Xtract One Technologies Inc. (TSX: XTRA) (OTCMKTS: XTRAF): A Rare Blend Of Growth & Value

Investment Summary

The global security landscape is shifting and changing drastically, characterized by increasing threats that demand technological advancements to address a modern problem with modern digital solutions. At the center of addressing this need lies Xtract One Technologies Inc. (TSX: XTRA) (OTCQX: XTRAF), a standout player in the AI-powered threat detection and security market.

The company's focus on unobtrusive and highly effective systems for patron screening places them in a position to seize the opportunities of an ever-expanding market. Its economic and technological moat, strong financial performance, vertical growth drivers, and unique value proposition tell a tale of why investors should consider this stock.

In our view, Xtract One fits both growth investment and value principles in 2025 and beyond. While being in its exponential growth phase, backed by solid fundamentals, we see this as a strong buying opportunity for investors looking for exposure to the next wave of security technology innovation.

Economic Moat

Xtract One's use of proprietary sensors and artificial intelligence models to differentiate between everyday objects and potential threats has undergone several years of development model training. These technologies are protected by patents and patent applications, and offer a significant barrier to entry in the segment for prospective competitors.

Xtract One's latest AI-driven solution, the Xtract One Gateway, has bi-directional screening capabilities, and is built for locations where visitors regularly carry larger personal items such as laptops in bags. Its proprietary sensors are designed for precise weapons detection, and eliminates the need for additional X-ray machines or separate physical bag checks – thus reducing operational overheads for its customers and providing a seamless entry and exit experience for patrons.

Customer relationships with Madison Square Garden Sports Corp., Oakview Group, and various school districts are enabling the company to broaden their scope across the sports, entertainment, education, and healthcare markets.

Market Potential

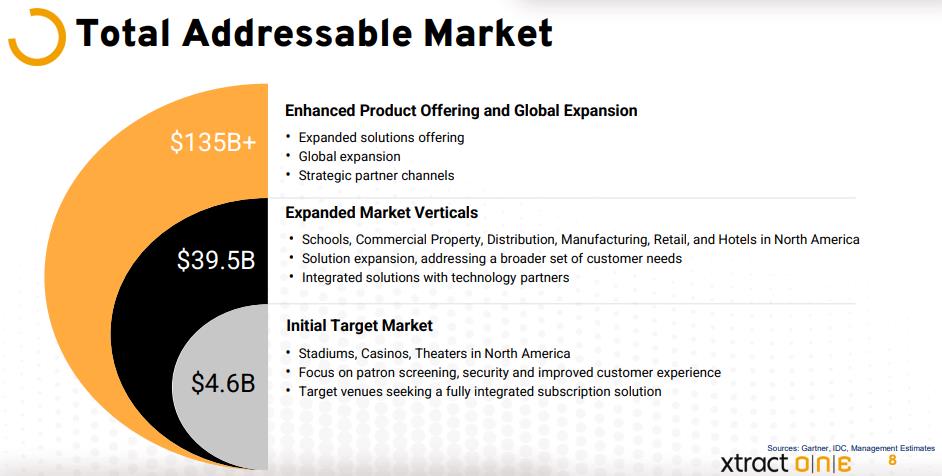

Xtract One's current addressable market, as per the management, stands at CAD $135 billion, with Xtract One at the forefront of future market share capture.

Source: Q3 2025 Presentation

Furthermore, Xtract One is actively diversifying into new geographical markets and customer segments. Additional market verticals include educational locations, manufacturing facilities, hotel and retail chains, and global expansion across Europe and Asia.

The swelling security screening market is largely driven by growing concerns of terrorism dangers, mass casualty events, weapons threats, and their proportionate parallel to the currently outdated technology that most venues deploy. This market is projected to grow by a CAGR of ~7% over the next 5 years. As security threats get more complex, we expect this market to continue its technological transformation, with customers adopting increasingly advanced solutions to meet their security needs.

Xtract One's unique product offerings set it apart from its competitors. We feel that newer competitors will face a high barrier to entry into such a niche market, and current competitors do not yet have comparable technological capabilities.

Operational & Financial Metrics

Xtract One's initiative of recruiting strategic channel partners that offer complementary technologies has provided the company with a larger base of customers to promote its product sales. Around 1/3 of Xtract One's revenues are derived from these channel partners and are expected to continue to be a major source of revenue for the company moving forward.

Source: Q3 2025 Presentation

Furthermore, the company has a substantial total backlog of CAD $36.5M, compared to $26.6M the year prior. $15.4M of which being contractual backlog, and $21.1M being pending backlog, awaiting installation. These sales backlogs provide us with fair visibility of Xtract One's revenue potential in the near/medium term and are a key positive indicator of future performance.

Gross profit margin has also improved over the nine months ended April 30th to 63.7% in 2025, compared to 61.3% over the same period the previous year. Cost reduction efforts have seen operating expenses and operating losses reduced for the company in recent financial results.

A handful of delayed deployments led to a weaker than anticipated revenue figure for Q3 2025; however, a growing backlog, increasing demand for the new Xtract One Gateway, and several new contract developments point to an upbeat fourth quarter and beyond for the company.

HedgeMix Financial Projections & Valuation

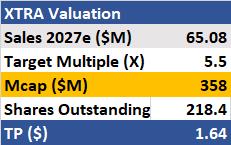

Turning to the valuation of Xtract One, we start by estimating the company's revenue and EBITDA for the next few years. We assume annual revenue growth rates of 55%, and 90% for FY2026 and FY2027 respectively.

Based on our estimates, we anticipate the company's revenue to grow to the tune of $65 million in 2027, with a potential breakeven in 2026. This not only reflects a continuation of its growth momentum but also its cost discipline.

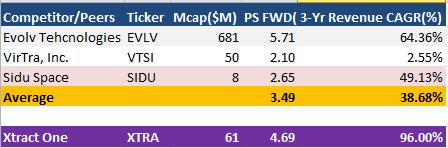

Given these estimates, we value this stock using a P/S based multiple relative valuation method. We are comparing the company to three of its peers as shown below.

Source: HedgeMix

We believe Xtract One should trade at the higher end of the peer group given its superior revenue growth profile, healthy margins, and strong management of operating expenses. As such, we value Xtract One at 5.5x 2027E sales of $65 million.

Source: HedgeMix

Given our assumptions and projections of strong tailwinds, we estimate a price target of $1.64 per share, indicating a significant upside potential for this stock. In our opinion, this warrants a Strong Buy.

Risks

The following are the potential risks for our thesis:

. Economic sensitivity: Any potential recession could impact customer spending, leading to lower revenue growth. However, the company's customer diversification and SaaS model mitigate the impact substantially.

. Execution risk: This being a small-cap company, its success depends on the precise execution of its strategy and plans. Any missteps may erode investors' confidence.

The Key Takeaway

Xtract One is a rapidly emerging player in the security screening and venue safety industry. The company's improving revenue indicators and financial metrics both point towards a high-growth phase in its operations. Xtract One's key differentiators at this point remain to be its superior products and strategic channel partnerships across all major market segments.

While the company is still in its early growth phase, Xtract One's current valuation appears to be significantly below its intrinsic value, and we feel that shares of TSX: XTRA & OTCQX: XTRAF offer an attractive opportunity for investors to participate in the company's long-term upside potential.

See more about Xtract One:

DISCLOSURE

This was written by HedgeMix Asset Management Ltd. The information provided herein reflects the views and opinions of the authors at the time of publication and is intended for informational purposes only. It does not constitute investment advice, an offer, or a solicitation to buy or sell any securities. Investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

This content is paid for by Xtract One Technologies. The information is not intended as, and shall not be understood or construed as, qualified financial advice. Do your own research and seek independent advice when required.

To view original press release on PR Gun, please visit

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment