Rates Spark: Euro Rates In A Comfortable Position

Markets don't seem to be taking any direction right now, and Lecornu's deadline on Wednesday to solve the French political crisis is unlikely to change that. If anything, we think euro rate markets are well-balanced in terms of positioning. The front end is still biased towards another European Central Bank rate cut, but only with a 40% conviction and clearly not this year. This makes sense as growth will need to pick up more, and downside inflation risks still dominate. At the same time, we struggle to identify catalysts that would materially change the current pricing.

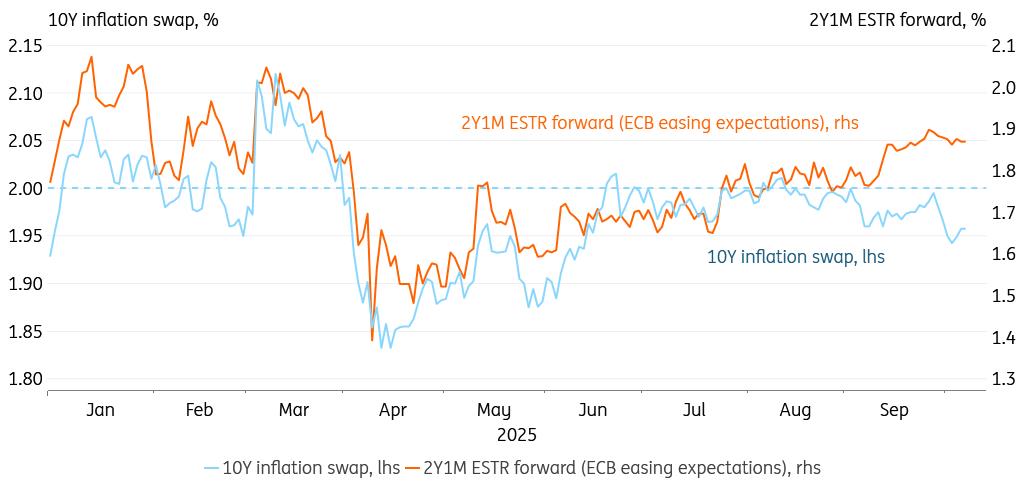

When looking at inflation swaps, the pricing also seems fair for now and should not be a source of volatility. The 10Y inflation swap has come down of late, reflecting the ECB's projections of a mild undershoot in 2026. But markets don't seem fussed, because the ECB easing expectations as captured by the 2Y1M ESTR forward drifted slightly higher. This signals markets are content with the undershoot and see no need for an additional rate cut. So even if we have inflation falling below 2%, we don't think this translates to lower 10Y rates for now.

Over the long term, however, we think inflation could contribute to materially higher 10Y swap rates. Before the global financial crisis, the 10Y inflation swap traded on average around 2.3%, well above the ECB target, incorporating an inflation risk premium of some 30bp. As the ECB is achieving a soft landing, this should, over time, also become the new equilibrium in our view. The real test will be whether inflation doesn't undershoot by too much in 2026. In our view, this won't happen, as the fiscal impulses should slowly start adding to price pressures. We therefore expect 10Y swap rates to still settle higher than current levels.

Markets are not fussed by a temporary undershoot in inflation

Source: ING, Macrobond Wednesday's events and market views

French politics aside, with Lecornu's deadline to negotiate a last-ditch solution approaching Wednesday evening, markets will not have much to work with on Wednesday. In the eurozone, ECB officials Escriva, Muller and Elderson will be speaking, and in the US the focus should also be on the central bank, with the highlight being the FOMC minutes of the September meeting. Separately, the Fed's Kashkari, Musalem and Barr are also scheduled to speak.

Absent data drivers, the primary market might receive more attention. In Europe, we have Germany tapping two bonds in the 15y area for a total of €2bn. The UK will auction a new 4y gilt (£5bn). Over in the US, the Treasury will auction US$39bn in 10y notes.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Pepeto Presale Exceeds $6.93 Million Staking And Exchange Demo Released

- Citadel Launches Suiball, The First Sui-Native Hardware Wallet

- Luminadata Unveils GAAP & SOX-Trained AI Agents Achieving 99.8% Reconciliation Accuracy

- Tradesta Becomes The First Perpetuals Exchange To Launch Equities On Avalanche

- Thinkmarkets Adds Synthetic Indices To Its Product Offering

- Edgen Launches Multi‐Agent Intelligence Upgrade To Unify Crypto And Equity Analysis

Comments

No comment