Valura.Ai Ignites GCC Wealth-Tech Scene With Record-Breaking Launch

The platform's rapid traction reflects a broader shift in the GCC toward digital-first, performance-driven wealth management

Published: Wed 10 Sept 2025, 11:46 AM

- Partner Content

- Share:

- Follow on Google Follow on WhatsApp Follow on Telegram

Valura , the GCC's most anticipated discipline-first wealth-tech platform, has officially launched to overwhelming demand, securing an astonishing 10,000 sign-ups within just hours of its debut. The unprecedented response prompted the company to introduce a waitlist to manage onboarding, underscoring the region's appetite for innovative digital wealth solutions. Recognized as one of the 'Top 100 Fintech Start-ups' worldwide by Money20/20 and shortlisted by NorthStar (Gitex), Valura has captured both regional enthusiasm and global.

“As the UAE continues its push to position itself as a hub for financial innovation, Valura's launch is a milestone moment,” said Priyesh Ranjan, founder and CEO of Valura.“From its record-breaking sign-ups to its elite global recognition, the platform has set a high bar for wealth-tech in the region, proving that the future of finance in the GCC may already be here.”

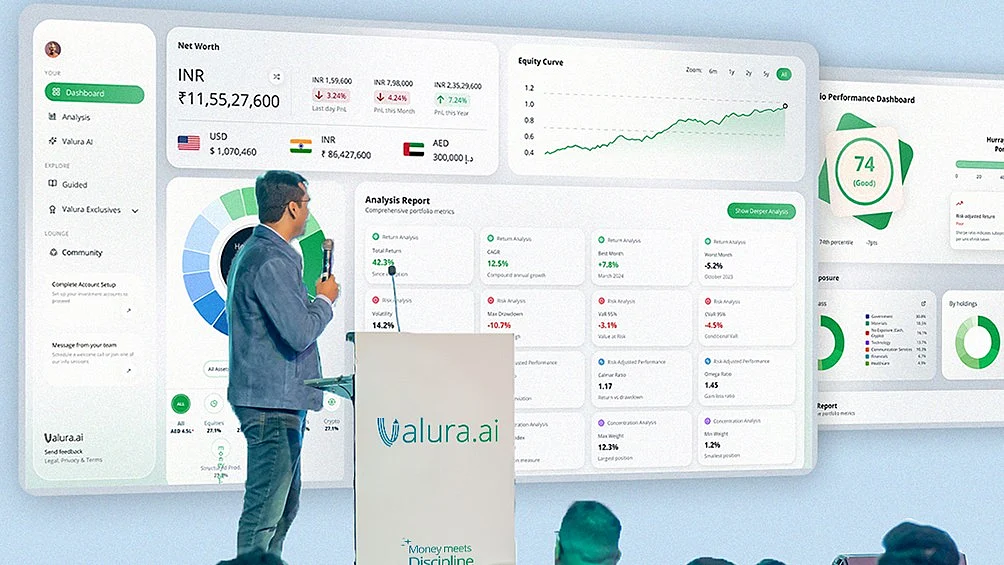

Licensed by the UAE Securities and Commodities Authority (SCA), Valura is redefining wealth management through its bold vision of“Wealth Without Walls.” The platform empowers investors across planning, investing, and tracking by consolidating all assets and liabilities - including real estate, stocks, crypto, mutual funds, gold, and loans into a single intelligent dashboard. This unified view gives users the clarity they need to see the bigger picture and make confident, informed financial decisions.

Valura's innovative toolset includes Valura Compass, a goal-based financial planning engine; the Discipline Score, which measures consistency and increases accountability; and the Command Center, a hub for aggregating and operating accounts. Together, these features allow users to streamline their financial journey like never before. The platform also opens access to over 10 asset classes through its marketplace, enriched with AI-powered insights and a one-click rebalancer - capabilities once reserved for private banks and high-net-worth individuals.

By combining machine-learning portfolio analytics, a one-click portfolio builder, and a multi-agent AI advisor, Valura delivers institutional-grade intelligence to retail investors. At the same time, it invests in building financial confidence from the ground up through Valura Academy, which provides gamified education for teens and women, fostering healthy money habits alongside real investing tools.

“Valura is not just another wealth platform; it's a movement to democratize finance across the GCC,” added Ranjan.“Our mission is to empower people with tools and knowledge that were once available only to the elite, helping them build wealth with discipline and confidence.”

Early beta users have already described Valura as a“game changer,” praising its intelligence, simplicity, and transparency. This forward-thinking approach earned the company recognition among the world's leading fintech innovators, reinforcing its status as a catalyst for regional change.

The platform's rapid traction reflects a broader shift in the GCC toward digital-first, performance-driven wealth management. With growing interest from Saudi Arabia and neighboring markets, Valura is now poised to expand its footprint beyond the UAE, further cementing the region's role as a global hub for fintech innovation.

For more information, visit:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Well Intervention Market Size To Reach USD 776.0 Million By 2033 CAGR Of 4.50%

- Japan Shrimp Market Predicted To Hit USD 7.8 Billion By 2033 CAGR: 2.62%

- Ion Exchange Resins Market Size, Industry Trends, Key Players, Opportunity And Forecast 2025-2033

- Nutraceuticals Market Size Projected To Witness Strong Growth During 2025-2033

- UK Cosmetics And Personal Care Market To Reach USD 23.2 Billion By 2033

- Primexbt Launches Empowering Traders To Succeed Campaign, Leading A New Era Of Trading

Comments

No comment