403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

The Best Gold Stocks To Buy Now

(MENAFN- Daily Forex) What Are Gold Stocks?Gold stocks refer to publicly listed companies that are active in the gold sector. They are primarily involved in the exploration, extraction, and refining of gold. The recent adoption of AI has opened the path for services companies that use AI to discover deposits. Gold storage companies provide an alternative method for indirect gold exposure. Still, investors should focus on exploration, extraction, and refining of gold via established and junior gold miners Should You Consider Investing in Gold Stocks?Gold has always held fascination as a wealth and status symbol, but gold stocks also offer numerous practical benefits, and investors should consider adding them to their portfolios. Gold outperforms during economic uncertainty and geopolitical risk events, which adds downside protection to equity portfolios. Gold stocks also offer an inflation hedge and outperform during periods of US Dollar weakness.Here are a few things to consider when evaluating gold stocks:

Idaho Strategic Resources (IDR)

Newmont Corporation (NEM)

SSR Mining (SSRM)

New Gold (NGD)

McEwen Mining (MUX)

AngloGold Ashanti (AU)

Coeur Mining (CDE)

Kinross Gold (KGC)

Gold Fields (GFI)

Royal Gold (RGLD)

Hecla Mining (HL)

DRDGold (DRD)

Contango Ore (CTGO)

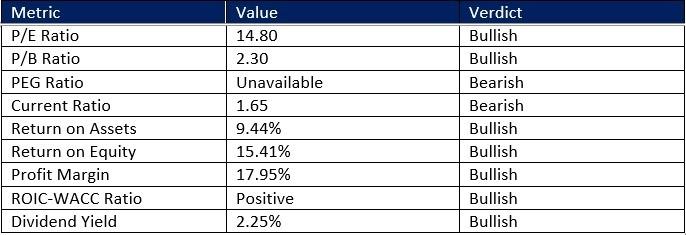

Seabridge Gold (SA)Caledonia Mining Corporation Fundamental AnalysisCaledonia Mining Corporation (CMCL) owns a 64% stake in the gold-producing Blanket Mine, and 100% stakes in the Bilboes Sulphide Project, the Motapa, and Maligreen gold mining claims, all located in Zimbabwe. The Blanket Mine produces 75,000 to 80,000 ounces of gold annually.So, why am I bullish on CMCL after its 50%+ rally?The current annual output with gold at record highs offers an excellent free cash flow that CMCL can reinvest in its Bilboes Sulphide Project, the Motapa, and Maligreen gold mining claims. Caledonia Mining Corporation has outstanding returns on assets, equity, and invested capital. Its profit margins also rank among the best in the industry. Its latest earnings report featured record-breaking production numbers, valuations are cheap, and the dividend yield is a bonus for investors Mining Corporation Fundamental Analysis Snapshot The price-to-earnings (P/E) ratio of 14.80 makes CMCL an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.07.The average analyst price target for CMCL is 27.50. It suggests no upside potential based on analyst estimates, but I expect upward revisions following its blockbuster earnings report Mining Corporation Technical Analysis

- Invest in a combination of established gold miners for stability and dividends, and junior miners, which carry greater risks but offer notable upside potential Analyze gold reserves of gold miners to gauge the longevity of their operations Focus 75% of your portfolio on gold stocks with mining operations in the top ten countries for gold production, with the remaining 25% on exciting global projects

Idaho Strategic Resources (IDR)

Newmont Corporation (NEM)

SSR Mining (SSRM)

New Gold (NGD)

McEwen Mining (MUX)

AngloGold Ashanti (AU)

Coeur Mining (CDE)

Kinross Gold (KGC)

Gold Fields (GFI)

Royal Gold (RGLD)

Hecla Mining (HL)

DRDGold (DRD)

Contango Ore (CTGO)

Seabridge Gold (SA)Caledonia Mining Corporation Fundamental AnalysisCaledonia Mining Corporation (CMCL) owns a 64% stake in the gold-producing Blanket Mine, and 100% stakes in the Bilboes Sulphide Project, the Motapa, and Maligreen gold mining claims, all located in Zimbabwe. The Blanket Mine produces 75,000 to 80,000 ounces of gold annually.So, why am I bullish on CMCL after its 50%+ rally?The current annual output with gold at record highs offers an excellent free cash flow that CMCL can reinvest in its Bilboes Sulphide Project, the Motapa, and Maligreen gold mining claims. Caledonia Mining Corporation has outstanding returns on assets, equity, and invested capital. Its profit margins also rank among the best in the industry. Its latest earnings report featured record-breaking production numbers, valuations are cheap, and the dividend yield is a bonus for investors Mining Corporation Fundamental Analysis Snapshot The price-to-earnings (P/E) ratio of 14.80 makes CMCL an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.07.The average analyst price target for CMCL is 27.50. It suggests no upside potential based on analyst estimates, but I expect upward revisions following its blockbuster earnings report Mining Corporation Technical Analysis

- The CMCL D1 chart shows price action breaking out above its ascending 0.0% Fibonacci Retracement Fan level It also shows Caledonia Mining Corporation pushing above the upper band of its bullish price channel with increased upside momentum The Bull Bear Power Indicator has been bullish for over four weeks

- The AU D1 chart shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan It also shows AngloGold Ashanti inside a bullish price channel The Bull Bear Power Indicator has been mostly bullish since the second week of August with an ascending trendline

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment