Asset Tokenization Market To Reach USD 13.55 Trillion By 2030, Driven By Real Estate And Institutional Adoption Trends

"Asset Tokenization Market"Mordor Intelligence has published a new report on the Asset Tokenization Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Asset Tokenization Market Overview

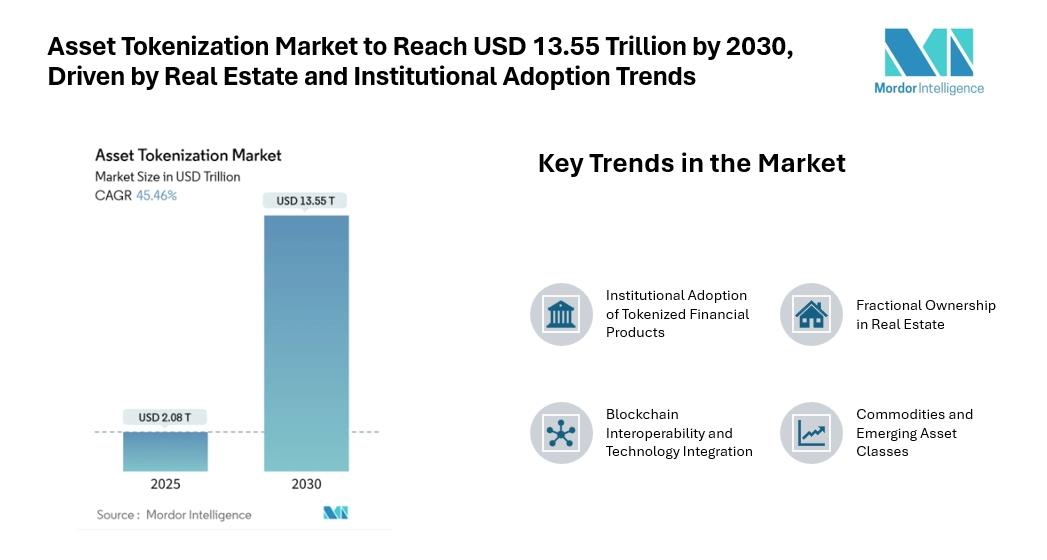

The Asset Tokenization Market is valued at USD 2.08 trillion in 2025 and is forecast to climb to USD 13.55 trillion by 2030 at a 45.46% CAGR, underscoring how digital representations of real-world assets are reshaping global capital formation. Key drivers include regulatory clarity, rising institutional adoption, fractional ownership models, and the integration of blockchain interoperability protocols, all contributing to the Asset Tokenization Market share.

In addition to growth in market size, evolving Asset Tokenization Market trends are shaping investor behavior and industry dynamics.

Key Trends in the Asset Tokenization Market

1. Institutional Adoption of Tokenized Financial Products Institutional investors are shifting capital to tokenized money-market and fixed-income products, driving adoption and prompting custodians and asset managers to support infrastructure, boosting Asset Tokenization Market share.

2. Fractional Ownership in Real Estate Fractional ownership in real estate tokenization lowers entry barriers, boosts participation, enhances transparency, promotes secondary liquidity, and benefits from crowdfunding regulations, supporting growth in retail-accessible tokenized properties.

3. Blockchain Interoperability and Technology Integration Blockchain interoperability and ISO-20022 integration enable seamless cross-chain transactions, improve reconciliation, reduce settlement risk, increase efficiency, and support wider adoption of tokenized assets in the market.

4. Commodities and Emerging Asset Classes Commodities tokenization, including carbon credits and precious metals, offers new investment opportunities, helping companies hedge ESG obligations and inflation, with compliant platforms favored by top banks and institutions.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights:

Asset Tokenization Market Segmentation

By Asset Class:

Real Estate

Debt Instruments

Investment Funds

Private Equity

Public Equity

Commodities

By Investor Type:

Institutional Investors

Accredited Retail Investors

Retail Investors

By Tokenization Platform Type:

Permissioned (Private) Blockchains

Permissionless (Public) Blockchains

Hybrid Models

By Offering:

Tokenization Platforms / Middleware

Smart-Contract Development and Audit

Custody and Wallet Services

Compliance and Legal-Tech Services

Secondary Trading and Exchanges

By Geography:

North America:

United States

Canada

Mexico

South America:

Brazil

Argentina

Rest of South America

Europe:

Germany

United Kingdom

France

Italy

Spain

Russia

Rest of Europe

Asia-Pacific:

China

Japan

India

South Korea

Australia and New Zealand

Rest of Asia-Pacific

Middle East and Africa:

Middle East

Saudi Arabia

United Arab Emirates

Turkey

Rest of Middle East

Africa

South Africa

Nigeria

Egypt

Rest of Africa

Explore Our Full Library of Technology, Media and Telecom Research Industry Reports -

Key Players in the Asset Tokenization Market

Securitize Markets, LLC – Provides end-to-end solutions for issuing and managing digital securities, enabling compliant tokenization of various asset classes.

tZERO Technologies – Offers a blockchain-based trading platform for tokenized securities, focusing on enhancing liquidity and transparency in digital asset markets.

Tokensoft Inc. – Delivers secure token issuance and management platforms for institutional and accredited investors, supporting compliance and secondary trading.

Polymath Research Inc. – Specializes in blockchain-based security token creation, providing tools for regulatory compliance and digital asset management.

Tokeny Solutions SA – Provides tokenization platforms for financial institutions, enabling compliant issuance, transfer, and management of digital securities.

Conclusion

The Asset Tokenization Market is set for continued growth, driven by technological integration, regulatory clarity, and rising institutional interest. Fractional ownership, cross-chain interoperability, and ISO-20022 adoption are key enablers that improve accessibility and efficiency, creating a favorable environment for both institutional and retail investors. These developments are reflected in current Asset Tokenization Market statistics, highlighting the expanding adoption and increasing liquidity of tokenized assets.

For more insights on Asset Tokenization Market, please visit the Mordor Intelligence Page:

Industry Related Reports:

Crypto Asset Management Market

The Crypto Asset Management Market is projected to grow from USD 1.66 billion in 2025 to USD 4.68 billion by 2030, at a CAGR of 23.03%. Growth is driven by increasing institutional adoption of digital assets and rising demand for secure, compliant portfolio management solutions. Enhanced regulatory clarity and innovative crypto investment products are also supporting market expansion.

Blockchain Technology Market

The Blockchain Technology Market is expected to grow from USD 24.46 billion in 2025 to USD 299.54 billion by 2030, at a CAGR of 65.0%. Key drivers include the adoption of blockchain for secure financial transactions and supply chain transparency, along with increasing enterprise investments in decentralized applications and digital infrastructure.

Digital Currency Market

The Digital Currency Market is projected to grow from USD 34.38 billion in 2025 to USD 60.78 billion by 2030, at a CAGR of 12.07%. Growth is driven by increasing adoption of blockchain-based payment systems and the rising interest of institutional investors. Expanding use cases in cross-border payments and regulatory clarity are also supporting market expansion.

Get more insights:

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

...

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Nodepay Launches Crypto's Largest Prediction Intelligence Platform

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

Comments

No comment