Bitcoin Mining Difficulty Reaches Record High Again In September

Following successive all-time highs in August and September, driven by a surge in mining hardware deployment, Bitcoin 's network difficulty continues to reflect growing computational power. Concurrently, the network's hashrate-the total processing power securing the blockchain-has also reached an all-time peak of over 1.1 trillion hashes per second, according to data from CryptoQuant.

This escalating difficulty and rising hashrate underscore the intensifying competition among miners, both individual and institutional. However, it also raises concerns about potential centralization, as the high costs associated with energy-intensive hardware and electricity requirements favor larger, well-funded entities. These trends highlight how the increasing difficulty is reshaping the landscape of Bitcoin mining , with implications for decentralization and network security.

Bitcoin network difficulty reached a new all-time high in September. Source: CryptoQuant

Industry observers note that rising mining difficulty, combined with the demand for high-performance computing hardware, is making it increasingly challenging for smaller-scale miners to remain competitive. This shift could impact the decentralization of the Bitcoin network, prompting discussions about the future of mining operations globally.

Global and US government involvement shaping the mining landscapeWhile small miners face mounting hurdles, governments and energy firms are stepping into the fray. Several countries are already mining Bitcoin using excess or surplus energy, including Bhutan, Pakistan, and El Salvador. Notably, Pakistan announced plans to allocate 2,000 megawatts of surplus energy specifically for crypto mining , reflecting a broader regulatory embrace of digital assets.

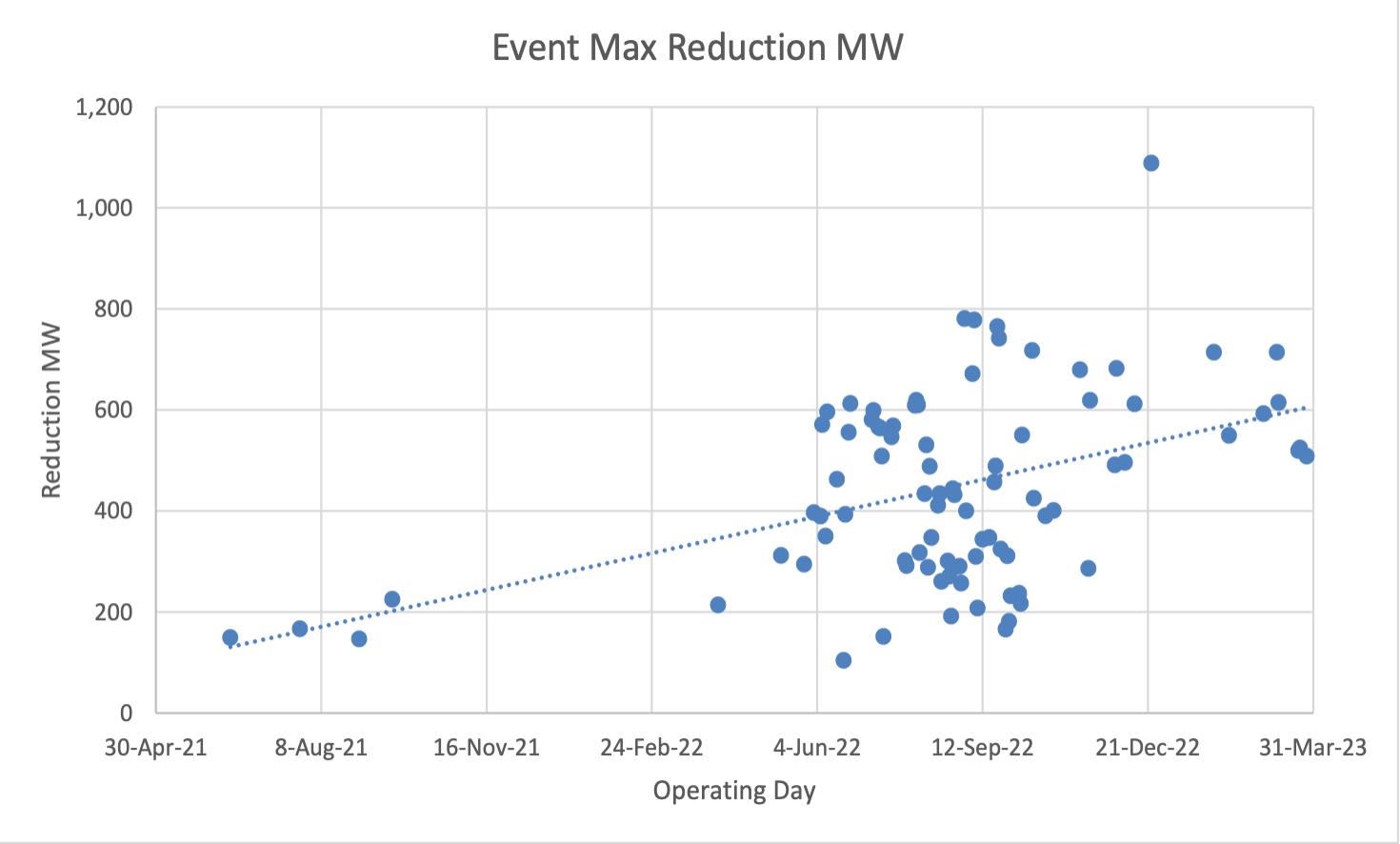

Within the United States, particularly in Texas, energy providers are integrating Bitcoin mining into the grid infrastructure to help stabilize electrical supply. These arrangements enable utilities to use mining operations as a flexible load, consuming excess power during low-demand periods and reducing output during peak times, thus mitigating grid stress and avoiding outages.

Energy providers in Texas are leveraging Bitcoin mining to balance electricity demand, as shown by reduced energy usage during peak periods. Source: ERCOT

This dynamic allows electricity companies to profit from excess energy and maintain grid stability without directly bearing the costs of variable energy prices. It also illustrates how Bitcoin mining is becoming intertwined with national energy strategies, raising questions about the broader implications for crypto regulation and market stability.

Related: Bitcoin mining stocks outperform BTC as investors bet on AI pivots

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment