Rates Spark: Benign Environment For Carry Trades

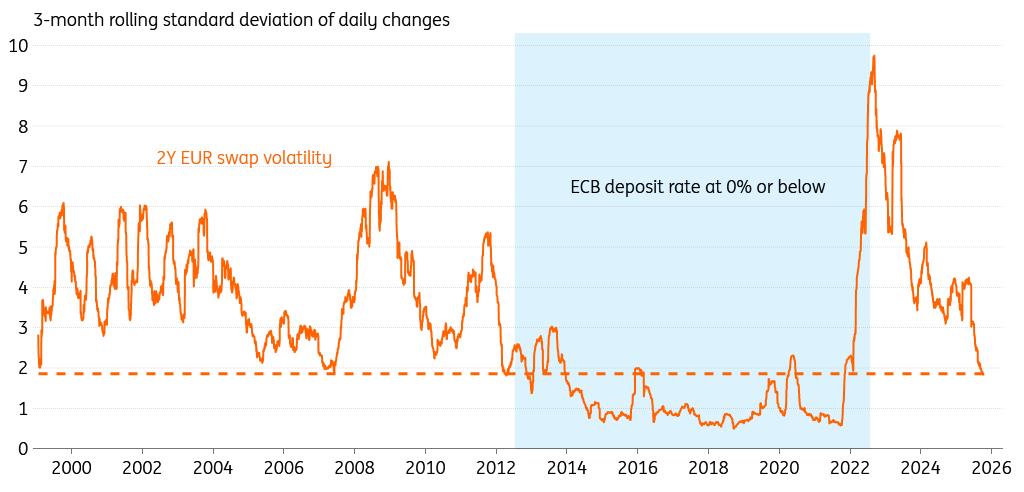

With the volatility at the front end of euro rates collapsing, we need to start asking ourselves what rates markets will look like after a soft landing. The daily volatility of the 2Y swap was only lower when the European Central Bank policy rate was at the zero lower bound. One could argue that this is a very benign environment for carry trades. Simply take up a bit more duration and sit back and relax. We already see that European government bond spreads and also corporate credit spreads look very tight. And this argument suggests this environment can continue.

The fact that the ECB still has room to ease more also makes carry trades more attractive. Whilst the ECB feels it is in a good place, the minutes from Thursday do confirm our notion that the bias is towards more cuts. We see downside risks to both inflation and growth, whereas the upside is more difficult to see. But if such risks were to materialise, the ECB could quickly cut more, maybe once, maybe even twice. In any case, barring any major economic setbacks, the additional easing would help contain the widening of spreads.

Front-end volatility has never been lower except during the zero lower bound

Friday's events and market views

French politics will remain in the headlines with the president expected to convene with party representatives in the afternoon and likely to appoint a new prime minister thereafter – some think it could again be Lecornu. There won't be much else to work with in Europe with the ECB's Escriva speaking and Italian industrial production data in the morning. After the markets close, rating reviews will move into focus with S&P slated to review Italy (BBB+/Stable) and the UK (AA/Stable). Moody's has Slovenia (A3/Positive) and Belgium (Aa3/Negative) on its review calendar.

The main US data item to watch is the University of Michigan Consumer Sentiment Index, which is expected to decline somewhat again. On the speaker front, the Fed's Daly, Goolsbee and Musalem are scheduled to speak.

There is no government supply scheduled for today, but it is worth noting that yesterday's 30y US Treasury auction was again a mixed result after the softer reception of 10y supply the day before. The auction tailed slightly, but there was a record-high share awarded to non-dealers.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Crypto Market Update: Pepeto Advances Presale With Staking Rewards And Live Exchange Demo

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Chartis Research And Metrika Release Comprehensive Framework For Managing Digital Asset Risk

- Nodepay Launches Crypto's Largest Prediction Intelligence Platform

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

Comments

No comment