Should We Expect 'Dovish' Pivot From US Federal Reserve?

Doha, Qatar: It is rare for the US Federal Reserve (Fed) not to be at the forefront of the economic policy agenda, leading the discussions and setting the terms of the debate. However, in recent months, radical policy uncertainty coming from the Trump administration completely changed the focus of attention to actions from the executive branch, pushing the Fed to follow and adapt to the macro debate, rather than lead it. This more re-active tone from the Fed was clearly observed also for the first time in the coveted Jackson Hole symposium earlier this month, when senior economists, bankers, market participants, academics and policy makers met to discuss the over politicisation of economic policies.

In it weekly commentary, QNB notes that the unprecedented levels of unpredictability on the fiscal and trade fronts, which led the US Economic Policy Uncertainty Index to all-time-highs, continue to make both growth and inflation particularly difficult to estimate or forecast. Despite a moderation since the heights following the“Liberation day” tariffs announcements, policy uncertainty remains at acute levels, generally above other sharp stress episodes, such as the Global Financial Crisis (GFC in 2007-09), the Euro debt crisis (2009-11), and the Covid-19 pandemic (2020).

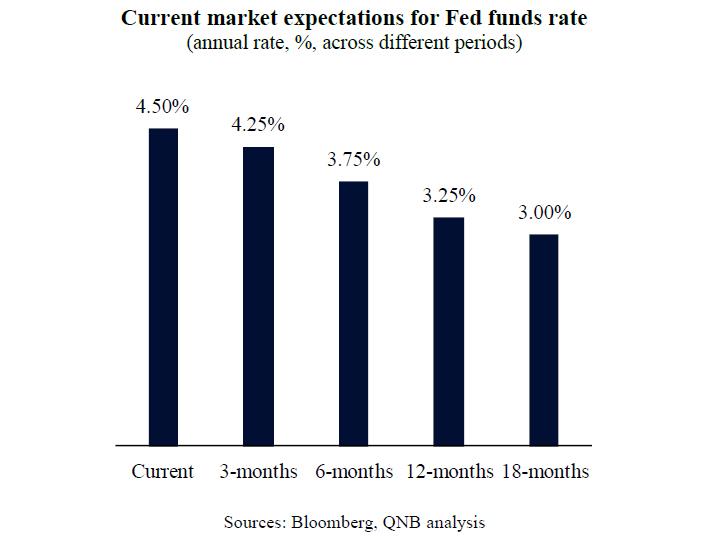

Analysts note that prevailing market expectations seem to be aligned with the macro environment, suggesting enough space for the Fed to provide further policy easing. Three main factors support our view.

First, despite significant division in recent Federal Open Market Committee (FOMC) meetings, Fed officials continue to communicate their own expectation that rate cuts should re-start over the coming months. The June 2025 Fed“dot plot,” which shows the projected target range for policy rates from each of the 19 FOMC meeting participant, is not far off from the prevailing market position for the next few quarters. To be clear, short-term risks to inflation are tilted to the upside, but this does not justify the existing abnormally high real policy rates. With inflation running at 2.7% and Fed funds at 4.5%, real rates are very restrictive at 1.8%, 264 basis points above the long-term average. This allows for ample room for additional rate cuts in the near future.

Second, the combination of a cyclical economic slowdown with negative policy shocks to sentiment suggest that further policy cuts are not only adequate but even necessary. T This is well reflected in rapidly weakening labor markets. After reaching maximum tightness in early 2023 with the unemployment rate much below equilibrium at 3.4%, labor markets fully adjusted and are now deteriorating further to dangerous levels.

Third, political conditions and the ongoing changes in the composition of the Fed's Board of Governors are likely to cement a stronger“dovish bias” into the FOMC decisions. President Trump has been vocal in terms of his preferences for deep policy rate cuts and for appointing a new Fed Chairman that is more aligned with his views. Chairman Powell's mandate is set to expire in May 2026 and this is already allowing Trump to increase his influence on the Fed, as potential candidates for the position are compelled to further showcase or double-down on their“dovish” positions and support for monetary accommodation.

All in all, despite policy uncertainty, above target inflation and potential one-off price spikes from tariffs, the Fed is expected to further cut rates in 2025 and throughout 2026. This comes on the back of an established minimal consensus within the Fed on the need to resume rate cuts, a weakening economy, and the cementing of an ample“dovish” majority within the Board of Governors and the FOMC over the next few months.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Japan Well Intervention Market Size To Reach USD 776.0 Million By 2033 CAGR Of 4.50%

- Vietnam Artificial Intelligence Market Size, Share, Growth, Demand And Report 2025-2033

- Industrial Hose Market Size, Trends, Growth Factors, Latest Insights And Forecast 2025-2033

- Nutritional Bar Market Size To Expand At A CAGR Of 3.5% During 2025-2033

- What Does The Europe Cryptocurrency Market Report Reveal For 2025?

- North America Perms And Relaxants Market Size, Share And Growth Report 2025-2033

Comments

No comment