The Best Nuclear Energy Stocks To Buy Now

(MENAFN- Daily Forex) What Are Nuclear Energy Stocks?Nuclear energy stocks refer to publicly listed companies that are active in the nuclear energy sector. They are primarily involved in operating nuclear reactors to generate electricity. Alternatively, investors can participate in nuclear energy through uranium mining stocks Should You Consider Investing in Nuclear Energy Stocks?Nuclear energy is a cornerstone of clean energy, and small modular reactors (SMEs) are the industry's most significant breakthrough. They can address the tremendous energy demand posed by data centers and AI. With energy needs rising, energy security is a national security concern for most countries. Forecasts estimate nuclear energy investment to exceed $2 trillion by 2050. Factor in the need to lower carbon emissions, and nuclear energy has a bright future.Here are a few things to consider when evaluating nuclear energy stocks:

Constellation Energy (CEG)

Cameco (CCJ)

BWX Technologies (BWXT)

Talen Energy (TLN)

Oklo (OKLO)

Duke Energy (DUK)

NextEra Energy (NEE)

Entergy Corporation (ETR)

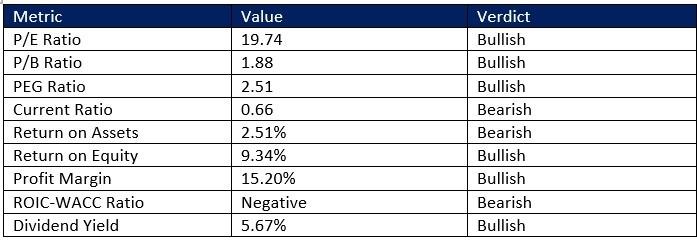

Dominion Energy (D)Duke Energy Fundamental AnalysisDuke Energy (DUK) operates seven nuclear facilities, amid a diverse mix of other power plants. Its service territory covers 104,000 square miles with 250,200 miles of distribution lines. Its nuclear power generation remains concentrated in North and South Carolina. Duke Energy is also a component of the Dow Jones Utility Average, the S&P 100, and the S&P 500.So, why am I bullish on DUK despite its sell-off?I appreciate that Duke Energy continues to modernize its nuclear power plants by integrating advanced monitoring systems to enhance operational efficiency and safety. Current valuations are reasonable, and profit margins should support its current business model. With a dividend yield above 5.50%, DUK is also an excellent dividend stock, and it should outperform the market during a correction as a defensive play. The price-to-earnings (P/E) ratio of 19.74 makes DUK an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.07.The average analyst price target for DUK is 132.00. It suggests moderate upside potential with fading downside risks Energy Technical Analysis

- Invest in nuclear energy stocks that have signed deals with some of the most notable end-users like tech giants Meta Platforms, Microsoft, Amazon, and Alphabet Analyze next-generation nuclear energy stocks that can power the future with disruptive technologies, including nuclear fusion reactors Include established nuclear energy stocks, uranium miners, and next-generation players your nuclear energy portfolio to diversify your exposure

Constellation Energy (CEG)

Cameco (CCJ)

BWX Technologies (BWXT)

Talen Energy (TLN)

Oklo (OKLO)

Duke Energy (DUK)

NextEra Energy (NEE)

Entergy Corporation (ETR)

Dominion Energy (D)Duke Energy Fundamental AnalysisDuke Energy (DUK) operates seven nuclear facilities, amid a diverse mix of other power plants. Its service territory covers 104,000 square miles with 250,200 miles of distribution lines. Its nuclear power generation remains concentrated in North and South Carolina. Duke Energy is also a component of the Dow Jones Utility Average, the S&P 100, and the S&P 500.So, why am I bullish on DUK despite its sell-off?I appreciate that Duke Energy continues to modernize its nuclear power plants by integrating advanced monitoring systems to enhance operational efficiency and safety. Current valuations are reasonable, and profit margins should support its current business model. With a dividend yield above 5.50%, DUK is also an excellent dividend stock, and it should outperform the market during a correction as a defensive play. The price-to-earnings (P/E) ratio of 19.74 makes DUK an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.07.The average analyst price target for DUK is 132.00. It suggests moderate upside potential with fading downside risks Energy Technical Analysis

- The DUK D1 chart shows price action breaking down below its ascending 61.8% Fibonacci Retracement Fan level It also shows Duke Energy inside its horizontal support zone with fading bearish trading volumes The Bull Bear Power Indicator turned bearish, but shows early signs of a reversal

- The D D1 chart shows price action between its ascending 50.0% and 61.8% Fibonacci Retracement Fan It also shows Dominion Energy inside a horizontal support zone The Bull Bear Power Indicator turned bearish, but remains close to its trendline.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Global Plant-Based Meat Market Report 2025: Size Projected USD 100.31 Billion, CAGR Of 21.92% By 2033.

- With Seal, Walrus Becomes The First Decentralized Data Platform With Access Controls

- Blackrock Becomes The Second-Largest Shareholder Of Freedom Holding Corp.

- United States Jewelry Market Forecast On Growth & Demand Drivers 20252033

- Origin Summit Debuts In Seoul During KBW As Flagship Gathering On IP, AI, And The Next Era Of Blockchain-Enabled Real-World Assets

- Brazil Edtech Market Size, Share, Trends, And Forecast 2025-2033

Comments

No comment