Indian Steelmakers Face Q2 FY26 Earnings Hit As HRC Prices Fall: JM Financial

Indian steel manufacturers are expected to face pressure on earnings in Q2 FY26 due to falling steel prices, with average domestic Hot-Rolled Coil (HRC) prices dropping from the last quarter, according to a report by JM Financials. The average domestic HRC prices have dropped to Rs 49,600/tonne, down Rs 2,000 from the first quarter.

The report added that the steel companies have guided for a USD5-10/tonne reduction in coking coal consumption costs, but the benefit is expected to be offset by lower realisations, leading to an estimated EBITDA contraction of Rs 3,500/tonne in Q2.

However, it adds declining raw material prices may ease working capital requirements, aiding net debt reduction.

In contrast, non-ferrous players are set to see margin expansion. Aluminium LME prices rose USD140/tonne QoQ to USD 2,600/tonne, while zinc prices also gained USD 120/tonne, boosting prospects for Hindustan Zinc.

Looking ahead, spreads are expected to improve in H2, driven by a USD20/tonne rebound in Chinese HRC prices, safeguard duty corrections by the Indian government, longer import duty visibility, and seasonally stronger demand, the report added.

Steel is a de-regulated sector and the government acts as a facilitator by creating a conducive policy environment for the development of the steel sector.

National Steel Policy, 2017 envisages a crude steel capacity of 300million tonnes(MT) and production of 255 MT by 2030 based on projections of rise in domestic demand driven by urbanisation and infrastructure growth, exports and various other factors.

Crude steel production for the year 2023-24 and 2024-25 were 144.30MT and 152.18 MT, respectively with 5.5 per cent change from last year.

Finished steel consumption for the year 2023-24 and 2024-25 were 136.29 MT and 152.13 MT respectively with 11.6 per cent change from last year.

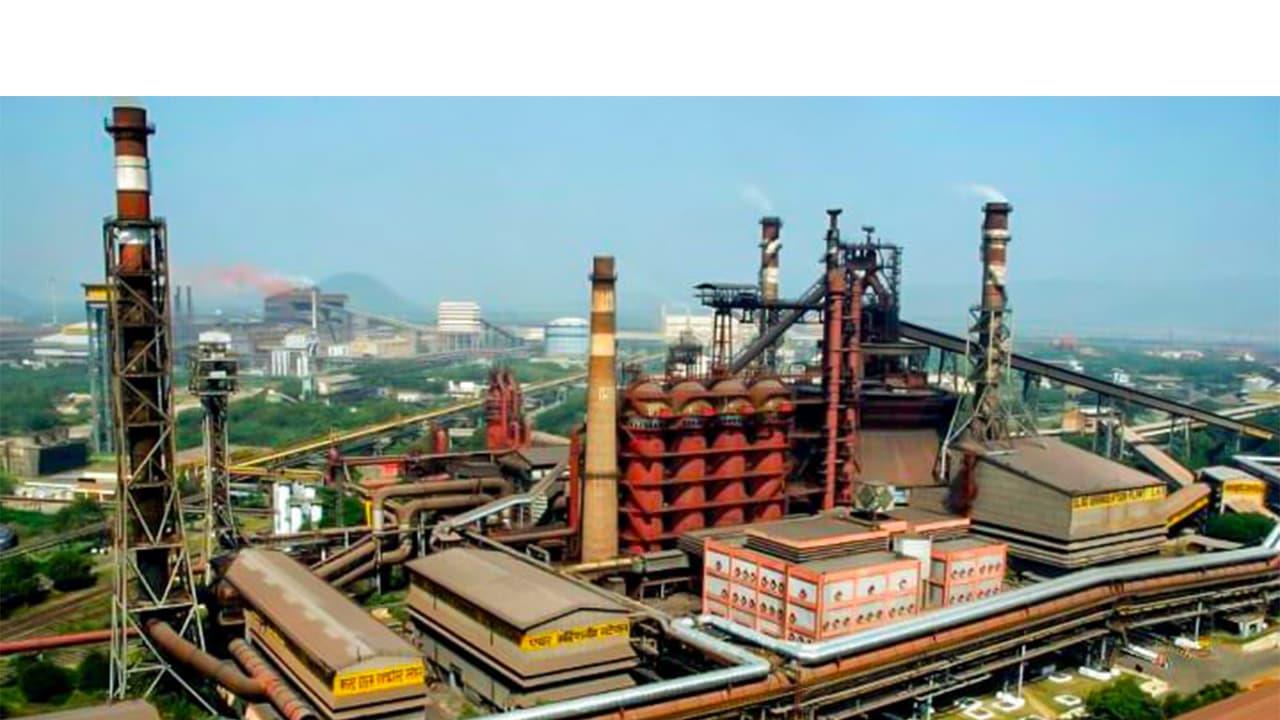

India is the world's second-largest crude steel producer and is set to become a global leader in steel capacity and production by 2030-31.

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment