Czech Retail Sales Rebound But External Headwinds Persist

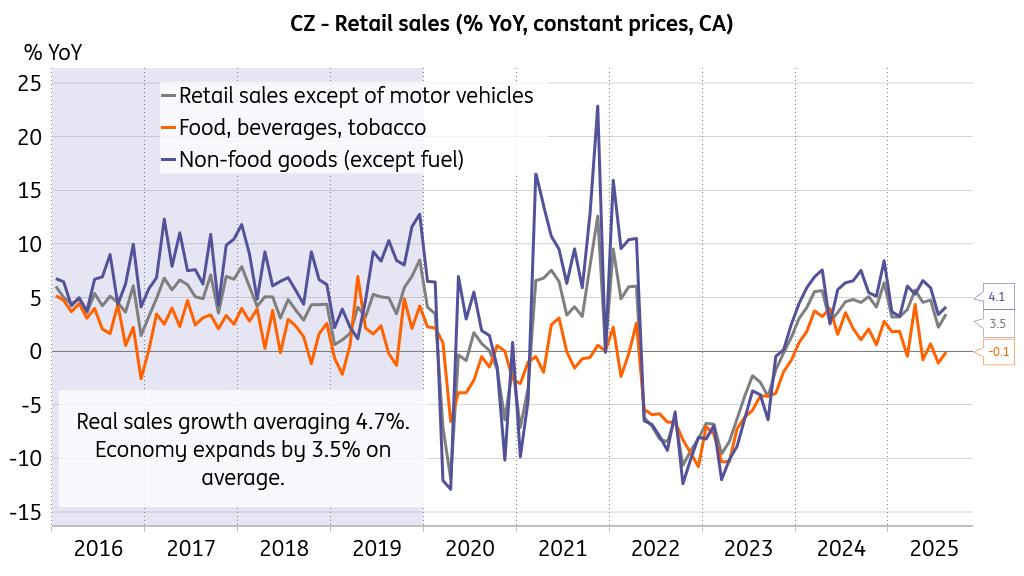

Czech real retail sales added 3.5% year-on-year and 0.6% month-on-month in August, with the annual dynamics stronger than market participants had expected. Sales of motor vehicles gained 8.1% YoY and 0.2% MoM. Real sales of fuel increased by 10.9% YoY and of non-food goods by 4.1% YoY, while food sales declined by 0.1% YoY. Sales grew in all product groups in non-food stores, except for stores selling computer and communication equipment.

Resources for spending are available, but sentiment will matter

Source: CZSO, Macrobond

Real retail sales have historically grown at an average pace of 4.7% when consumers are confident and willing to spend freely, as seen during the 2016–2019 period when the economy expanded by an average of 3.5% annually. So, a 3.5% annual growth rate in real retail sales is respectable, but the current level has remained stagnant since April. Given the robust nominal and real wage increases throughout the first half of the year, we maintain our hypothesis that this is merely a largo intermezzo - a pause before a molto vivace resurgence in spending towards year-end.

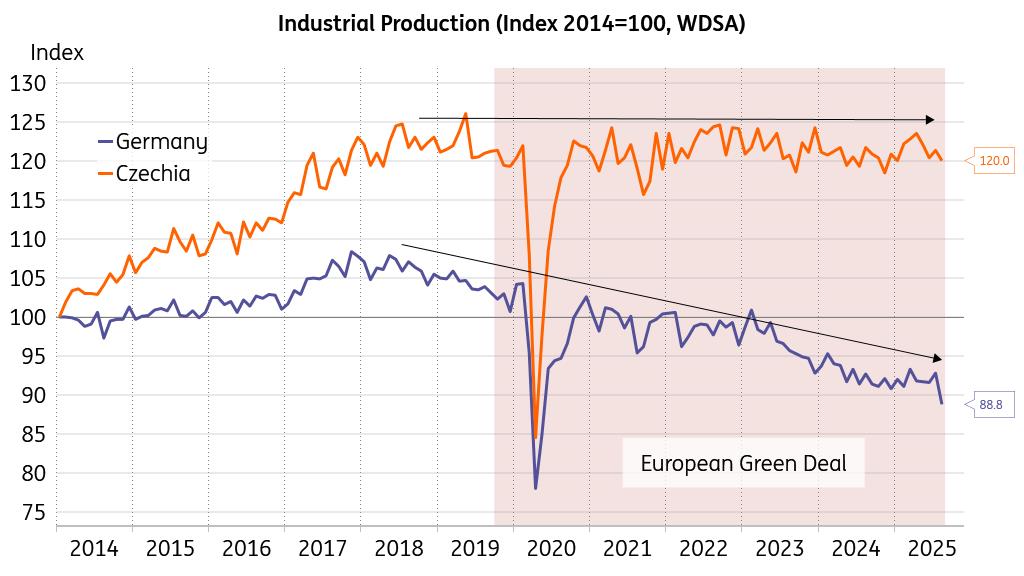

The foreign environment is wobblyIn the medium term, however, this also comes down to the overall European economic performance, particularly the main trading partners of the Czech exporting base within the eurozone. We saw a sharp decline in German industrial production in August, accompanied by deteriorating business climate indicators for September.

German recovery is not in sight

Source: Macrobond

Add the political turmoil in France right now, and it inevitably raises questions about how all of this might ripple through to Czech exporters and the overall industrial performance. Indeed, the Czech economy is not immune to significant underperformance in the eurozone, and this poses a substantial risk to a fully-fledged expansion when looking ahead. Downward risks stemming predominantly from the external environment and potentially weak foreign demand will also be reflected in the CNB's decision function, confirming rate stability as the optimal answer for now.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment