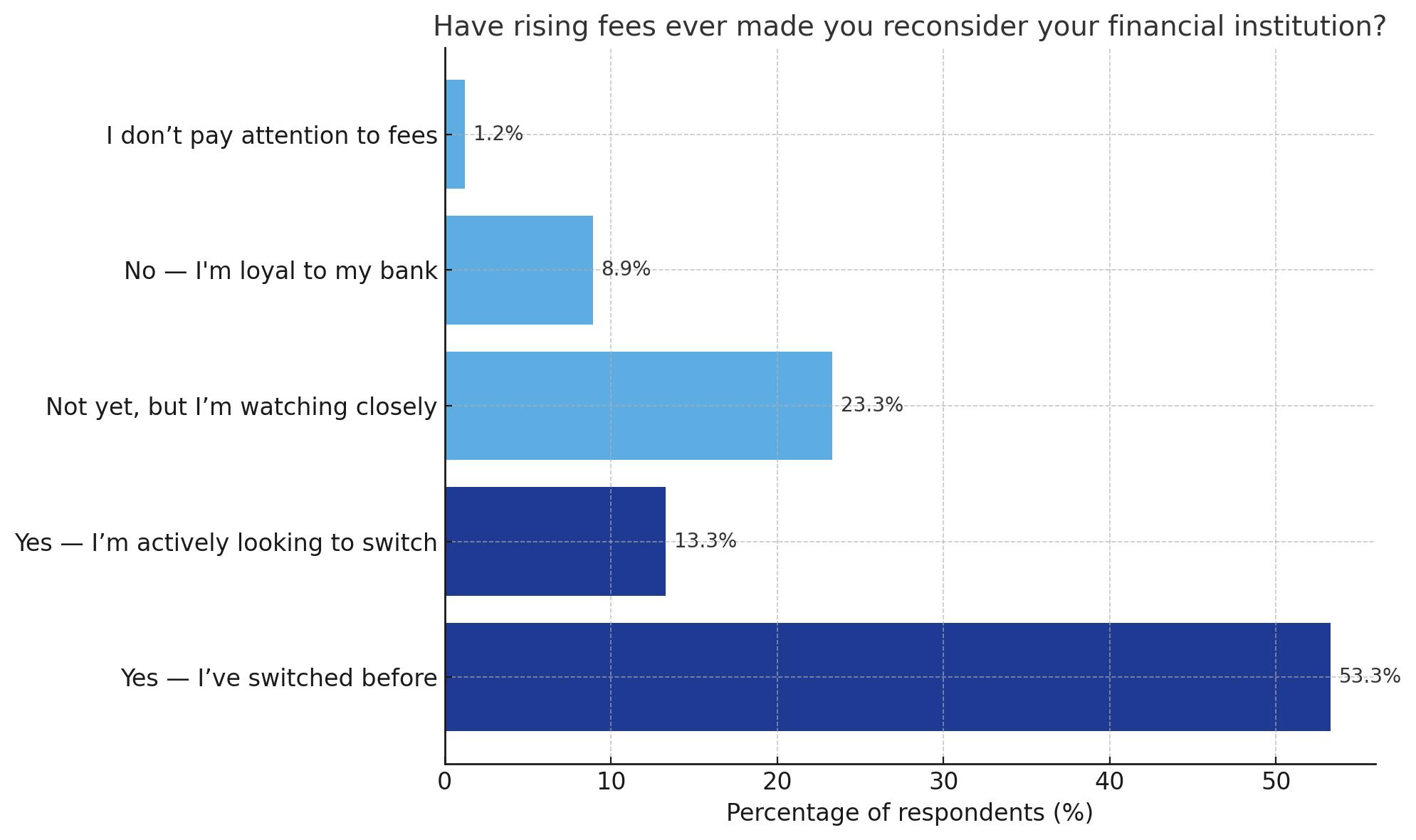

Fed Up With Fees: Over Half Of Canadians Have Switched Banks Over Fees - And Many More Are Considering It

That means nearly 9 in 10 Canadians are either ready to switch or are seriously considering it.

Canadians are fed up with feesThe findings reflect a growing frustration with banking costs. In recent years, major Canadian banks have steadily raised monthly account fees, minimum balance requirements, and transaction charges. For households already stretched by inflation, every extra dollar counts.

Many Canadians appear to feel that fees are a silent budget killer. Although a monthly fee can appear small on paper, over the course of a year, Canadians can pay hundreds of dollars just to access their own money.

Loyalty is fadingThe survey also shows that loyalty is eroding: just 9% of respondents said they remain loyal to their bank despite rising fees, and 1% said they don't currently pay much attention to fees. However, other research, such as a 2024 report from Abacus Data, suggests a majority of Canadians (66%) do not intend to switch financial providers in the next two years. That suggests that while frustration with bank fees is real, not everyone is ready to take action.

Still, mounting frustration should be a flag to financial institutions. These days loyalty programs, long-standing customer relationships, and traditional brick-and-mortar convenience may not be enough to keep clients from exploring alternatives.

Canadians consider switching banks due to rising fees

Money: Have rising fees ever made you reconsider your financial institution

Canadians are turning to online-only banks, credit unions, and fintech platforms that offer no-fee accounts, higher interest rates on savings, and fewer restrictions.

Beyond monthly account fees and minimum balances, switching institutions still comes with costs. In 2025, TD raised its RRSP and TFSA transfer-out fee to $150, matching similar changes earlier made by RBC. These“exit fees” can make switching more expensive for customers with multiple registered accounts.

Plus, switching isn't always seamless - automatic bill payments and direct deposits need to be updated - but the payoff can be significant. For many, the math is simple: why pay $20 a month in fees when competitors charge nothing?

What this means for your moneyIf bank fees are weighing on you, you're far from alone - but before making a switch, it helps to compare carefully. Questions to ask:

- 1. What are all your monthly charges (account fees, transaction costs, minimum-balance penalties, etc.) and are there no-fee or lower-fee alternatives? Look at monthly charges, transaction limits, and penalties. 2. What exit or transfer fees might you face if you move (for example, for TFSAs or RRSPs)? 3. Do the perks of your current bank (branches, service, loyalty programs) offset those fees - or could alternative providers offer enough benefit? Some banks offer perks like travel insurance or cashback that may offset costs. Plus, branch access, ATMs, mobile apps, and customer service all matter. 4. Plan for the hassle of updating direct deposits, automatic payments, etc. Make a list of all automatic payments and deposits to update.

The survey indicates that many Canadians are fed up with fees: over half say they've already switched institutions due to cost, and a large portion are considering it. Still, other data shows many are hesitant to act, often due to switching friction or exit fees. For banks, this points to a balancing act: raising fees risks customer loss, but hidden costs and transfer penalties may discourage some from leaving - meaning transparency and customer value may become more important than ever.

Survey methodologyThe Money survey was conducted through between June 11 and June 18, 2025 with 5,275 email newsletter subscribers, over the age of 18, surveyed resulting in 86 responses. The estimated margin of error is +/- 7%, 17 times out of 20.

About caMoney is a leading financial platform committed to providing individuals with comprehensive financial education and resources. As part of Wise Publishing, Money is a trusted source of reliable financial news, expert advice, comparison tools and practical tips. Canadians get insight on a variety of personal financial topics, including investing, retirement planning, real estate, insurance, debt management and business finance.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment