Tokenize SBET Common Stock On Ethereum With Sharplink's Platform

- SharpLink Gaming partners with Superstate to tokenize NASDAQ -listed SBET shares on Ethereum. The company has established a significant Ether treasury, making it the second-largest public ETH holder. The tokenization aims to facilitate trading of public equities on decentralized platforms and compliant DeFi protocols. This initiative aligns with evolving U.S. crypto regulation and integration of blockchain in traditional markets.

SharpLink Gaming, a prominent player in the performance marketing sector specializing in iGaming and sports betting, revealed plans to tokenize its common stock via the Ethereum blockchain. Partnering with the fintech firm Superstate, the company will leverage its Open Bell platform to convert its Nasdaq-listed shares (SBET ) into digital tokens. This step signifies a technological milestone and a strategic move towards modernizing capital markets.

“Tokenizing SharpLink's equity directly on Ethereum embodies not just a technological breakthrough but also signals our vision of where global capital markets are headed,” said co-CEO Joseph Chalom.

By partnering with Superstate, SharpLink joins an emerging cohort of companies opting for public stock tokenization. For example, Forward Industries recently announced its move to tokenize shares on the Solana blockchain, further validating the industry's shift towards blockchain-enabled equity trading.

Second-largest ETH holderFounded in 2019, SharpLink initially focused on marketing services within the iGaming and sports betting sectors. In June 2025, the company pivoted to creating a corporate Ether reserve, emerging as one of the world's top public ETH holdings. This strategic reserve showcases a growing trend among public companies leveraging cryptocurrencies as part of their treasury strategies.

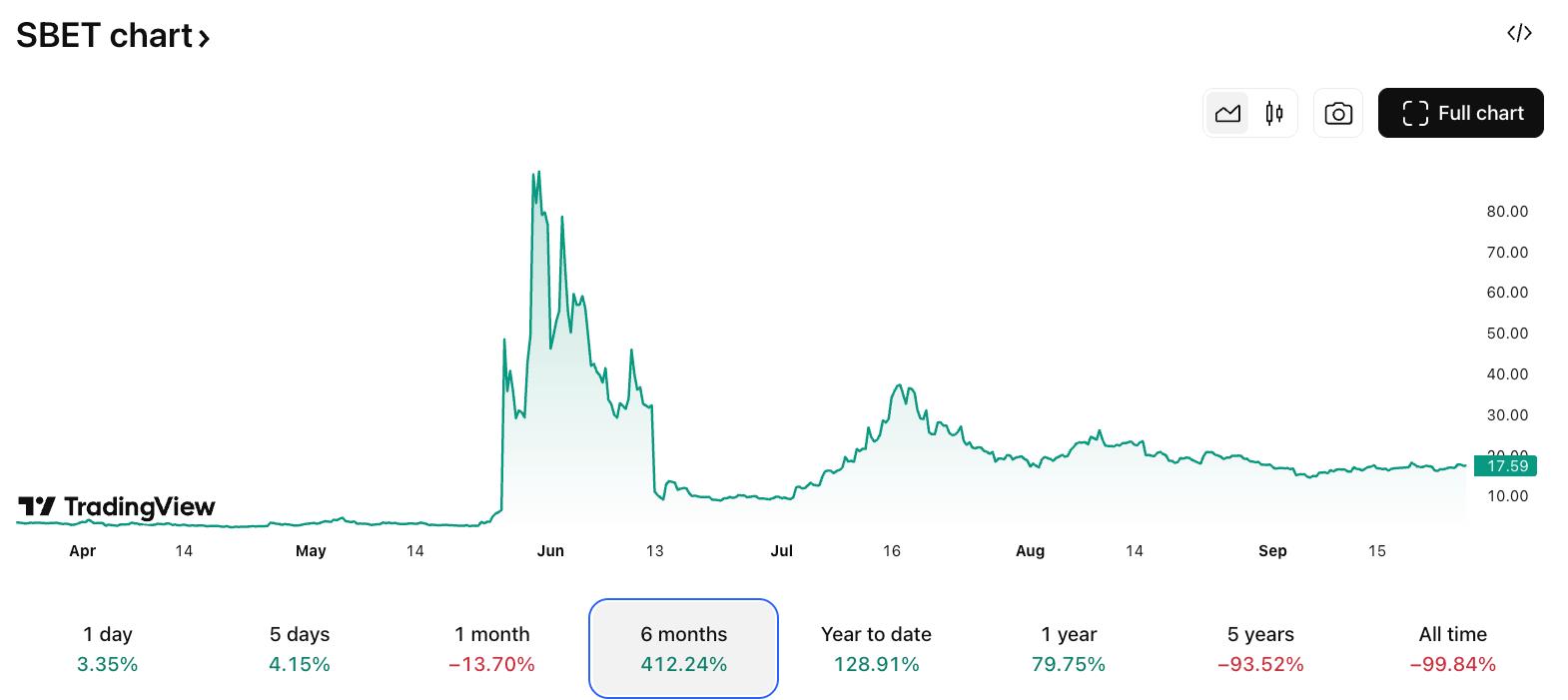

SharpLink Gaming is the second-largest public company holding Ether as of Sept. 25. Source: CoinGeckoFollowing the announcement of its ETH treasury, SharpLink's shares surged over 100%, jumping from approximately $40 on May 27 to nearly $90 on May 30. However, the stock subsequently declined sharply, falling below $40 by mid-June and stabilizing around that level since. This volatility underscores the experimental nature of integrating cryptocurrencies with traditional equity markets.

Sharplink Gaming (SBET) stock six-month price chart. Source: TradingView Expanding trading through DeFi

According to a filing with the U.S. Securities and Exchange Commission, Sharplink intends to develop mechanisms for trading its tokenized shares on decentralized exchanges, particularly automated market makers (AMMs). These protocols leverage smart contracts and liquidity pools, enabling seamless trading of digital assets without traditional market intermediaries.

Moreover, the company aims to expand these efforts across other decentralized finance (DeFi) protocols in a fully compliant manner. This initiative complements regulatory advancements and aims to modernize securities trading, aligning with the SEC's broader objectives to foster innovation while safeguarding investor interests.

“This initiative aligns with the SEC's Project Crypto agenda, aimed at integrating digital assets into the regulatory framework and supporting on-chain markets,” stated Sharplink.

Further reading: 7 reasons why Bitcoin mining is a terrible business idea

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment