Will Aster Price Surge Again In October? Predictions & Trends

- ASTER is currently supported at $1.60–$1.80, a zone that has historically preceded significant rebounds of 15–35%.

October's scheduled token unlock of $325 million worth of ASTER - about 11% of its market cap - is unlikely to destabilize the market given its high daily trading volume and robust liquidity. Technical patterns indicate a potential bullish breakout if ASTER breaches $2, with targeted gains of up to 35% in the short term.

A bearish scenario could unfold if the token dips below $1.60–$1.80, possibly leading to a decline towards $1.25, aligning with technical warning signs like the descending triangle formation.

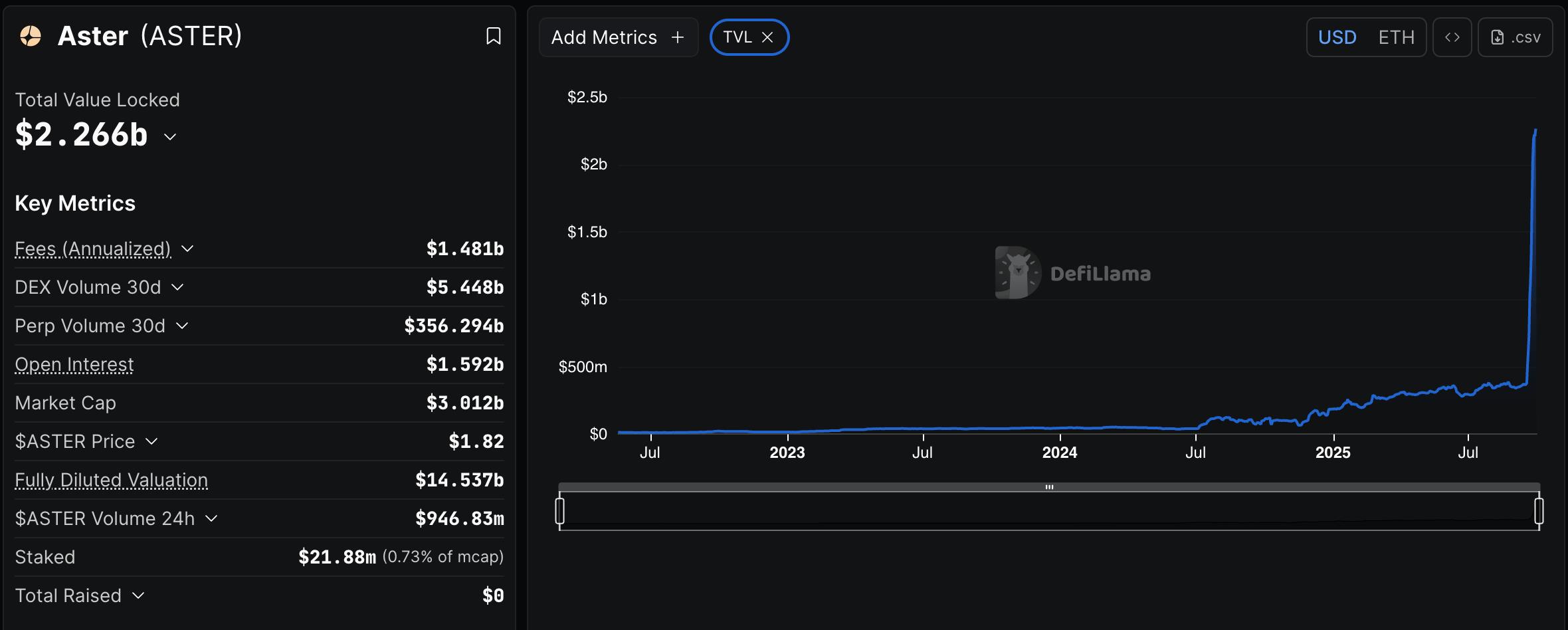

Aster (ASTER) has seen its price retreat over 25% from a recent high of approximately $2.43, dropping to around $1.80 as of late September. The correction comes amid rising concerns over a significant token unlock scheduled for October 17, which will release 183.13 million ASTER tokens worth approximately $325 million - roughly 11% of its total market cap. Despite this, ASTER maintains a daily trading volume nearing $1 billion and holds over $2.26 billion in total value locked (TVL), indicating strong liquidity that could help absorb the increased supply without triggering a major downturn.

Support Levels Indicate Possible ReboundTechnical analysis shows that ASTER's recent dip places it within a“hot support” zone at $1.60–$1.80, a range that analyst Michaël van de Poppe notes has historically preceded rebounds of 15-35%. Given this pattern, a bounce in the coming days seems probable-particularly if the token breaks above the $2 level, which could propel it toward new all-time highs above $2.43.

ASTER/USDT four-hour price chart. Source: TradingViewSuch bullish sentiment aligns with ASTER's ongoing falling wedge pattern-a technical indicator often signaling trend reversals. A confirmed breakout could project a measured move up to $2.22–$2.45, presenting a 35%-plus rally in October.

Trader BitcoinHabebe predicts that if ASTER bounces decisively from the support zone, the token could reach $3 in October, labeling the $1.60–$1.80 range as an area of accumulation.

Factors That Could Reverse the Bullish CaseThe bullish outlook hinges on ASTER maintaining above the $1.60–$1.80 support zone. Falling below this level might trigger a decline towards $1.25, near previous support levels observed in late September. This potential drop is supported by a descending triangle pattern-characterized by lower highs and a flat support line-that typically signals bearish momentum. If the pattern confirms a breakdown, the measured move projects a slide toward $1.26, matching Van de Poppe's downside target for October.

ASTER/USDT four-hour price chart. Source: TradingView

This scenario underscores the importance of support levels; a breach could accelerate a sharper decline, testing critical lows in the $1.20–$1.30 range.

Upcoming Token Unlock and Market ImpactThe October 17 token unlock represents a significant event, with 183.13 million ASTER tokens set to enter circulation. Given the existing high trading volume and substantial liquidity, many believe the market can handle this influx without major upheaval. Some traders see the unlock as an opportunity to buy the dip, potentially fueling a rally to new highs.

Aster DEX dashboard. Source: DeFi Llama

Nevertheless, market skeptics point out that about $700 million worth of ASTER is scheduled for unlocking by the end of the year, which could lead to increased selling pressure and a gradual downside movement if traders' confidence wavers. Trader Gordon, who has profited from shorting ASTER, warns that the token may continue to“bleed” as supply increases, urging caution ahead of the unlock. The project is also considering vesting schedules for new tokens to mitigate downside risks.

This environment emphasizes that while technicals point to a potential rebound, fundamental factors like tokenomics and upcoming unlock events could sway market sentiment and price action in the near term.

This article does not constitute financial advice. Investors should conduct independent research and consider market risks when engaging in crypto trading and investment decisions.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment