Bitcoin Approaches All-Time High As Total Market Cap Hits $4.21 Trillion

- Bitcoin rallied 14% in a week, approaching $124,000 amid a U.S. government shutdown and macroeconomic headwinds. On-chain data shows a $1.6 billion surge in Bitcoin buying activity, coupled with a Coinbase premium gap of nearly $92, indicating strong US-led demand. Analysts predict potential price discovery next week, with resistance levels near $130,000 amid institutional interest. Market sentiment remains optimistic as macro conditions support risk assets, with inflows into Bitcoin ETFs and large spot purchases.

Bitcoin (BTC ) has registered an impressive upward movement over the last week, climbing roughly 14% to trade just below $124,000, after hitting a low near $108,600 last Friday. This rally could push Bitcoin into uncharted territory above $125,500, especially as the total cryptocurrency market capitalization surpassed $4.21 trillion, signaling widespread confidence in crypto markets.

Bitcoin one-day chart. Source: Cointelegraph/TradingViewAn intriguing aspect of this rally is how markets are seemingly disregarding the ongoing U.S. government shutdown. While various federal agencies remain furloughed and scheduled economic data releases face delays, investor appetite for risk assets like Bitcoin continues to grow, with the cryptocurrency itself climbing 8% since the shutdown commenced. The uncertainty is also complicating Federal Reserve policy decisions, as postponed inflation and employment data brings additional volatility and speculative flows into the crypto space.

According to analysts from Bitfinex , the recent price movements appear organic, with one suggesting that political developments, such as a potential stimulus check funded by tariffs, could provide further upward momentum reminiscent of post-Covid economic relief measures. They also highlighted that steady inflows into cryptocurrency ETFs bolster the bullish outlook, provided macroeconomic conditions remain supportive.“If inflows persist and macro data remains as expected, Bitcoin could reach new highs in the fourth quarter,” they added.

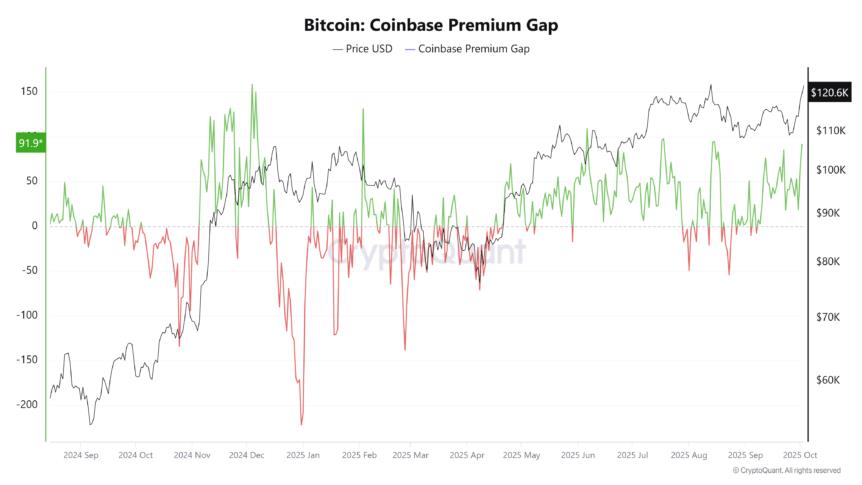

Onchain Demand IntensifiesOnchain metrics confirm that buy-side demand is fueling the rally. Analyst Maartunn pointed out a massive $1.6 billion taker buy volume spike within a single hour across exchanges, underscoring the strong institutional and retail participation. Meanwhile, the Coinbase Premium Gap, which measures the differential between Coinbase and Binance pricing, has surged to nearly $92. This is the highest level since mid-August and signals US investors are paying a premium for Bitcoin, reflecting significant local demand.

Bitcoin Coinbase Premium Gap. Source: CryptoQuant

However, the premium's recent spike raises questions, as historically, such high levels have coincided with market cooling phases later in the year. Traders and analysts remain attentive to the upcoming weekly closing, as it will be crucial to confirm whether Bitcoin can sustain this momentum through resistance zones around $130,000.

prochains niveaux et perspectivesMarket analysts anticipate possible price discovery in the upcoming week, with support zone around $120,000 holding firm. Trader Jelle commented,“Holding $120,000 over the weekend could set the stage for new all-time highs next week.” Meanwhile, Rekt Capital described the current phase as“Phase 3 Price Discovery,” where Bitcoin stands to establish new highs, provided demand remains robust and sell walls around $130,000 do not trigger a reversal.

Skew highlighted that while strong US inflows via Coinbase and strategic“risk-on” positions on Binance support optimism, heavy sell orders clustered around $130,000 remain a challenge. The upcoming daily closes will be critical in assessing whether Bitcoin can maintain its upward trajectory toward the next resistance barrier.

This evolving Bitcoin rally demonstrates the increasing maturity of crypto markets, fueled by macroeconomic tailwinds, onchain buying pressure, and institutional participation, setting the stage for potentially significant moves in the near term.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment