Don't Be Relaxed On Hungarian Inflation, Price Pressures Are Rising

| 4.3% |

Hungary's headline inflation (YoY)

ING estimate 4.3% / Previous 4.3% |

According to recent data released by the Hungarian Central Statistical Office (HCSO), the average price level remained unchanged in September 2025, compared to August. This was in line with market expectations and our own.

However, the annual inflation rate remains inconsistent with the central bank's price stability target of 3%, with the headline figure standing at 4.3% YoY. The yearly rate of price increases has remained at this level for three consecutive months. Despite the Hungarian economy stagnating for three years and the government introducing measures to curb inflation (with a total impact of around 1.5ppt), Hungary is still struggling with price stability issues.

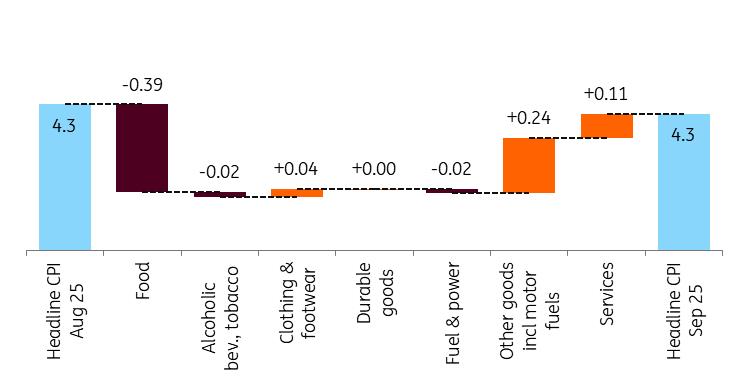

Main drivers of the change in headline CPI (%)

Source: HCSO, ING The details

-

Food prices decreased by 0.2% compared to the previous month. This suggests that the strengthening of the forint is beginning to push down the average price of these products, despite the upward pressure on prices exerted by the global food price cycle. As a result, year-on-year food inflation slowed significantly.

Unlike in August, the strength of the forint is keeping the price of durable consumer goods under control. The strength of the currency and seasonality also had a significant impact on the price of air travel, which fell by nearly 12% on a monthly basis.

Interestingly, the monthly price increase for clothing items was higher than usual for this time of year. This was driven by a price increase for clothing materials, which rose by more than 10% in September.

As expected, due to the usual seasonal price fluctuations, prices for services decreased compared to the previous month, but the changes were smaller than anticipated. Services have now overtaken food prices to become the main contributor to inflation, with the annual indicator accelerating to almost 6%. Together, these two factors (food and services) account for around two-thirds of the headline figure of 4.3%.

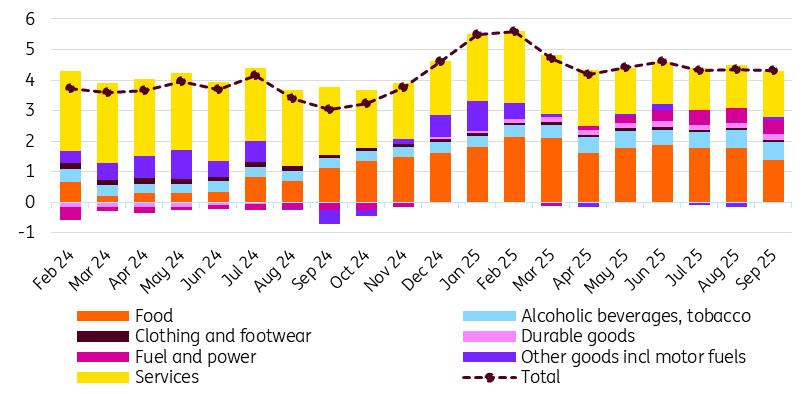

Source: HCSO, ING Core inflation is stabilising, but it's still high

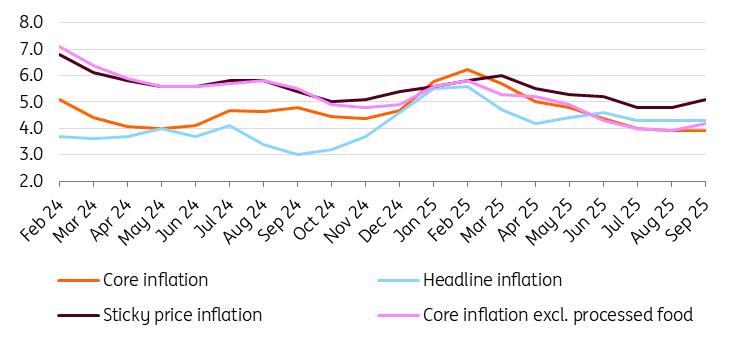

The inflation situation is not helped by the fact that annual core inflation has remained at 3.9% since August. This indicator, which captures underlying price trends, also does not align with the central bank's price stability target. Furthermore, sticky price inflation and core inflation excluding processed food have accelerated, with the former rising above 5% year-on-year again.

The inflation structure is rather hawkishAlthough we correctly predicted headline inflation, its structure was different to what we anticipated. Durable goods, services and clothing inflation were higher, while non-core price pressures were weaker. Consequently, core inflation was significantly stronger than forecast (3.9% vs 3.4%). In our view, the September inflation figure has a hawkish twist.

It can still be said that the low monthly price changes seen in recent months do not significantly alter households' inflation expectations. Although there are signs of moderation, high price expectations make it difficult for the central bank to reach the 3% inflation target in the short term. High expectations are therefore inconsistent with the objective of price stability, leaving no room for manoeuvre in monetary policy.

Headline and underlying inflation measures (% YoY)

Source: HCSO, ING A likely downward trend, but many risks remain

Looking ahead, the inflation rate may rise in the coming months due to base effects. Where exactly it will peak depends largely on the outcome of the mandatory price shield measures. Our inflation forecast of 4.6% for this year remains unchanged, based on the assumption that the measures will be phased out at the end of November (in line with the actual decree). For the next two years, we forecast that the inflation rate will average around 4%. In 2026, the average rate of price increases is likely to exceed this figure, falling below 4% in the subsequent year.

In light of this, the strict monetary policy stance and the unchanged base rate are certain to remain in place in the short term. At the same time, there is an increasing chance that the benchmark rate will remain at 6.50% for most, if not all, of 2026. This is because the Hungarian economy may experience shocks over the next one or two years that carry clear inflationary risks. Examples include government-driven demand stimulus affecting households' financial situation, the elimination of margin freezes, the end of voluntary price caps, and a double-digit increase in the minimum wage each year for the next two years.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Pepeto Presale Exceeds $6.93 Million Staking And Exchange Demo Released

- Citadel Launches Suiball, The First Sui-Native Hardware Wallet

- Luminadata Unveils GAAP & SOX-Trained AI Agents Achieving 99.8% Reconciliation Accuracy

- Tradesta Becomes The First Perpetuals Exchange To Launch Equities On Avalanche

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Edgen Launches Multi‐Agent Intelligence Upgrade To Unify Crypto And Equity Analysis

Comments

No comment