China's Cargo Ban Gives New Meaning To BHP's 'Broken Hill' Origin

China Mineral Resources Group (CMRG), a state-owned Chinese company established in July 2022 to centralize the import of iron ore, has urged major steelmakers and traders in China to halt their purchases of BHP's dollar-denominated seaborne iron ore cargoes, Bloomberg reported on Monday.

This means no new contracts can be signed. Shipments already departed from Australian ports are also affected. Only some BHP cargoes already landed in China, small in volume, remain tradable.

Bloomberg reported that the decision followed a series of failed talks between the Chinese and Australian sides that took place late last week and into this week. Neither CMRG nor BHP has provided public comment yet.

The move comes against the backdrop of failed negotiations earlier this year over the renewal of contract terms. BHP had insisted on an annual pricing model anchored to the 2024 Platts average (US$109.5o per metric ton), while Chinese buyers demanded quarterly terms linked to spot levels, which were about US$15 lower.

Since September, CMRG has already urged domestic steelmakers to cease purchasing BHP's Jimblebar fines due to its stalled long-term contract talks with BHP. Jimblebar fines are a high-grade ore with 65% iron content and high smelting efficiency.

Latest stories

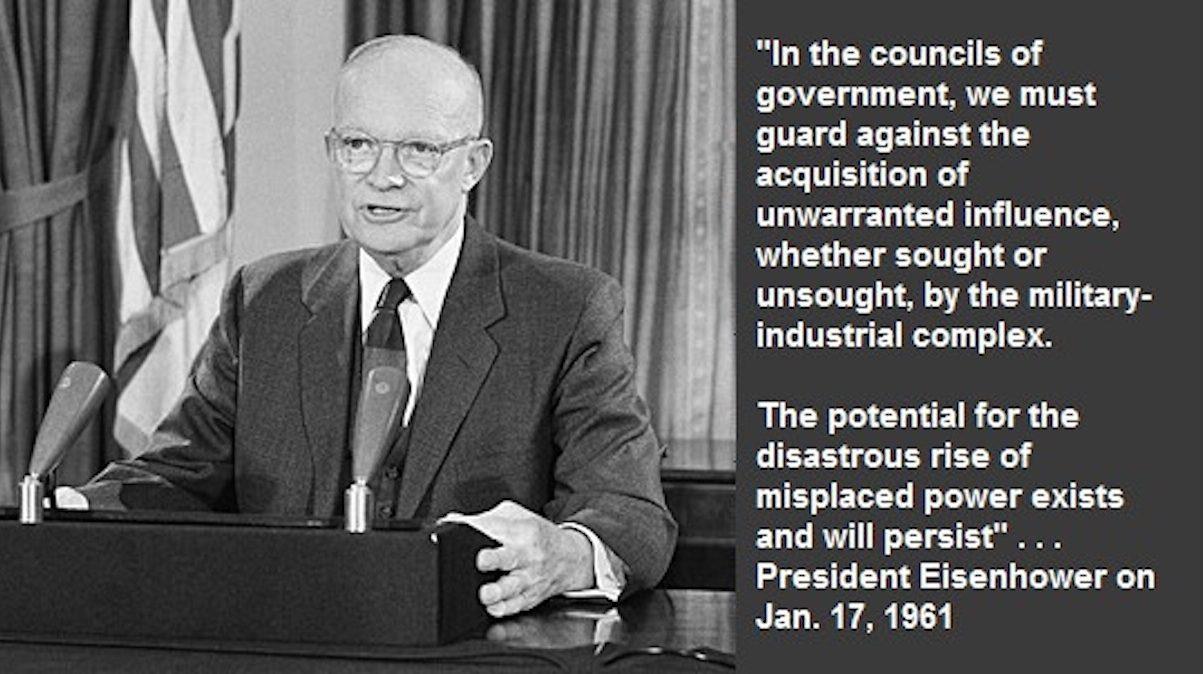

Hegseth 'warrior ethos' mistakes military might for true security

The Ukrainian university that is flourishing in wartime

“Once the decision was made, three vessels carrying Jimblebar fines that had just arrived at Tianjin Port were held back from clearance,” a Guangdong-based Chinese writer states in an article published on September 21.“Hebei mills' electronic systems also stopped allowing their procurement managers to order Jimblebar fines.”

That writer says steel mills' procurement managers were instructed to suspend new orders and utilize existing inventory first. He points out that talks between CMRG and BHP had already been stalled since May.

“It is ridiculous that we consume 70% of the world's iron ore, but we don't have any say in the pricing system,” he adds.“The price negotiation is not only about a few dollars per tonne but about who controls pricing power.”

