Binance Clarifies: Tokens Didn't Lose 100% Of Value During Market Crash

- Several altcoins on Binance showed a temporary $0 price during Friday's market chaos due to a display glitch, not actual devaluation. Binance attributed this to reductions in decimal places allowed for certain trading pairs, causing interface errors. The market crash resulted in the liquidation of up to $20 billion, becoming one of the largest in crypto history. Trader speculation suggests Binance may have been targeted by a coordinated attack exploiting internal Oracle data sources. Binance is planning to switch to external oracles to prevent future manipulations and has committed to compensating affected traders.

Following Friday's market upheaval, Binance issued an official statement confirming that some tokens, including IoTeX (IOTX), Cosmos (ATOM), and Enjin (ENJ), did not actually crash to zero. Instead, traders saw a display issue caused by recent updates to the platform's trading rules. Binance explained:

Altcoins appeared to drop to $0 on Binance during Friday's market crash. Source: Cointelegraph

The incident unfolded during a broader crypto market sell-off that caused the price of Bitcoin and Ethereum to plunge temporarily, triggering liquidations in the tens of billions and exposing vulnerabilities in leverage-based trading amid volatile conditions.

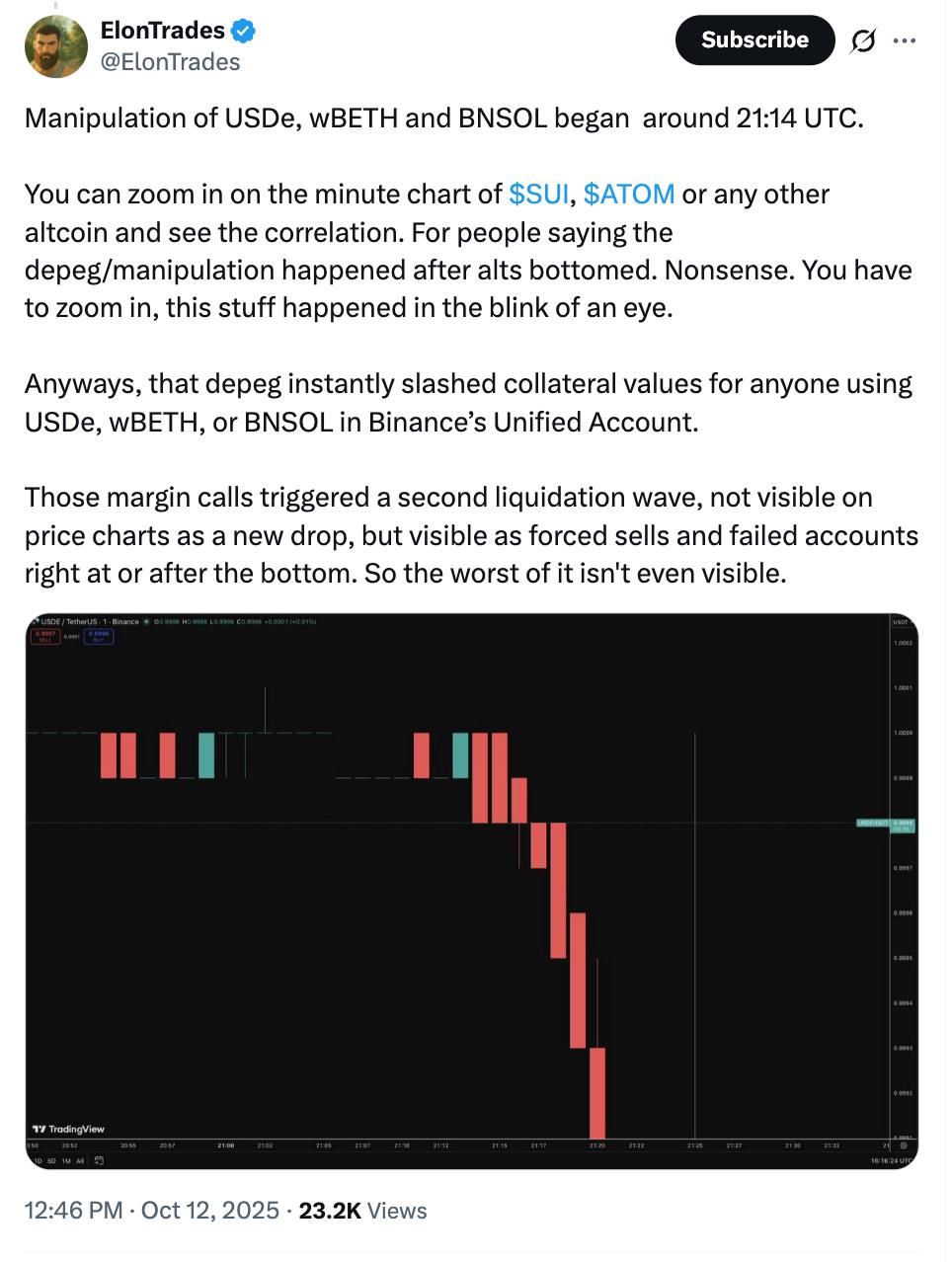

Market Contagion and Potential Attack VectorsMany traders and industry observers believe Binance may have been targeted through a sophisticated exploit. Some speculate that a malicious actor possibly manipulated Binance's internal oracle data-sources that feed price information-causing a cascade of liquidations and systemic risk. Notably, Ether 's USDe synthetic dollar depegged from its value and dropped sharply, with some reports suggesting it briefly touched $0.65.

ElonTrades, a prominent crypto trader, highlighted that attackers might have exploited Binance's“Unified Account” feature, which relies on internal order book data rather than external oracles, creating opportunities for manipulation. Binance has announced plans to address this vulnerability by adopting external oracles by October 14, aiming to mitigate future exploits.

Source: ElonTrades

The aftermath saw a wave of liquidations totaling approximately $1 billion on Binance alone, which then spread to broader crypto markets, exacerbating fears of systemic risk amid ongoing debates about crypto regulation and exchange security. Binance announced a compensation pot of $283 million to aid traders affected by the event.

While the incident underscored the risks inherent in crypto markets, industry leaders like Kris Marszalek of Crypto have called for stronger regulatory oversight over centralized exchanges, which are central to liquidity and market stability in the digital asset ecosystem.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment