Crypto Markets Surge After US Treasury Reaches $850 Billion Target: Analyst Predictions

“With this liquidity drain completed, up only can resume,” Hayes wrote on Friday, noting the TGA's opening balance exceeded $807 billion. Typically, funds allocated to the Treasury's account are sequestered and not circulating in private markets, impacting overall liquidity.

However, skepticism remains among some analysts regarding Hayes' optimistic outlook that liquidity will flow into the broader financial markets once the goal is reached. André Dragosch, the European research head at investment firm Bitwise, responded,“Net liquidity has only a loose correlation with Bitcoin and crypto , in my view, and I consider it somewhat irrelevant in assessing market movements.”

Many traders expect liquidity levels to increase in the coming months, driven by the Federal Reserve's ongoing interest rate cuts, which historically have bolstered asset prices, including cryptocurrencies like Bitcoin and Ethereum . As liquidity increases, a potential rally could materialize until the Fed halts or reverses course, tightening monetary policy again.

US Federal Reserve Implements First Rate Cut of 2025The Federal Reserve surprised markets by slashing interest rates by 25 basis points - the first reduction since 2024. This move triggered a brief dip in Bitcoin 's price below $115,000, demonstrating typical“sell the news” behavior that often accompanies rate adjustments.

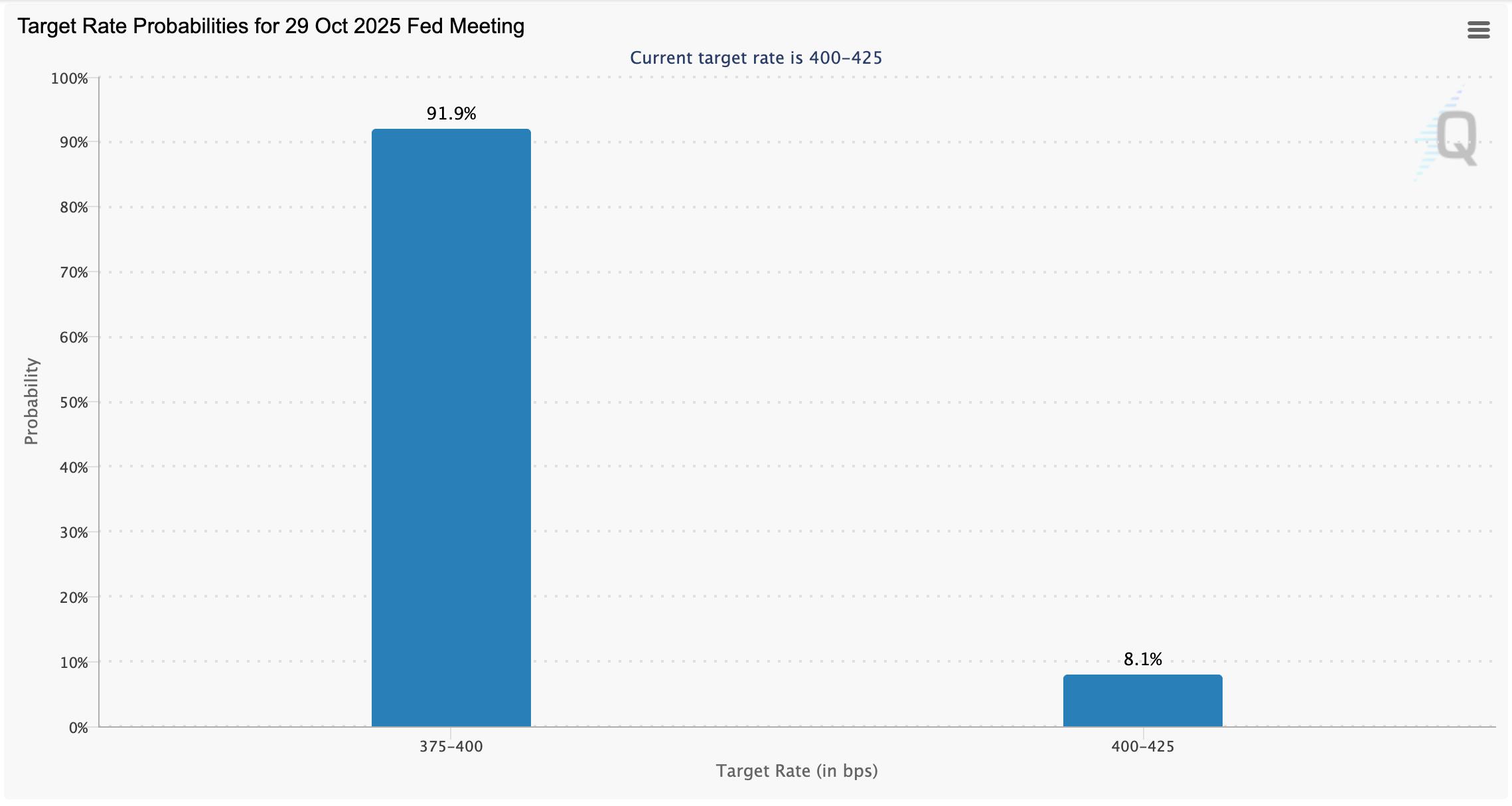

Coin Bureau founder Nic Puckrin cautioned that the recent correction might be temporary, noting that markets had likely priced in the rate cut well before it was announced. Federal Reserve Chair Jerome Powell emphasized that policymakers remain divided over further rate cuts in 2025, but very few traders now anticipate more than a 50 basis point reduction at the next meeting in October - with approximately 92% expecting a cut of that size according to data from the CME Group.

Source: CME Group

The broader outlook continues to influence crypto markets, as investors monitor central bank policies and their potential impact on the growing ecosystem of blockchain-based assets, including DeFi platforms and NFTs. As rate policies evolve, the trajectory of cryptocurrency prices-especially Bitcoin and Ethereum -remains tightly linked to macroeconomic developments and policy signals from the US Federal Reserve.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment