National Bank Of Hungary Preview: Old Habits Die Hard

Taking everything into account, we still see no reason for the National Bank of Hungary (NBH) to ease monetary policy in September or in the near future. In line with this view, we expect the central bank to keep the interest rate complex unchanged at its next meeting on 23 September. The base rate will remain at 6.50%, with a +/- 100bp interest rate corridor – a high-conviction call.

Looking further ahead, we still do not anticipate any interest rate cuts this year, given that the Monetary Council is still focused on addressing persistently high inflation expectations. The only new development is the strengthening of the forint. However, we think policymakers would favour a stronger/stable currency over a lower interest rate environment. The risk-reward equation suggests a better reward in a 'high for longer' interest rate scenario.

Lower rates won't do much for the real economy, but the lower risk premium would make the forint vulnerable to a disorderly sell-off, especially given the current situation of widespread long HUF positioning. A strong forint helps to tame underlying inflation and can slowly but surely reduce perceived inflation and inflation expectations. This would also be welcomed on the fiscal side. With 30% of public debt denominated in foreign currencies, a strong HUF could prevent an increase in the debt-to-GDP ratio.

We have adjusted our longer-term outlook on monetary policy. While we still expect a total of 100bp of easing in 2026, in line with our dovish forecasts for the region, we have updated the profile of the Hungarian rate cut cycle. Rather than gradual easing, we anticipate a back-loaded cycle starting in the second half of 2026. This will stabilise the forint in the 380–395 range over the next five quarters, providing a better opportunity to accelerate the reduction of inflation expectations and reset corporate mindsets regarding HUF behaviour and their own pricing habits.

Updated Hungarian interest rate and EUR/HUF forecasts of ING

Source: ING Our market views

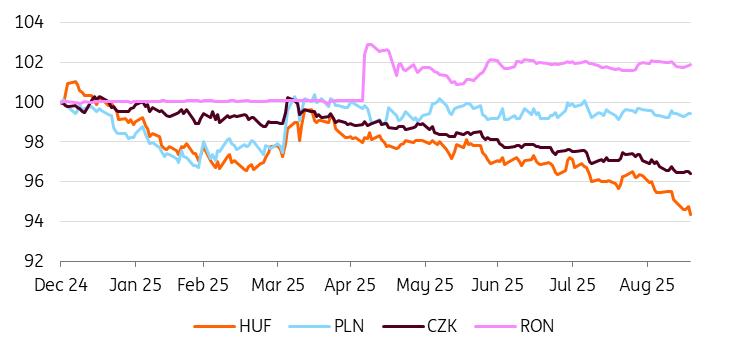

The NBH's hawkish rhetoric and the stable environment in Hungary are giving the HUF its best times and outperforming its CEE peers. The summer kicked off an influx of buyers, and we haven't seen much change since then. Although positioning screams max long, the market seems to have decided to keep this carry trade for longer. Given our hawkish revision of the NBH path, we see this trend continuing until the end of the year.

On the other hand, we must always keep in mind the overcrowded positioning, which will leave HUF very sensitive to global shocks. For now, however, the combination of a hawkish NBH, stable rates for an extended period, and EUR/USD heading upwards should add fuel to the HUF rally, with 380 EUR/HUF in our new forecast for the end of the year.

CEE FX performance vs EUR (end-2024 = 100%)

Source: NBH, ING

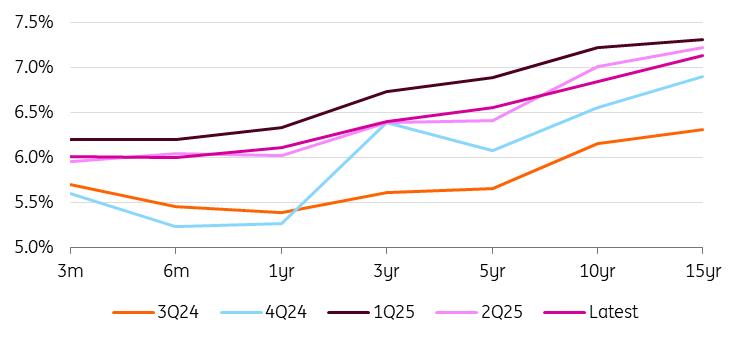

Although the rates market has expected only a minimal chance of a rate cut this year for some time now, the last few days have brought a somewhat dovish shift for next year. At this point, the market sees the first cut in Q1 2026 and a terminal rate of around 5.50% in the following 18 months, which is somewhat faster than we see in our new forecast.

More interesting is the belly and end of the curve, where 5y5y finally broke out of the range of recent months and broke below the 7.00% level. We believe that the market has perfect conditions for further flattening of the curve. The front end of the curve should be anchored by a hawkish NBH, while the weak economy and dovish core market should push the long end down.

At the same time, fiscal policy confirms the determination to keep the deficit under control, below most CEE peers, despite the market pricing in some risk premium. We therefore expect further flattening of the curve and tightening of asset spreads between IRS and HGBs.

Hungarian yield curve

Source: GDMA, ING Background and the new staff projection

As the economic data (including inflation and GDP figures) were not significantly different to the National Bank of Hungary's June staff projections, we don't think the central bank can justify a dovish shift. Despite the recent strengthening of the forint, market players now seem to have a different mindset. Previously, when we saw a significant strengthening of HUF, investors quickly started to price in a swift easing cycle. But not any more. It seems old habits do die. The market sees no chance of a cut in September and only a slim chance of easing in the fourth quarter. Therefore, any kind of dovish shift in forward guidance would cause major market distortion, in our view.

The central bank is also going to update its staff projections. We don't expect any meaningful changes to the GDP and inflation forecasts for 2025-27, which are going to be released at the rate-setting meeting. The full September Inflation Report will be released on 25 September.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment