Bitcoin Hits $112K Again, Bull Market Continues - Expert Insights

- Bitcoin recovers to over $112,000 amid ongoing market volatility, signaling potential bullish strength. On-chain metrics, including Market Value to Realized Value (MVRV), support the view that the bull market remains intact. Recent liquidation events wiped out over $4 billion of crypto longs, highlighting short-term market nervousness. The Crypto Fear & Greed Index has shifted to a neutral zone, indicating cautious optimism among traders. Analysts believe Bitcoin's current consolidation phase could precede another significant upward move.

A prominent Bitcoin analyst has maintained an optimistic outlook, asserting that Bitcoin is still in a bull market despite recent turbulence. The flagship cryptocurrency spiked past $112,000 on Monday, surpassing levels not seen since previous sharp declines last week. Currently trading around $111,835, Bitcoin's swift rebound reflects underlying market resilience amid heightened volatility caused by broader macroeconomic factors.

Bull market“not over” for BitcoinAccording to XWIN Research Japan in a recent CryptoQuant note, on-chain data continue to indicate that Bitcoin's long-term bull trend persists. The firm emphasized that despite the short-term fluctuations that unsettled traders, key indicators like the behavior of long-term holders and the Market Value to Realized Value (MVRV) ratio suggest a resilient market surface. The MVRV has dipped to around 2, which, historically, signals neither euphoria nor panic, but rather a phase of consolidation conducive to further gains.

“Bitcoin's recent pullbacks should be viewed as digestion rather than the end of a rally,” the report explained. The data show that investors are still sitting on significant gains, and current market conditions likely set the stage for the next upward leg, particularly if Bitcoin consolidates within this MVRV range, historically a strong expansion zone.

Bitcoin's MVRV ratio (purple) compared to its price (black) since late 2024. Source: CryptoQuantMeanwhile, long-term investor profit-taking has decreased, effectively reducing available supply and supporting the potential for renewed upward movement. The combination of these metrics suggests that the current correction is part of a healthy, ongoing cycle rather than a terminal phase. Historically, such consolidation often precedes Bitcoin's strongest expansion phases, reinforcing continued optimism among seasoned traders and institutional investors.

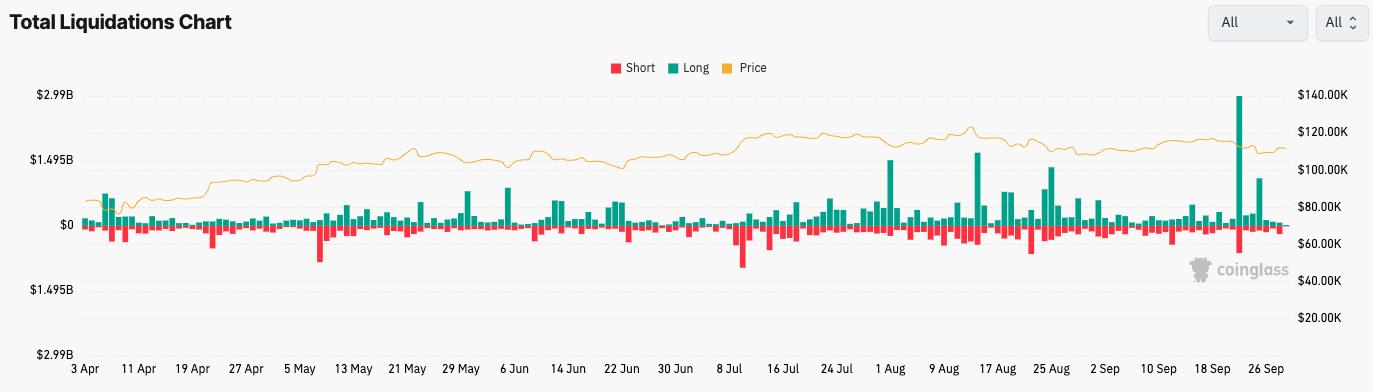

Crypto market sees significant liquidationsHowever, the recent recovery follows a period of intense liquidation activity, with over $4 billion wiped out in liquidations over the past week. The most notable event occurred on Monday, September 22, when nearly $3 billion of long positions were liquidated across the crypto space as Bitcoin dipped below $112,000, dragging down the broader market.

The amount of long liquidations across the market surged on Monday, Sept. 22, and Thursday as Bitcoin fell. Source: CoinGlass

This was followed by another $1 billion in liquidations on Thursday, surpassing Bitcoin's decline to $109,000. Long positions in Ethereum also saw over $400 million liquidated during this period, reflecting heightened short-term trader vulnerability. Despite these sharp corrections, market analysts caution that such liquidations, while painful in the moment, often set the stage for healthier long-term growth through the clearing of over-leveraged positions.

Market sentiment shifts to“Neutral”The Crypto Fear & Greed Index, a widely used sentiment indicator, has rebounded from fear levels to a neutral stance, scoring 50 out of 100. This marks a notable shift since last Friday, when the index hit a low of 28, signaling extreme fear. The rebound indicates growing trader confidence as Bitcoin manages to stabilize after recent declines, hinting at cautious optimism in the broader crypto markets.

While short-term volatility remains, the current technical and on-chain signals suggest that Bitcoin's latest consolidation could lay the groundwork for another strong upward move, with experts foreseeing that the crypto bull market is far from over. Investors are advised to consider the evolving metrics and market conditions as they position for future gains in this dynamic space.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Seoul Exchange, One Of Only Two Licensed Platforms For Unlisted Securities, Will Exclusively Use Story To Settle Tokenized Rwas

- Phase 6 Reaches 50% Mark As Mutuum Finance (MUTM) Approaches Next Price Step

- 0G Labs Launches Aristotle Mainnet With Largest Day-One Ecosystem For Decentralized AI

- Solotto Launches As Solana's First-Ever Community-Powered On-Chain Lottery

- Kintsu Launches Shype On Hyperliquid

- Blockchainfx Raises $7.24M In Presale As First Multi-Asset Super App Connecting Crypto, Stocks, And Forex Goes Live In Beta

Comments

No comment