GST Rate Cuts On 11 Bengal-Specific Items Will Boost State's Economy: Sitharaman

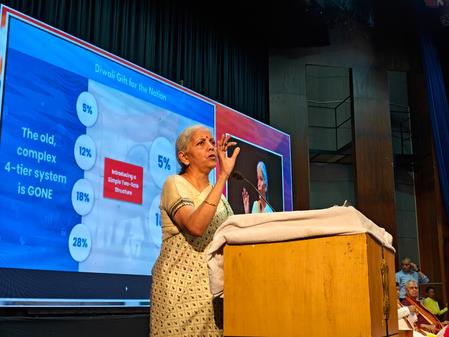

Addressing the GST 2.0 outreach programme here, Sitharaman also highlighted that the decision to make the reforms come into effect from September 22 was largely due to the fact that the government wanted consumers to benefit ahead of Durga Puja.

GST on Shantineketan leather goods has come down by 5 per cent, while the rate on Bankura terracota craft is now also at 5 per cent, which will help craftsmen as the demand for these products will go up due to the decline in prices.

Similarly, the GST rate on Madhurkati match and Purulia Chau masks and wooden masks of Dinajpur have also been reduced to 5 per cent.

Other items from West Bengal that will benefit due to the GST rate cuts include processed mango items from Malda and Darjeeling tea, which will now be taxed at 5 per cent.

The reduction in the duty on jute bags will also lead to an increase in the demand for these items, which will benefit the farmers and manufacturers in the state, the Finance Minister said.

The rates were not fixed randomly but aimed to help the middle class, the poor and farmers, she added.

The GST 2.0 reforms, under which the tax rates were cut, would also help the MSME sector and lead to higher economic growth and the creation of more jobs in the country.

Sitharaman also said that the GST Council is a constitutional body and the opposition-ruled states, including West Bengal, had agreed that as far as the reduction in GST slabs and the cut in GST rates on health schemes were concerned, they are with the council's recommendations, and there was enormous support for the reforms.

"States came together and agreed to the proposal to reduce the slabs. I wrote personal letters to all Finance Ministers of states," she remarked.

"Bureaucrats deliver when leaders support the system. The Prime Minister had stated that he wanted simplicity in the GST tax system," Sitharaman said.

She said the Finance Ministry has been constantly reviewing the rules to push ahead with tax reforms.“No one imagined that the income tax rate on personal income would be slashed,” Sitharaman remarked.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Ozak AI Partners With Pyth Network To Deliver Real-Time Market Data Across 100+ Blockchains

- Blockchainfx Raises $7.24M In Presale As First Multi-Asset Super App Connecting Crypto, Stocks, And Forex Goes Live In Beta

- B2PRIME Secures DFSA Licence To Operate From The DIFC, Setting A New Institutional Benchmark For MENA & Gulf Region

- BTCC Summer Festival 2025 Unites Japan's Web3 Community

- From Zero To Crypto Hero In 25 Minutes: Changelly Introduces A Free Gamified Crash Course

- BILLY 'The Mascot Of BASE' Is Now Trading Live On BASE Chain

Comments

No comment