Turkey Reinforces Price Stability With Lower Growth Targets

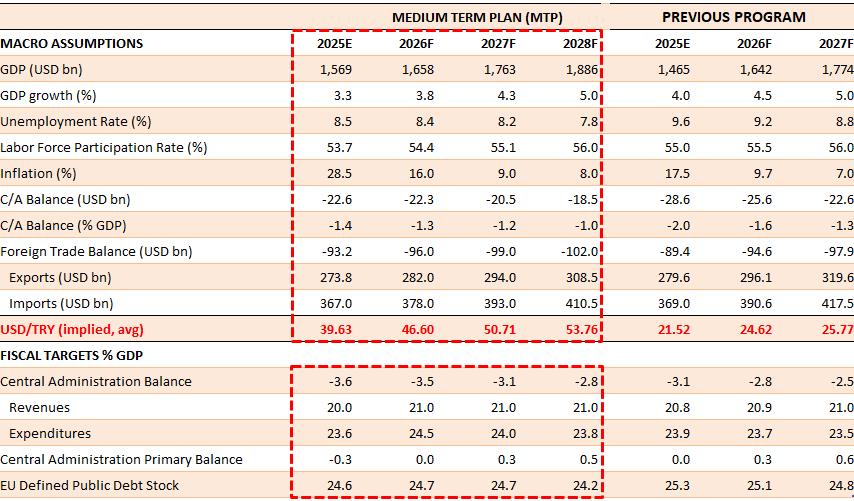

Source: Official Gazette, ING

Turkey's Vice President Cevdet Yılmaz convened a press conference with Finance Minister Mehmet Şimşek and Central Bank Governor (CBT) Fatih Karahan to present the details of the Medium-Term Plan (MTP) for 2026-28. The plan outlines the government's macroeconomic projections and sets forth its principal policy and reform agenda.

On the global front, the MTP anticipates that geopolitical tensions and uncertainty in economic policymaking will continue to fuel protectionist tendencies and disrupt supply chains. The interaction between these risks and monetary policy dynamics is expected to play a decisive role in shaping investor behaviour across global markets – particularly in emerging economies. Within this context, one of the MTP's central goals is to chart a growth path that is both sustainable and aligned with the ongoing disinflation process. Vice President Yılmaz underscored that disinflation remains the government's top policy priority and pledged continued coordination between monetary, fiscal, and income policies to bring inflation down to single digits over time.

The plan revises GDP growth forecasts downward by 0.7ppt for each year from 2025 to 2027. Nonetheless, the government expects growth to accelerate from 3.3% in 2025 to 5% by 2028. The official projection of 3.3% for this year is more optimistic than the 2.9% consensus in the latest Market Participants Survey, while the 2026 forecast is broadly in line with the market's 3.7% expectation. Reflecting strong domestic demand, our own forecast has been revised upward – from 2.7% to 3.3% for 2025, and from 3.5% to 4% for 2026. Still, the growth trajectory outlined in the MTP remains below Turkey's long-term average, signalling that policymakers are prioritising disinflation over rapid expansion.

On inflation, the MTP projects a year-end rate of 28.5% for 2025 – down from 33% in the previous plan and within the Central Bank's forecast range of 27-29%. For 2026 and 2027, inflation estimates have been revised upward compared to the previous plan and aligned with the Bank's interim targets.

In terms of fiscal policy, the MTP forecasts a central government budget deficit of 3.6% of GDP for 2025, up from 3.1% in the previous plan. Finance Minister Şimşek has already cautioned that this year's deficit target may not be met due to weaker-than-expected revenue performance. The plan anticipates gradual improvement, with the deficit narrowing to 2.8% of GDP by 2028 – still higher than previously projected in last year's MTP. While the government signals fiscal discipline by keeping the deficit (excluding earthquake-related spending) near the Maastricht threshold of 3.0%, a notable increase in primary spending and interest payments is expected next year. This rise, however, is projected to be offset by stronger revenue generation. Policymakers have emphasised that fiscal policy will support disinflation, suggesting reduced reliance on inflationary measures such as administered price hikes and tax increases. Still, the combination of subdued public investment – capital expenditures and transfers are set to decline by 0.2% to 2.4% of GDP – and relatively strong current spending may not bode well for long-term growth prospects.

Externally, the government projects a current account deficit of 1.4% of GDP in 2025, with a gradual decline to 1.0% by 2028. However, the growth path envisioned in the plan raises questions about the feasibility of achieving this external adjustment.

Finally, regarding exchange rate assumptions, Vice President Yılmaz clarified that the USD/TRY projections in the MTP are based on market expectations for this year. For subsequent years, the plan relies on inflation differentials, assuming no real change in the currency's value.

Overall, Vice President Yılmaz acknowledged the short-term trade-off between inflation and growth, reiterating the government's commitment to curbing inflation without triggering a recession. While the new MTP offers more realistic projections than its predecessor, attaining the goals of external adjustment and disinflation remains a challenge, in our view.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Market Research

- Gas Engine Market Analysis: Strong Growth Projected At 3.9% CAGR Through 2033

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- Excellion Finance Launches MAX Yield: A Multi-Chain, Actively Managed Defi Strategy

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

- Blackrock Becomes The Second-Largest Shareholder Of Freedom Holding Corp.

Comments

No comment