Why Did Some Altcoins On Binance Suddenly Crash To Zero?

-

In what marked one of the most tumultuous days in recent crypto history, the cryptocurrency market experienced a dramatic plunge on October 10, with Bitcoin tumbling from nearly $124,000 to as low as $105,000. Even more alarming, certain altcoins traded on Binance briefly plummeted to zero valuations, a phenomenon not seen elsewhere. This sudden crash has raised questions about the stability of crypto trading platforms and the resilience of the DeFi ecosystem amid extreme market volatility.

- Several altcoins, including Cosmos's ATOM, briefly hit zero on Binance amid the market sell-off, but maintained value on other exchanges.

The crypto market tanked following FTX's collapse, with a loss of approximately $850 billion in market cap within hours. Leverage liquidations and system overloads contributed to the flash crash, exposing risks within crypto trading infrastructure.

On October 10, the broader cryptocurrency market experienced its sharpest decline since the FTX scandal, with total capitalization falling by roughly $850 billion within a few hours. Bitcoin (BTC ) declined around 10-15%, dropping from highs near $124,000 to lows of approximately $105,000. But the impact on altcoins was even more pronounced, especially those traded on Binance, where many tokens experienced abrupt crashes-some plummeting by nearly 100% in minutes.

Tokens like Cosmos (ATOM ), IoTeX (IOTX ), and Enjin (ENJ ) briefly registered zero value on Binance, with their trades essentially collapsing to nothing. Despite this, these tokens retained their market values on other exchanges, emphasizing that the zero valuations were isolated incidents specific to Binance's platform during the chaos.

ATOM/USDT, IOTX/USDT, ENJ/USDT one-day chart on Binance. Source: TradingViewWhile ATOM fell by roughly 53% on Binance, its declines on other exchanges reached around 50%. Similar patterns occurred with IOTX and ENJ, which saw drops of 46% and 64.5%, respectively. This phenomenon, where certain high-profile tokens temporarily hit zero prices only on Binance, points to unusual volatility and system strains during the crash.

ATOM/USDT, IOTX/USDT, ENJ/USDT one-day comparison across multiple exchanges. Source: TradingView What caused these altcoins to hit zero?

During the crash, over $20 billion worth of crypto positions were liquidated, more than twenty times the amount during the March 2020 COVID-19 market sell-off. Over 1.6 million traders faced forced liquidation as leverage-borrowed funds used to amplify trading-wiped out their accounts.

Total crypto market liquidations during the crash. Source: CoinGlass

Many traders on Binance had used leverage, which significantly exacerbated losses as prices plunged. According to Arthur Hayes, co-founder of BitMEX , major exchanges were liquidating collateral tied to cross-margin positions, fueling the sell-off further. When prices started falling rapidly, Binance's automatic liquidation systems sold off collateral assets, including altcoins used as collateral, intensifying downward pressure.

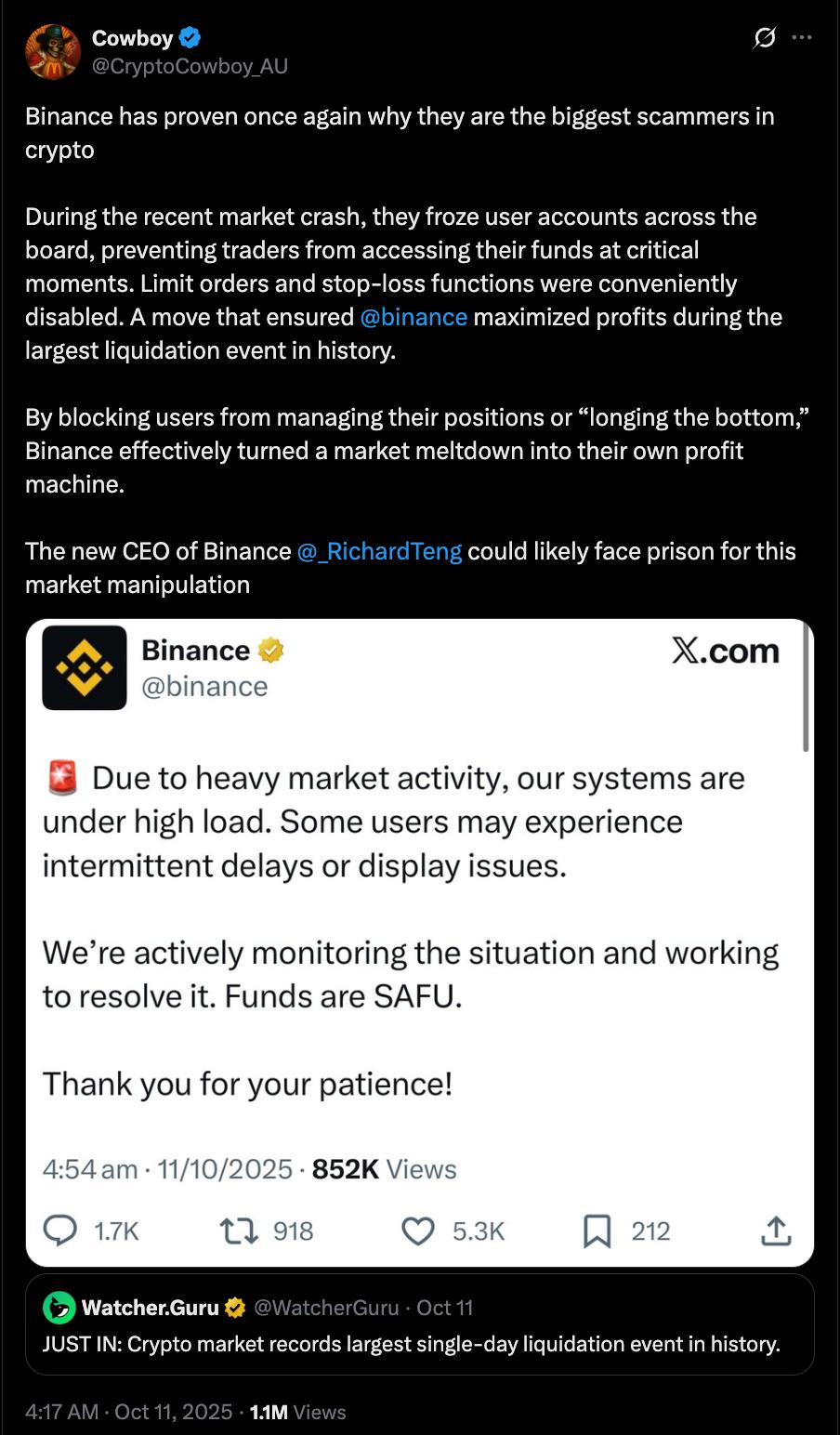

As panic set in, Binance faced technical overload, with some users reporting frozen accounts, missed stop-loss orders, and delays in trade execution. Industry analysts suggest that major market makers, such as Wintermute, withdrew funds during the chaos, further drying up liquidity.

Fragment of tweet discussing exchange overload and fund withdrawal. Source: CryptoTwitter

This series of events resulted in a moment where certain tokens had no buy orders on Binance, and the system displayed“zero” prices-even though these tokens remained valuable on other exchanges. Similar flash crashes have occurred before, such as Ethereum briefly falling to $0.10 during a 2017 exchange error, highlighting the systemic vulnerabilities during rapid market declines.

Binance responds to the chaosBinance's leadership issued apologies for the disruptions. Co-founder Yi He acknowledged the issues, stating,“Some users have encountered transaction problems amid extreme volatility and surging platform traffic.” Binance CEO Richard Teng also expressed regret, emphasizing a commitment to learning from the incident to improve platform stability.

Binance added that it intends to compensate users with verifiable losses directly caused by platform failures but clarified that losses from normal price swings or unrealized gains are not eligible for reimbursement. This turbulent episode underscores the importance of robust risk management and technological resilience within the fast-paced world of crypto markets.

This incident demonstrates the heightened risks inherent in cryptocurrency trading, especially when using leverage and engaging in high-volume, low-liquidity assets. Traders and industry stakeholders continue to call for stronger safeguards and clearer regulation of crypto exchanges to mitigate future systemic failures.

-

This rewrite maintains a natural, authoritative tone and adheres to SEO best practices for content relevant to the crypto markets, Bitcoin, and blockchain technology.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment