Romania's Growth Stalls Near Zero

Detailed GDP figures for 2Q 2025 reaffirm that Romania's economy is essentially flatlining. Year-on-year growth stood at just 0.3%, matching the weak pace of the first quarter and leaving first-half growth at a mere 0.3%.

The slowdown in private consumption is becoming more evident. However, a silver lining is emerging in the trade balance: for the first time since 2023, the growth of goods exports outpaced that of goods imports, reversing five consecutive quarters of import dominance.

As the private sector is set to cool, public investment financed by EU funds should become the economy's primary engine. Official estimates suggest that an unprecedented €15–17 billion in EU transfers (via the Recovery Plan and cohesion funds) could be injected into the economy over the next year. This substantial inflow is expected to sustain activity in the construction sector and help prevent a deeper downturn. Infrastructure projects and related spending should also support industrial output, especially in sectors like construction materials and equipment. In short, EU-funded investment is set to carry the bulk of the growth burden in the coming quarters.

Private consumption, meanwhile, is expected to slow considerably. That said, we do not anticipate a full contraction. Households have shown some resilience: retail sales and real incomes improved in 2Q versus 1Q, helping to avoid a drop in consumption. Early 3Q retail data also suggests continued resilience (details below). We expect consumer spending to grow only modestly, with inflation continuing to erode purchasing power and keep household demand subdued.

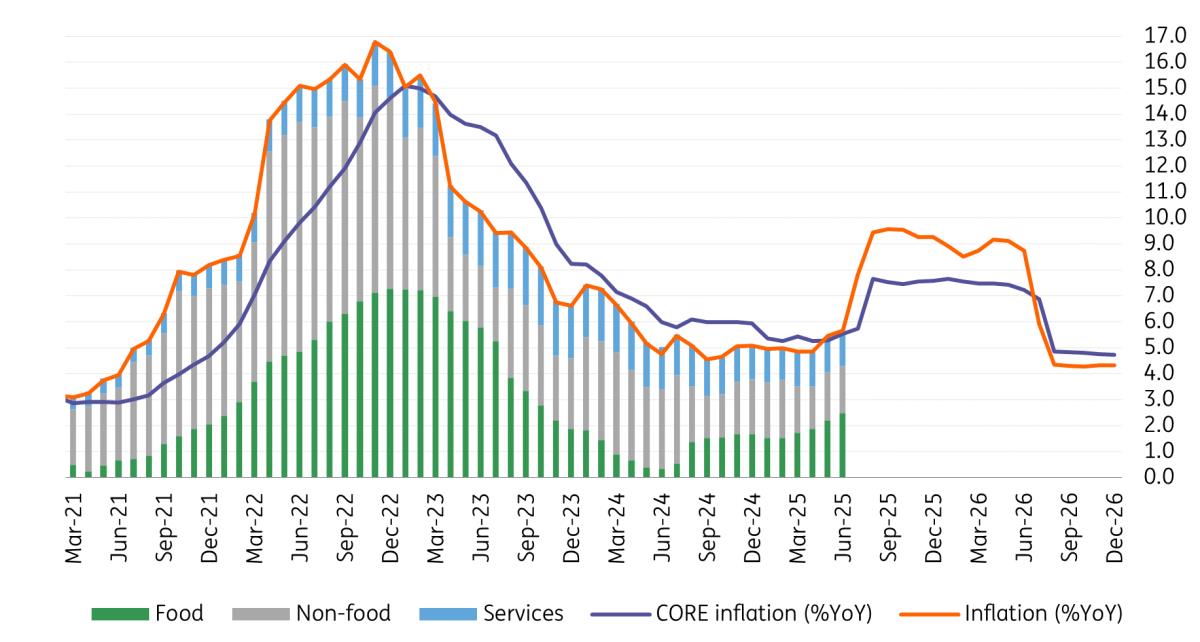

Inflation forecasts

Source: NSI, ING

There are also early signs of a better agricultural year. Following last year's weak harvest, initial reports point to above-average crop yields in 2025. Romania's wheat output, for example, is forecast to rise significantly, with average yields reaching up to 5.0 tonnes per hectare - around 20% above the five-year average and higher than in 2024. Thanks to favourable spring rains, analysts expect one of the best wheat harvests in over a decade. While agriculture represents a small share of GDP, a stronger harvest should still provide a modest boost to headline growth and support food exports - a welcome development amid an otherwise subdued outlook.

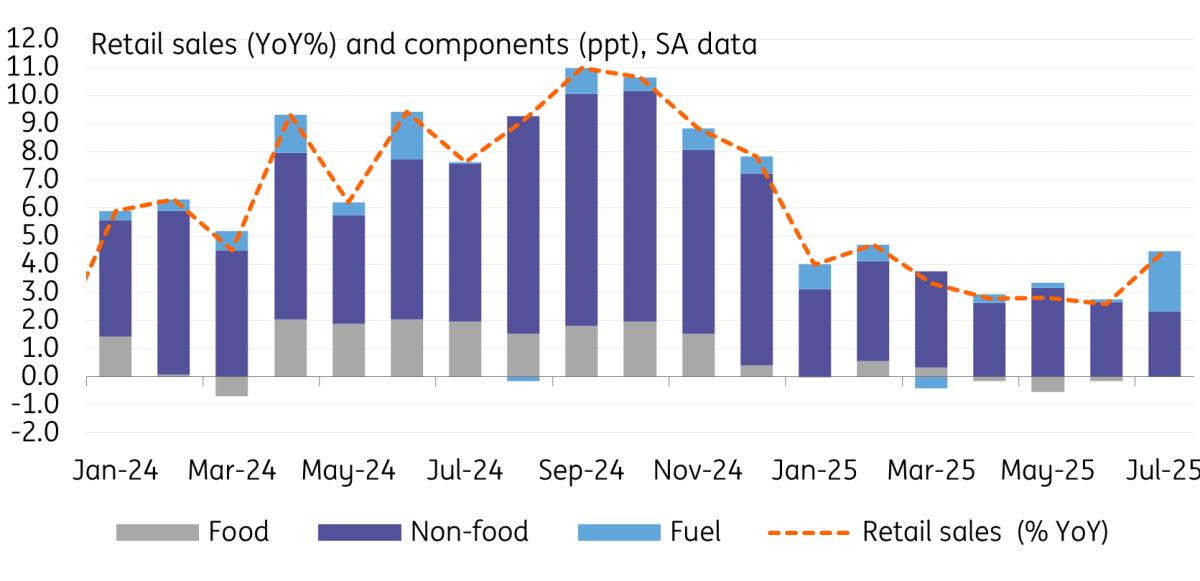

Retail salesYesterday's data brought a first glimpse into the third-quarter demand dynamic. Retail sales data showed a 0.3% monthly increase in July, on top of June's 1.1%. At face value, these numbers could point to the fact that consumers showed little hesitation over the first part of the summer. However, frontloading behaviour might be at play, since the all-important 1st tax package was expected to be implemented initially in July, and then later on deferred to August.

Looking at the details of the July release, the jump in fuel sales was more pronounced compared to non-food items, as consumers acted on the increase in excise duties as well.

Retail sales evolution

Source: NSI, ING

Putting everything into context, the past year's strong outturn in non-food retail sales, combined with the strong performance of consumer credit, could be the outcome of concentrated purchases of household products that are not replaced every year or so. What's more, the accumulated debt needs to be serviced in the coming quarters, at a time when inflation is set to get very close to double digits, public incomes won't be indexed, and a slimmer state apparatus is in the making.

As such, we continue to see moderation and caution ahead from consumers, which will indeed weigh on growth, but, on a more positive note, it should also keep demand-driven inflation and the trade deficit more in check.

Treading waterOverall, the economy is essentially treading water. We maintain our 2025 GDP growth forecast at 0.3%, as gains from public investment and a better harvest just offset weak private demand. For 2026, we now expect growth of around 1.4%, revised down from 1.7%, with any recovery likely to be mild. The anticipated increase in EU funds inflows should keep the economy afloat and prevent a recession, but with domestic consumption subdued and external challenges persisting, a stronger acceleration remains unlikely for now.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Market Research

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- BTCC Announces Participation In Token2049 Singapore 2025, Showcasing NBA Collaboration With Jaren Jackson Jr.

- PLPC-DBTM: Non-Cellular Oncology Immunotherapy With STIPNAM Traceability, Entering A Global Acquisition Window.

- Bitget Launches PTBUSDT For Futures Trading And Bot Integration

- Ecosync & Carboncore Launch Full Stages Refi Infrastructure Linking Carbon Credits With Web3

- Bitmex And Tradingview Announce Trading Campaign, Offering 100,000 USDT In Rewards And More

Comments

No comment