India's Tax System Should Aim At Trust-Based Governance & Procedural Decriminalisation: NITI Aayog

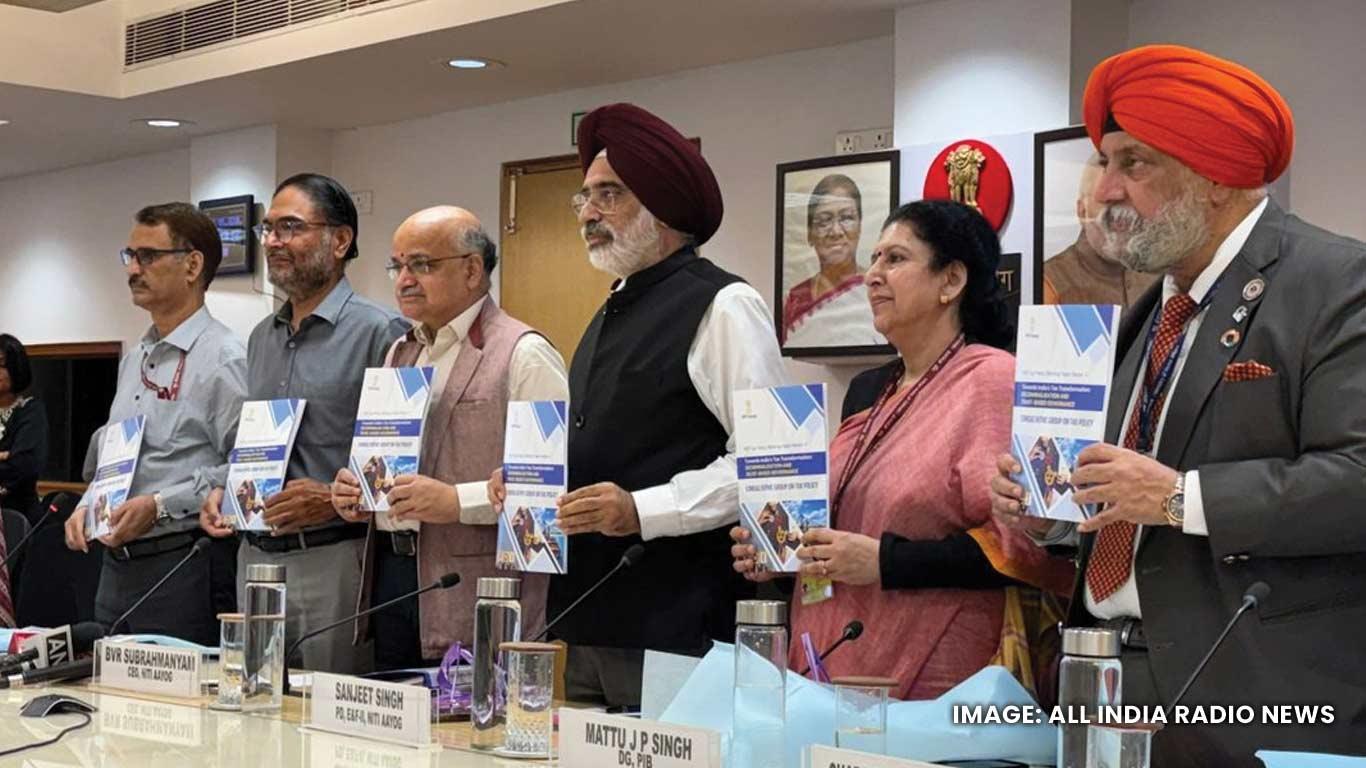

Releasing the paper, B.V.R. Subrahmanyam, CEO, NITI Aayog, said India's tax system is entering a decisive phase characterised by simplification, modernisation, and a growing emphasis on trust in tax administration.

“As India transitions from enforcement-driven compliance to trust-based governance, the focus must shift to proportionate, fair, and transparent enforcement mechanisms that empower taxpayers while protecting fiscal integrity,” he noted.

The working paper provides a detailed assessment of criminal provisions under the Income-tax Act, 2025, analysing their necessity, proportionality, and alignment with the government's broader reform agenda.

It proposes a principle-based framework to rationalise punishments, decriminalise minor or procedural non-compliances, and strengthen judicial discretion.

While acknowledging that the 2025 Act has removed several outdated offences, the study points out that 35 actions and omissions across 13 provisions still attract criminal penalties, most carrying mandatory imprisonment.

The paper recommends a calibrated decriminalisation roadmap-removing imprisonment for procedural lapses, restricting criminal sanctions to wilful evasion or fraud, and expanding the scope of civil and administrative penalties.

According to Subrahmanyam, such reforms will reduce litigation, improve investor confidence, and advance India's commitment to a fair, predictable, and globally aligned tax regime.

The approach reflects a broader policy shift toward trust-based governance, encouraging voluntary compliance and efficient use of enforcement resources.

The paper's release event was attended by representatives from the CBDT, CBIC, ICAI, and DPIIT, as well as leading tax experts from Vidhi Legal, Lakshmikumaran & Sridharan, Deloitte, and EY, among others. These stakeholders collaborated with the NITI Aayog Consultative Group on Tax Policy (CGTP).

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Nodepay Launches Crypto's Largest Prediction Intelligence Platform

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

Comments

No comment