403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Copart Signal 17/09: Price Action Reversal Brewing (Chart)

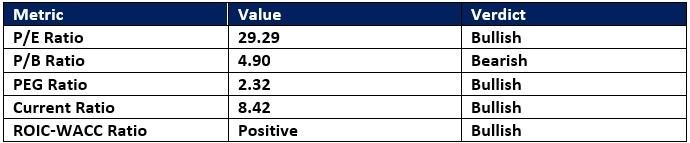

(MENAFN- Daily Forex) Long Trade IdeaEnter your long position between $46.14 (the lower band of its horizontal support zone) and $47.38 (the upper band of its horizontal support zone).Market Index Analysis

- Copart (CPRT) is a member of the NASDAQ 100 and S&P 500. Both indices hover near all-time highs with contracting trading volumes. The Bull Bear Power Indicator for the NASDAQ 100 shows a negative divergence and does not confirm the uptrend.

- The CPRT D1 chart shows price action inside its horizontal support zone. It also shows price action breaking down below its ascending Fibonacci Retracement Fan. The Bull Bear Power Indicator is bearish, but close to its ascending trendline. The average bullish trading volumes during positive sessions are higher than the average bearish trading volumes. CPRT corrected as the NASDAQ 100 pushed higher, a bearish trading signal, but bullish catalysts have accumulated.

- CPRT Entry Level: Between $46.14 and $47.38 CPRT Take Profit: Between $58.07 and $60.69 CPRT Stop Loss: Between $42.82 and $44.15 Risk/Reward Ratio: 3.59

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment