Czech Services Inflation Remains Elevated

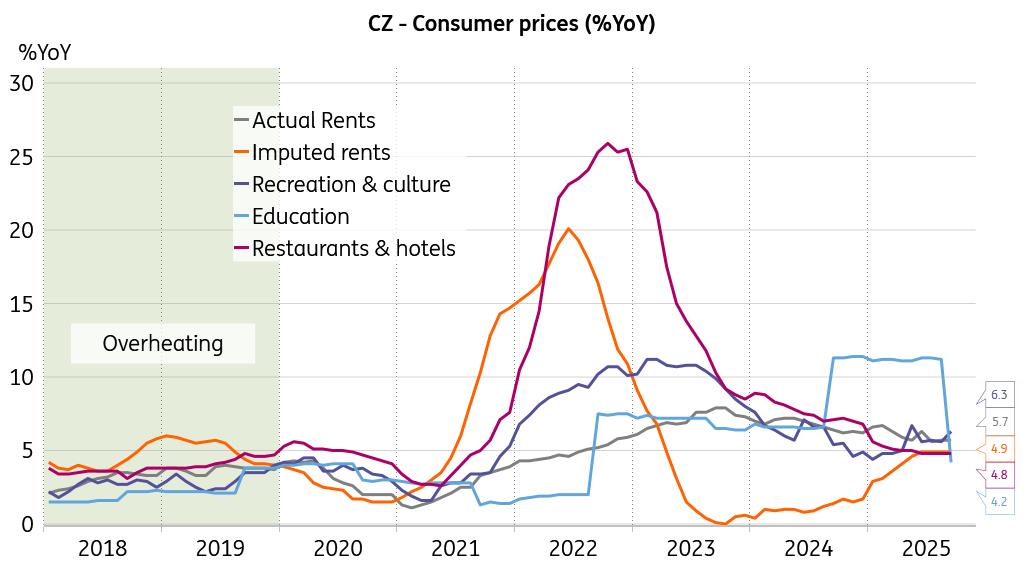

Czech annual headline inflation was confirmed at 2.3% in September, while prices dropped by 0.6% from the previous month. Food prices had a significant impact on the headline figure, with the annual rate softening since July. The annual price growth in September was mostly impacted by price dynamics in the housing sector, where imputed rents continued to grow by 4.9% year-on-year. Imputed rents have maintained a stable annual rate since June, while the monthly gain in September remained relatively upbeat at 0.6%. Market rents maintained their robust annual rate of 5.7% in the same month, and water charges added 4.2% YoY. In contrast, electricity prices dropped by 3.5% YoY and natural gas prices by 8.5% YoY.

Prices in education eased, yet rents remained relentless

Source: CZSO, Macrobond

Price growth in the goods segment eased to 0.8% YoY, while prices of services maintained an elevated dynamic of 4.7% YoY. Prices for food services were up 4.5% YoY, and accommodation services gained 6.6% YoY. We estimate that core inflation remained somewhat elevated at around 2.8%, driven by persistent price dynamics in services, with the most essential items still growing at around 5% or more. Some mitigating effects are linked to a significant moderation in price growth in education, where prices increased by 4.2% YoY in September compared to 11.2% annual growth in August. The traditional September price hike in the education section was 3.4% month-on-month this time, showing the least pronounced monthly gain since 2022 and only a third of the previous year's significant increase.

Domestic price pressures subject to continued expansionOverall, we see the persistently elevated price dynamics in services as a continued issue for the guardians of price stability, especially as this could work its way through to households' inflation expectations and wage demands when looking ahead. This may become a serious concern once the economy enters a phase of mature expansion and begins to operate above its productive sweet spot - a scenario anticipated for the Czech economy by mid-next year.

German sentiment sours putting Czech resilience to the test

Source: Macrobond

However, new risks to Czech growth are currently entering the stage of theatrum mundi, namely the possibility of a noticeable underperformance in the eurozone economy on the back of another weak quarter for the German economy, and the implications of the fiscal and political challenges in France. Indeed, it is a different universe for Czech exporters if Germany continues in the unimpressive status quo or heads for outright recession. Domestic price pressures and external growth risks will be the key considerations for members of the Czech National Bank as they weigh their next move. In the meantime, holding rates steady remains the most prudent course.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Nodepay Launches Crypto's Largest Prediction Intelligence Platform

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

Comments

No comment