Tudor Gold Intersects 2.57 G/T Gold Equivalent Over 54.00 Meters At Treaty Creek, Northwest British Columbia

| Hole | Collar Coords | Dip/ Azimuth | From (m) | To (m) | Interval (m) | Gold (g/t) | Silver (g/t) | Copper (%) | AuEQ (3) (g/t) |

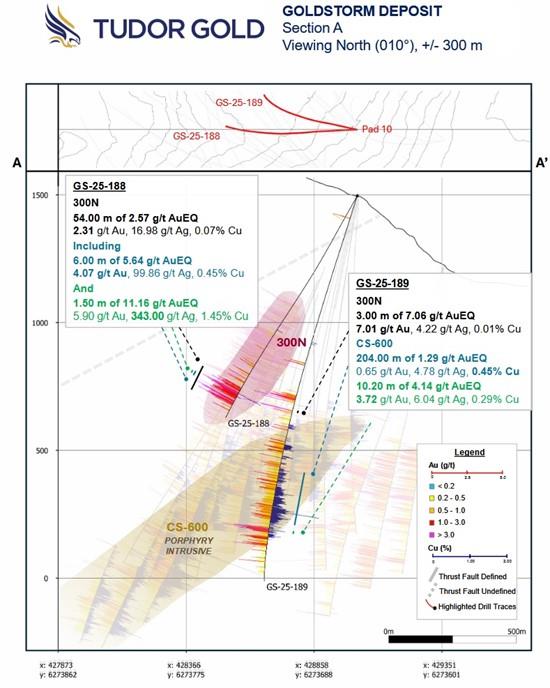

| GS-25-188 | 429024 mE 6273658 mN | -62/283 | 900.00 | 954.00 | 54.00 | 2.31 | 16.98 | 0.07 | 2.57 |

| | | Including | 900.00 | 906.00 | 6.00 | 4.07 | 99.86 | 0.45 | 5.64 |

| | | and | 901.50 | 903.00 | 1.50 | 5.90 | 343.00 | 1.45 | 11.16 |

| GS-25-189 | 429024 mE 6273658 mN | -71/293 | 836.00 | 845.00 | 9.00 | 2.45 | 0.94 | 0.01 | 2.48 |

| | | | 882.50 | 885.50 | 3.00 | 7.01 | 4.22 | 0.01 | 7.06 |

| | | | 1130.00 | 1334.00 | 204.00 | 0.65 | 4.78 | 0.48 | 1.29 |

| | | | 1355.40 | 1365.60 | 10.20 | 3.72 | 6.04 | 0.29 | 4.14 |

| | | Including | 1357.50 | 1361.00 | 3.50 | 5.81 | 1.00 | 0.38 | 6.29 |

| . All assay values are uncut and intervals reflect drilled intercept lengths. |

| . HQ and NQ diameter core samples were sawn in half and typically sampled at standard 1.5 m intervals. |

| . The following metal prices were used to calculate the Au Eq metal content: Gold $1850/oz, Ag: $21/oz, Cu: $3.75/lb. Calculations used the formula AuEQ = Au g/t + (Ag g/t*0.0100901) + (Cu ppm*0.0001236). All metals are reported in USD and calculations consider recoveries of 90 % for gold, 80 % for copper, and 80 % for silver. |

| . True widths have not been determined as the mineralized body remains open in all directions. Further drilling is required to determine the mineralized body orientation and true widths. |

To view an enhanced version of this graphic, please visit:

To view an enhanced version of this graphic, please visit:

Tudor also announces that the Company has agreed to issue 422,874 common shares of the Company (the "Settlement Shares") to INFOR Financial Inc. ("INFOR") at a price of $0.69 per Settlement Share in settlement (the "Debt Settlement") of $291,783.46 owing by American Creek Resources Ltd. ("AMK"), a wholly owned subsidiary of the Company, to INFOR pursuant to a financial advisory agreement dated May 26, 2025 between AMK and INFOR.

The Debt Settlement is subject to TSX Venture Exchange approval. The Settlement Shares will be subject to a statutory hold period of four months from the date of issuance, in accordance with applicable securities legislation.

Qualified Person

The Qualified Person for this news release for the purposes of National Instrument 43-101 is the Company's President and CEO, Ken Konkin, P. Geo. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

QA/QC

Diamond drill core samples were prepared at MSA Labs' Preparation Laboratory in Terrace, BC and assayed at MSA Labs' Geochemical Laboratory in Langley, BC. Analytical accuracy and precision are monitored by the submission of blanks, certified standards and duplicate samples inserted at regular intervals into the sample stream by Tudor Gold personnel. MSA Laboratories quality system complies with the requirements for the International Standards ISO 17025 and ISO 9001. MSA Labs is independent of the Company.

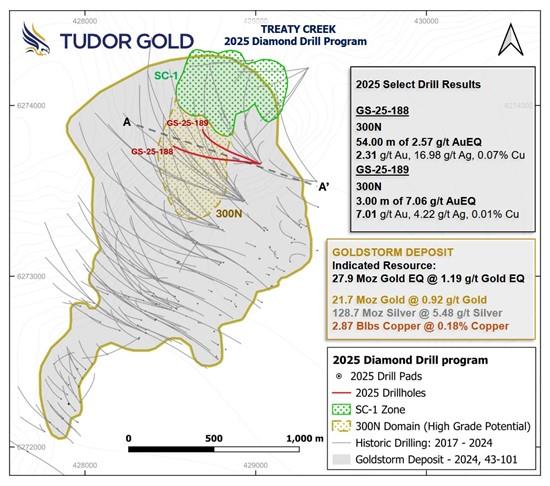

About Treaty Creek

The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones. As disclosed in the "NI-43-101 Technical Report for the Treaty Creek Project", dated April 5, 2024 prepared by Garth Kirkham Geosystems and JDS Energy & Mining Inc., the Goldstorm Deposit has an Indicated Mineral Resource of 27.87 million ounces (Moz) of AuEQ grading 1.19 g/t AuEQ (21.66 Moz gold grading 0.92 g/t, 2.87 billion pounds (Blbs) copper grading 0.18%, 128.73 Moz silver grading 5.48 g/t) and an Inferred Mineral Resource of 6.03 Moz of AuEQ grading 1.25 g/t AuEQ (4.88 Moz gold grading 1.01 g/t, 503.2 Mlb copper grading 0.15%, 28.97 Moz silver grading 6.02 g/t), with a pit constrained cut-off of 0.7 g/t AuEQ and an underground cut-off of 0.75 g/t AuEQ. The Goldstorm Deposit remains open in all directions and requires further exploration drilling to determine the size and extent of the Deposit.

About Tudor Gold

Tudor Gold Corp. is a precious and base metals exploration and development company with claims in British Columbia's Golden Triangle (Canada), an area that hosts producing and past-producing mines and several large deposits that are approaching potential development. The 17,913 hectare Treaty Creek Project (in which Tudor Gold has an 80% interest) borders Seabridge Gold Inc.'s KSM property to the southwest and borders Newmont Corporation's Brucejack Mine property to the southeast.

For further information, please visit the Company's website at or contact:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Market Research

- Gas Engine Market Analysis: Strong Growth Projected At 3.9% CAGR Through 2033

- Daytrading Publishes New Study On The Dangers Of AI Tools Used By Traders

- Excellion Finance Launches MAX Yield: A Multi-Chain, Actively Managed Defi Strategy

- United States Lubricants Market Growth Opportunities & Share Dynamics 20252033

- ROVR Releases Open Dataset To Power The Future Of Spatial AI, Robotics, And Autonomous Systems

- Blackrock Becomes The Second-Largest Shareholder Of Freedom Holding Corp.

Comments

No comment