What Europe Stands To Lose From Trump's Latest Tariffs Revisited

Earlier this year, we examined the potential consequences of Trump's renewed tariff agenda for the European Union. With a framework agreement between the EU and US now in place, the euro appreciating against the dollar and early trade data emerging, it's time to revisit our earlier assessment. Export front-loading at the start of the year helped sustain export levels in the first half of 2025. However, we expect EU exports to the US to decelerate as tariffs begin to bite, reinforcing our call of a direct GDP impact of -0.3% in the short run with significant risks to growth in the longer run.

A clearer but still volatile tariff landscapeWith the conclusion of the EU-US trade deal last July and the publication of the framework agreement, European producers now have more clarity on the tariffs. The agreement foresees a 15% blanket tariff on the most-favoured nation (MFN) rate for goods not impacted by sectoral tariffs. These sectoral tariffs are significantly more punitive, including 50% duties on steel, aluminium, and copper products. On the other side of the table, the EU agreed to remove its tariffs on industrial goods and pledged to purchase up to $750 billion worth of US energy and to facilitate up to $600 billion in investment into the US economy by 2028.

Despite this progress, uncertainty persists. In late August, the US expanded its sectoral tariff list to include a 50% duty on the aluminium and steel content of 407 additional products, while a list of exemptions to the blanket tariffs was published on 5 September. On 25 September, US president Donald Trump announced a 100% tariff on pharmaceutical products as of 1 October. At the same time, the US Supreme Court is expected to rule on the legality of tariffs imposed under the International Economic Emergency Powers Act of 1977 (IEEPA) on 5 November.

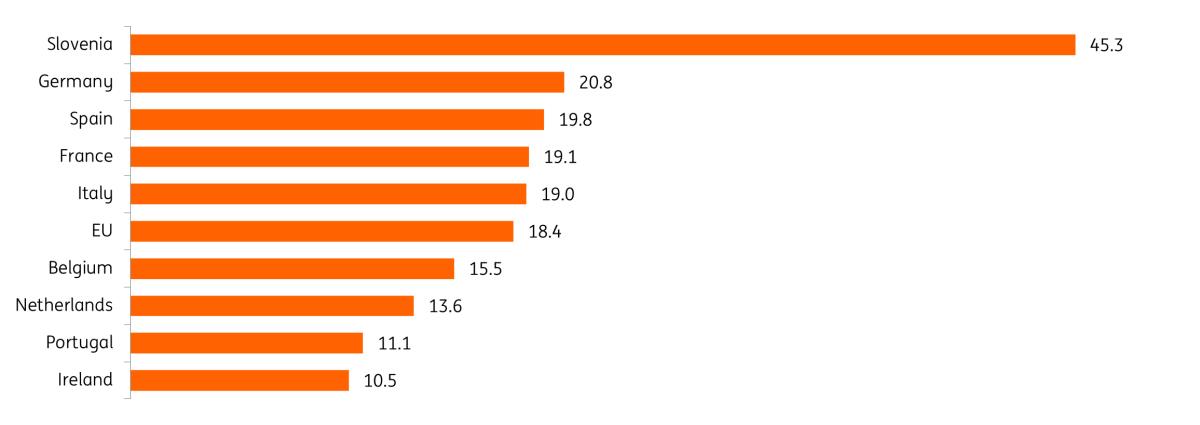

The evolving scope of sector tariffs and exemptions continues to complicate compliance. Slovenia, for instance, could see an estimated tariff hike of 45% (see Figure 1) due to some of its exports falling under the newly expanded list of products subject to 50% aluminium and steel content tariffs. While the effective tariff may prove lower in practice, the informational burden and ambiguity surrounding the reporting of metal content in products constitute a significant non-tariff barrier to trade.

Figure 1 - Estimated tariff hike as of 19 September 2025 (in percentage points) differs across EU countries

Source: Global Trade Alert, ING Research Strong tariff shock with differences between EU countries...

Slovenia stands out as an outlier, but the impact of sectoral tariffs and exemptions varies significantly across EU member states, reflecting differences in tariff structures and the export composition of each country. Ireland, benefiting from vaccine-related exemptions, faces a relatively 'modest' estimated tariff increase of 10.5 percentage points. For the EU as a whole, our estimates based on Global Trade Alert data suggest a trade-weighted effective tariff rate of 19.6%, a sharp rise from just 1.2% in 2024. This 18.4 percentage point increase is notably higher than the 13.1% rate used by the ECB in its latest macroeconomic projections, underscoring the difficulty of pinning down the current tariff environment.

Looking ahead, we expect tariff levels to remain elevated for the foreseeable future despite legal challenges from within the US. Tariffs as a source of revenues to finance parts of the fiscal deficit and as an important political tool to achieve all kinds of goals, even going beyond trade, will remain an important part of the US government's policy toolkit. Don't forget that the US government retains broad authority to reintroduce tariffs under alternative legal frameworks, as previously seen with automotive, steel, aluminium, and copper products. These laws allow for temporary tariffs that can be extended indefinitely by Congress. Add the substantial revenue generated by tariffs, and it is likely these will remain in place throughout Trump's term. Assuming no further escalation from the US side, any EU retaliation also appears unlikely.

... resulting in a direct hit to GDP of -0.3%With direct exposure to the US market amounting to roughly 1.9% of EU GDP, we estimate that an 18% tariff could reduce EU GDP by approximately 0.33% in the coming two years. While this outcome is consistent with our previous projection, the underlying drivers have shifted. Previously, we considered a worst-case scenario involving a 25% tariff hike, which did not fully materialise. That scenario was accompanied by a modest depreciation of the EUR/USD while, since the start of the year, the euro has appreciated by almost 15%.

Although this 15% appreciation is substantial, its effect on GDP is expected to be more limited than that of the tariffs. Tariff changes are typically assumed to be fully passed through to prices, whereas exchange rate movements tend to have a more partial effect. A study by economists from Harvard, the IMF, and the Federal Reserve suggest that only around 22% of exchange rate fluctuations are reflected in domestic prices, mainly due to the fact that the majority of US imports are invoiced in USD.

In sum, the smaller-than-expected tariff increase has been offset by the euro's appreciation, leaving our estimate for the GDP impact unchanged.

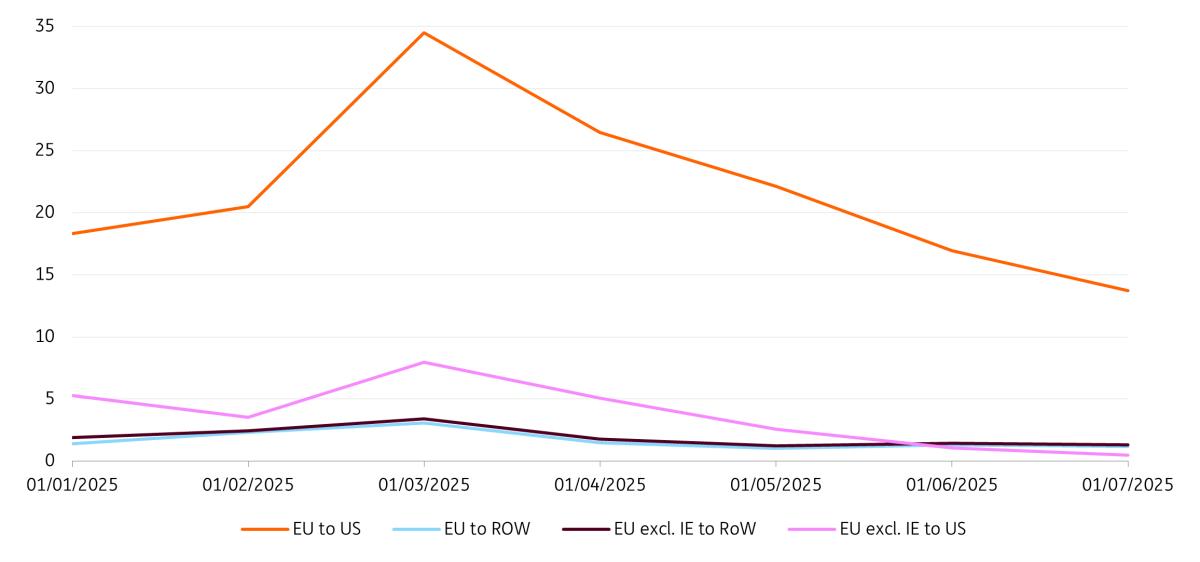

Keep an eye on exports as tariffs start to biteHow much of the negative impact has materialised so far? Not much, according to export data. This is largely due to front-loading: European exporters accelerated shipments ahead of the 1 April tariff hike, especially in Ireland's pharmaceutical sector. As a result, EU exports to the US surged early in the year and have since begun to decelerate. Export levels remain elevated though, up 13.8% year-on-year by the end of July, or 0.5% excluding Ireland (see Figure 2).

That said, the downward trend is clear, and we expect this slowdown to deepen in the second half of 2025. Our GDP impact estimates imply a reduction of EU exports to the US by almost 17% over the next two years, all else equal. The US accounted for 20% of extra-EU exports in 2024, rising to 22% by July this year. If the projected decline materialises, its share could fall to around 17.2%, all else equal. Such a sharp decline, especially in sectors and member states more exposed to the tariff shock, would be a clear indication that tariffs are beginning to bite.

Figure 2 - EU-US exports trending down post-'Liberation Day' (year-to-date YoY export growth)

Source: Eurostat, ING Economic Research Indirect effects can magnify welfare impact of tariffs...

While a 0.3% decline in GDP might seem moderate, the economic fallout from US tariffs could be significantly amplified through indirect channels. Tariffs disrupt production, which can lead to job losses, reduced household consumption, and delayed investment, particularly as firms reconsider multi-year projects amid heightened uncertainty.

Moreover, these effects are not limited to the EU-US trade relationship. Tariffs imposed on other countries, such as Canada and Mexico, distort global trading patterns and weakens demand for European exports, which feeds back into EU output. Global value chains further intensify this dynamic as demand for intermediate goods from Europe, processed in a foreign country prior to entering the US market, decline.

Model-based estimates capture the scale of these interdependencies. The Kiel Institute's trade model suggests a broader short-term GDP impact of -0.5% for the EU, factoring in spillover effects from Canada (-4.3% to GDP) and Mexico (-5.7% to GDP). Similarly, the ECB 's multi-country framework, which explicitly models shock propagation through global production networks, estimates a cumulative reduction in euro area GDP growth of 0.7 percentage points over the period 2025–2027.

... especially in the long runWhile we remain cautious about the full short-run realisation of these multiplier effects, they clearly reinforce the long-term risks. In the long run, we estimate the direct impact on EU GDP could rise to 0.86%, with further downside possible if confidence and investment deteriorate.

As such, the stakes for the EU are high: limiting the downside risks of the EU-US trade relationship will require opening up alternative trading opportunities, be it by deepening the internal market or expanding trade agreements with third countries. The recent closure of the EU-Mercosur partnership agreement, the swift conclusion of the EU-Indonesia trade deal, and advanced negotiations on an EU-India free trade agreement are perfect examples of this proactive approach.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment