Is $75B In Crypto Potentially Recoverable? Here's What You Need To Know

- Illicit crypto assets estimated at over $75 billion, with most controlled by darknet market operators and vendors. Approximately 75% of these illicit funds are held in Bitcoin , though stablecoins are increasingly involved. Potential for asset forfeitures is rising, with recent seizures like Canada's $40 million in digital assets demonstrating law enforcement's capabilities. Crypto crime remains a small fraction of overall blockchain activity, comprising just 0.14% in 2024. Blockchain transparency aids law enforcement but also fuels misconceptions about crypto's overall crime levels.

As global policymakers explore the idea of creating national cryptocurrency reserves, recent findings reveal that governments and law enforcement agencies may already be sitting on a substantial trove of recoverable on-chain assets linked to illegal activities. This development sheds new light on potential intersections between crypto law enforcement and the broader conversation about crypto reserves.

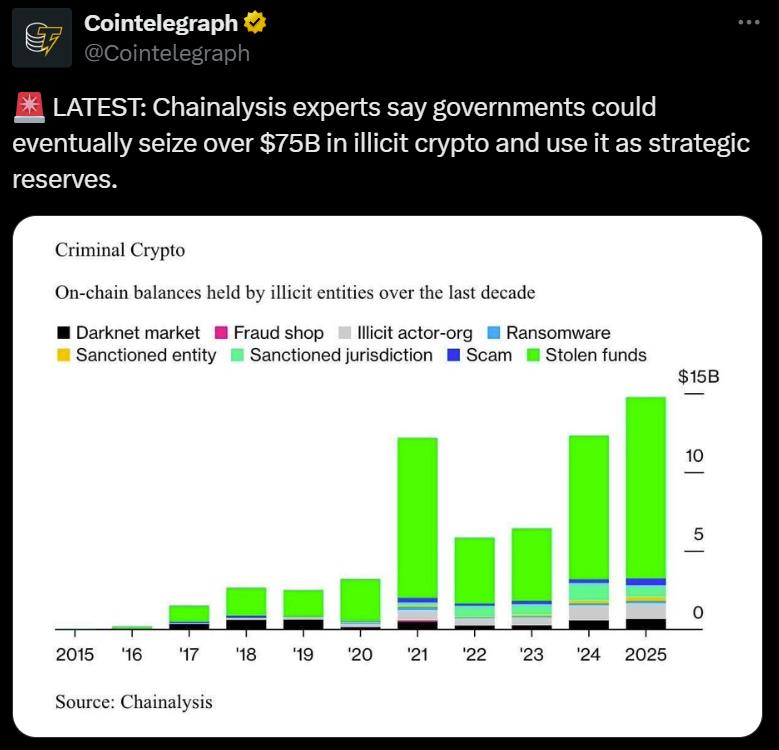

In a report released Thursday, Chainalysis estimated that the total value of crypto balances associated with illicit activities surpasses $75 billion. Of this, roughly $15 billion is held directly by illicit actors, while more than $60 billion resides in wallets with downstream ties to criminal entities. The blockchain analytics firm further disclosed that darknet market operators and vendors control over $40 billion in crypto assets, illustrating the scale of underground digital economies.

Stolen assets represent the largest share of illicit cryptocurrency holdings. Source: ChainalysisBitcoin accounts for about 75% of these illicit holdings, although stablecoins are gaining prominence in money laundering and other unlawful transactions. The recent report also highlights that efforts like the US Trump administration's Strategic Bitcoin Reserve and Digital Asset Stockpile could tap into these assets through asset forfeitures, emphasizing potential avenues for recovering illicit funds.

Chainalysis CEO Jonathan Levin noted that the findings could drastically increase asset forfeiture potential, prompting countries to rethink strategies for asset recovery in crypto investigations.“The cryptocurrency ecosystem presents law enforcement with an unprecedented opportunity: billions of dollars in illicit proceeds are sitting on public blockchains and are theoretically seizable if authorities can coordinate action,” he said.

Source: Cointelegraph

Recently, Canadian authorities seized approximately $40 million in digital assets from TradeOgre, a crypto exchange accused of operating without appropriate registration and facilitating money laundering. The move sparked criticism from parts of the crypto community, claiming that such regulatory overreach could be overestimating the anti-money laundering efforts and affecting legitimate users.

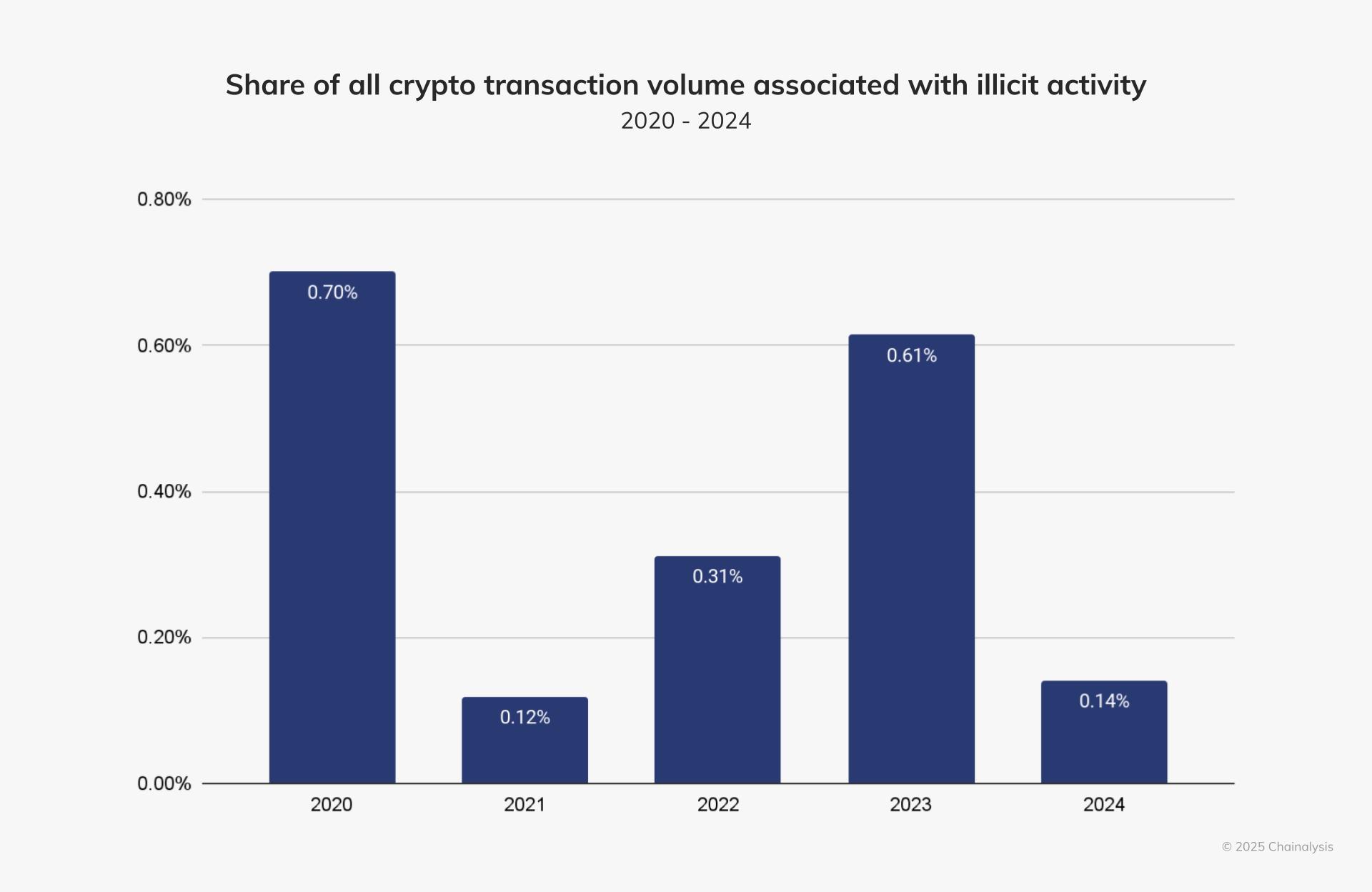

Blockchain transparency skews perception of crypto crimeWhile reports of crypto-related crimes, including high-profile hacking incidents, have surged, their overall scale remains relatively small compared to total blockchain activity. According to Chainalysis's 2025 Crypto Crime Report, illicit transactions made up just 0.14% of all blockchain activity in 2024, down from previous years, reflecting the increasing transparency and security improvements within the crypto ecosystem.

Less than 1% of all crypto transaction volume is linked to illicit activity. Source: Chainalysis

By contrast, the United Nations estimates that between 2% and 5% of global GDP is laundered through traditional financial systems yearly. The heightened visibility of blockchain transactions makes illicit activities easier to detect and report, contrasting with the secrecy inherent in cash-based crimes.

As the cryptocurrency industry continues to evolve, it faces intense regulatory scrutiny that amplifies perceptions of widespread wrongdoing. However, many analysts argue that the actual scale of crypto crime remains relatively small, and blockchain's openness provides avenues for more effective enforcement and asset recovery efforts.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment