Asia Week Ahead: Singapore Monetary Policy Decision And Key China Data

Singapore's GDP growth has been better than expected this year, as evidenced by strong industrial output. We expect the same trend to be reflected in the third-quarter GDP print. The impact of pharma tariffs on Singapore's exports to the US is likely to be small. We expect 3Q GDP of 1.8% year on year. Though weaker than the 4.4% YoY of the previous quarter, this marks an upgrade to our previous forecast of 1% YoY.

We do not expect the Monetary Authority of Singapore (MAS) to ease policy next week, given this strong growth backdrop. Core inflation has been weaker than expected, but we think MAS would prefer to use the policy space later if GDP growth turns weaker.

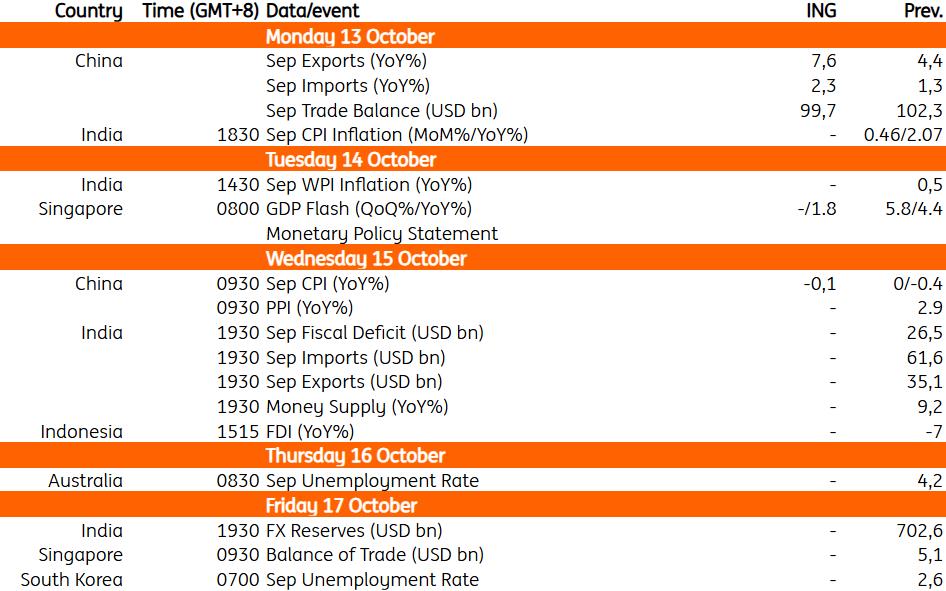

China: Exports expected to rebound while deflation continuesChina is set to publish data on trade and inflation for September. Trade figures are likely to show external demand remains a key driver of growth for the Chinese economy. We expect exports to rebound to 7.6% YoY in September. Imports are likely to see a milder uptick to 2.3% YoY, contributing to a trade surplus of around $99.7bn on the month. Inflation looks likely to have stayed in deflationary territory in September, with our CPI forecast set at -0.1% YoY. We should continue to get more Golden Week economic data in the coming days. Thus far, we've seen solid travel numbers but some disappointing box office and consumption data. This suggests domestic demand could still benefit from further policy support.

Key events in Asia next week

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Nodepay Launches Crypto's Largest Prediction Intelligence Platform

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

Comments

No comment