Iron-ore mine in SimandouLast year, China imported 1.237 billion tonnes of iron ore, about 60% of which came from Australia. BHP (founded as the Broken Hill Proprietary Company; its name changed after a 2001 merger) accounted for 40% of China's total iron ore imports. This high level of reliance left Beijing feeling vulnerable in negotiations.

As the purchases of Jimblebar fines were halted, some Chinese buyers turned to source the minerals from Brazil. Additionally, Chinese steelmakers have invested heavily in iron ore mines in Guinea's Simandou region in West Africa.

The Simandou project is expected to ship its first cargo this November. Once fully operational, the mine is expected to deliver 120 million tonnes of iron ore annually, accounting for about 10% of China's annual iron ore imports.

“In 2024, the mining cost of Australian iron ore was only a little over US$10 per tonne, but the mineral was priced at about US$130 per tonne based on the Platts benchmarks,” says Yu Wuyin, a Shandong-based columnist.“The hundreds of billions of dollars we pay extra every year have become a feast on someone else's table.”

“After being taken advantage of for so many years, we finally realized that we must develop our own iron ore sources to compete with the existing suppliers,” she says.“Chinese companies' investments in Simandou are a breakthrough. Simandou holds the largest untapped deposit of 4.7 billion tonnes of high-grade iron ore, which has an average iron content above 65%.”

That writer also reminds readers of a case in which Stern Hu, the former head of Rio Tinto's China iron ore business, was accused of spying on China's steel industry and disclosing the information to Australian miners. She says Hu's move seriously hurt China's bargaining power in the iron ore price negotiations.

Stern Hu's CaseIn mid-2009, Chinese authorities detained Hu on charges of bribery and stealing commercial secrets during sensitive price talks. His arrest came at a time when negotiations between Chinese steel mills and foreign miners over annual contract prices had reached an impasse. In 2010, Hu was sentenced to 10 years in prison, serving eight before his release in 2018.

Born in an underprivileged family in Tianjin in 1963, he was admitted to Peking University. Using government funding, he studied metallurgy in Australia. In 1997, he was naturalized as an Australian citizen.

Sign up for one of our free newsletters

-

The Daily Report

Start your day right with Asia Times' top stories

AT Weekly Report

A weekly roundup of Asia Times' most-read stories

Chinese media reported that Hu leveraged his knowledge of the Chinese steel industry to help Australian iron ore sellers secure high offers, resulting in Chinese steel makers paying an additional 700 billion yuan over the years from 2003. They said Hu obtained the Chinese steel sector's core information by offering industry leaders luxury meals and gifts.

Apart from this case, the lack of transparency in Platts' benchmarks also led to higher prices paid by Chinese steelmakers, according to some Chinese media.

“It seems fair to price iron ores globally with Platts' benchmarks, but the situation is more complicated than people can imagine,” Jiemian, a Shanghai-based financial news website, said in a commentary.“Platts is part of S&P Global, which has close ties with leading international banks. JPMorgan, for example, is both a significant shareholder in BHP and an influential player in shaping the Platts index. Can such a pricing system be fair?”

In its analysis, Jiemian concluded that the business nature of Platts leaves pricing power concentrated in Western capital rather than reflecting China's dominant position in the iron ore trade.

Read: Poland border closure choking China-EU rail trade

Follow Jeff Pao on Twitter at @jeffpao3

Sign up here to comment on Asia Times stories Or Sign in to an existing accoun

Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.

-

Click to share on X (Opens in new window)

X

Click to share on LinkedIn (Opens in new window)

LinkedIn

Click to share on Facebook (Opens in new window)

Facebook

Click to share on WhatsApp (Opens in new window)

WhatsApp

Click to share on Reddit (Opens in new window)

Reddit

Click to email a link to a friend (Opens in new window)

Email

Click to print (Opens in new window)

Print

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Falconx Launches First Ethereum Staking Rate Forwards (Fras) Referencing Treehouse's TESR

- Ethereum Based Meme Coin Pepeto Presale Past $6.7 Million As Exchange Demo Launches

- Solstice Announces Strategic Collaboration With Chainlink And Leading Custody And Venture Firms To Enhance Ecosystem Ahead Of USX Stablecoin Launch

- Zebu Live 2025 Welcomes Coinbase, Solana, And Other Leaders Together For UK's Biggest Web3 Summit

- Falcon Finance Unveils $FF Governance Token In Updated Whitepaper

- Noveba Brings Apple Pay To Customers

Comments

No comment