Czech Industry Joins The Growth Pack

Czech real industrial production growth picked up to 1.8% year-on-year in July when adjusted for the number of working days, adding 0.8% month-on-month. The unadjusted output growth of 4.9% YoY in July came in stronger than market participants had expected. Robust gains were recorded in motor vehicle manufacturing, machinery, chemicals and plastic products, pharmaceuticals, and fabricated metal products, creating the backbone of Czech industry and its supply chain.

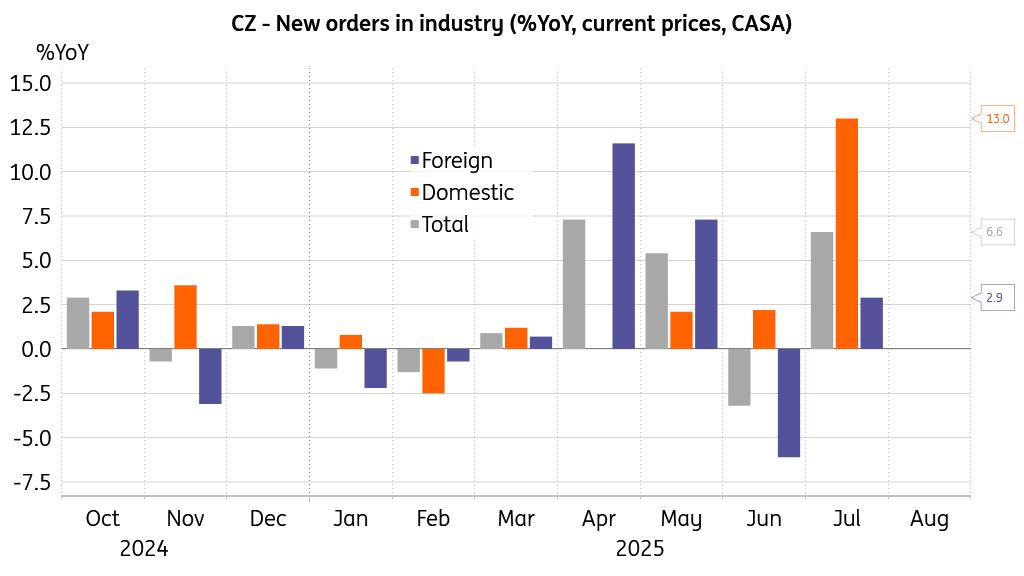

New orders look good

Source: CZSO, Macrobond

The value of new orders in current prices rose by 6.6% YoY in July, with new orders from abroad gaining 2.9% YoY, and domestic new orders increasing by a robust 13.0% YoY. In monthly terms, the value of new orders was up by 2.9%. The growth in new orders in industry was predominantly driven by motor vehicle manufacturing. That said, the low comparative base of the previous year was partially responsible for the punchy 15% annual increase in automotive. Still, significant long-term contracts were concluded by companies manufacturing other transport equipment and devices, a vital component of the Czech industrial base. The average number of employees in industry fell by 1.9% YoY in July, while the average monthly nominal wage dynamics softened to 5% in July.

Construction boom still in teenage yearsConstruction output rose by 10.1% YoY in July and was up 1.0% MoM, indicating that the construction boom is still in its teenage years as we have suggested. The indicative value of building permits issued rose by 37.9% YoY in July, while 9.2% fewer dwellings were started and 13.4% fewer dwellings were completed than a year ago. We view housing demand as not yet saturated across Czechia, despite the continued gains in residential prices. The average number of employees in construction added 0.6% YoY in July, while the average wage growth slowed to 3.8% YoY in the same period.

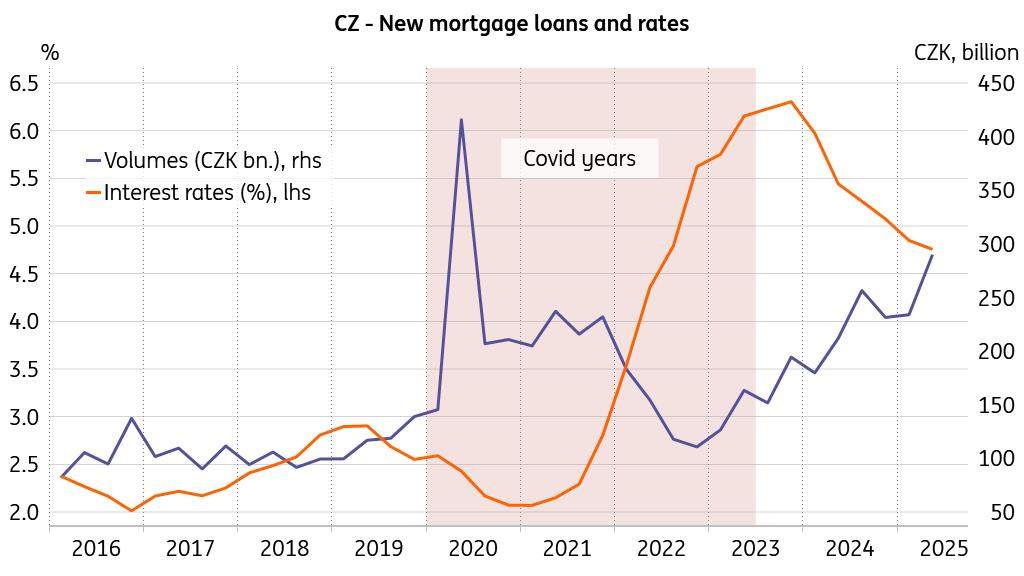

New mortgage loans fly high

Source: CNB, Macrobond

New mortgage loans hit a record high in 2Q25 when disregarding the pandemic-era spike. On the one hand, households might have rushed to secure an advantageous rate before policymakers call a stop to further reduction in borrowing costs. On the other hand, the demand for housing remains elevated, and the appetite to take new loans to acquire a property may still carry on for a while.

Solid export performance buttresses outlookAccording to preliminary data, the foreign trade balance in goods at current prices ended July with a deficit of CZK 1.7 billion, which was CZK 5.5 billion less pronounced than a year earlier. The overall foreign trade balance in goods was positively influenced mainly by a higher surplus in motor vehicles trade, other means of transport, and machinery. Exports maintained a solid annual growth pace of 4.7% in July, while imports increased by 3.1% YoY in the same period. Solid growth in new orders suggests that Czech exporters can hope for a favourable outlook.

Overall, Czech industry is bottoming out, joining the engines of household consumption and construction. We view July's softening in annual wage dynamics as part of the monthly volatility that does not alter the general setup for robust wage numbers when looking ahead. The Czech economy is moving forward on solid ground.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Market Research

- Gas Engine Market Analysis: Strong Growth Projected At 3.9% CAGR Through 2033

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- Excellion Finance Launches MAX Yield: A Multi-Chain, Actively Managed Defi Strategy

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

- Blackrock Becomes The Second-Largest Shareholder Of Freedom Holding Corp.

Comments

No comment