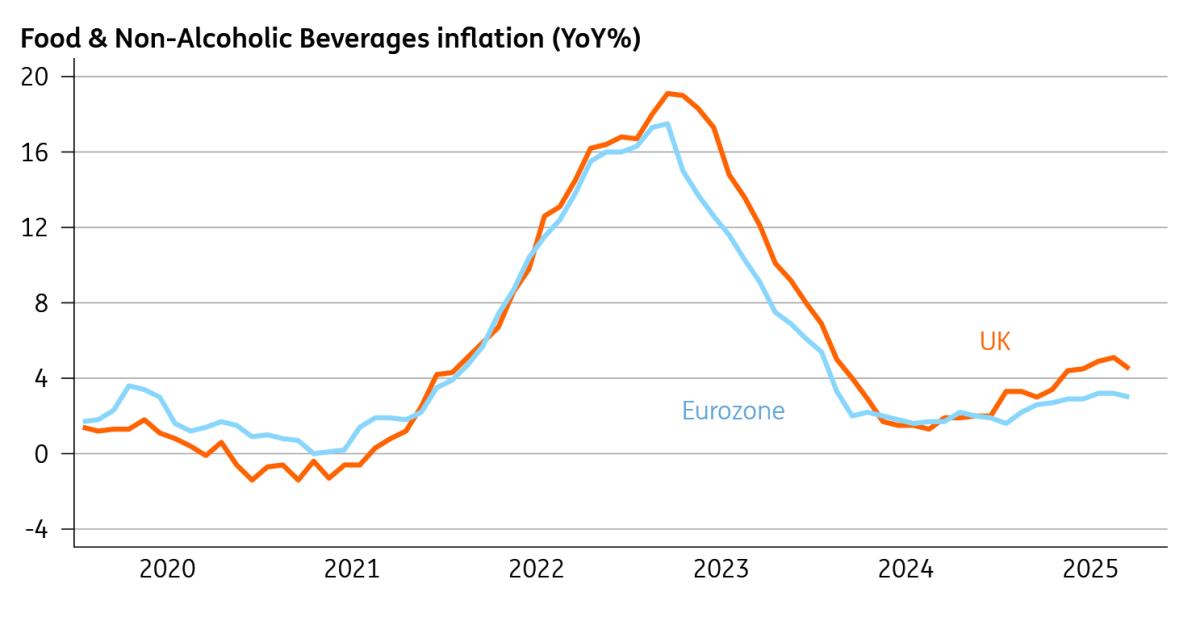

What really stands out from the latest UK price data is the big drop in food inflation. Food has become a key preoccupation of officials as inflation has slowly built through this year, driven partly by April's tax and minimum wage hikes. The Bank of England has been concerned that this could fuel inflation expectations among consumers, causing the current inflation spike to morph into a more persistent episode of price pressure.

But food prices actually dropped in September, helping the annual rate move below 5%. It's now running half a percentage point below the Bank's August forecasts.

It's a similar story with services inflation; that's running 0.3pp below those August projections. Various measures of“core services”, which exclude volatile stuff, dipped in September. That includes restaurants/cafés, often seen as a bellwether for underlying price pressures. We suspect some of the BoE's focus on food inflation has been born out of concern that we could see similar pressure emerge in catering, where trends tend to be slower-moving and more persistent. Fortunately, the annual rate also dipped back here in September.

UK food inflation dipped in September

Source: Macrobond, ING

Altogether, at 3.8%, it looks like UK inflation has peaked. We see it at 3.5% over the remaining months of 2025, before dipping back from January. This latest data, combined with better news on wage growth, brings another rate cut this year firmly back into play.

Until recently, we had forecast a November cut but have since pushed back that call to February, on the basis of recent cautious BoE commentary. That's still loosely our base case, though markets are now pricing a 72% chance of a December cut, up from just 22% two weeks ago. That looks entirely possible to us, though it will depend on the details of the late-November Autumn Budget.

The Bank will want confirmation that there will indeed be a material fiscal tightening in 2026, led by tax hikes. And that those tax hikes don't push up on headline inflation in 2026, in the same way some of last year's increases did in recent months.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment