Northrop Signal 27/08: Is More Upside Ahead? (Chart)

(MENAFN- Daily Forex) Long Trade IdeaEnter your long position between 586.05 (the intra-day low of its last bearish candlestick) and 595.85 (yesterday's intra-day high).Market Index Analysis

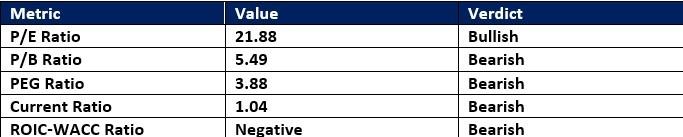

- Northrop Grumman (NOC) is a member of the S&P 500 Index. This index hovers near record highs, but bearish conditions continue to accumulate. The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

- The NOC D1 chart shows price action inside a bullish price channel. It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels. The Bull Bear Power Indicator has been bullish since July. The average bullish trading volumes are higher than the average bearish trading volumes. NOC rallied with the S&P 500, a significant bullish trading signal.

- NOC Entry Level: Between 586.05 and 595.85 NOC Take Profit: Between 673.11 and 706.77 NOC Stop Loss: Between 551.80 and 563.64 Risk/Reward Ratio: 2.54

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Kucoin Presents Kumining: Embodying Simple Mining, Smart Gains For Effortless Crypto Accumulation

- 1Inch Becomes First Swap Provider Relaunched On OKX Wallet

- Cregis Joins TOKEN2049 Singapore 2025

- Leverage Shares Launches First 3X Single-Stock Etps On HOOD, HIMS, UNH And Others

- Blockchainfx Raises $7.24M In Presale As First Multi-Asset Super App Connecting Crypto, Stocks, And Forex Goes Live In Beta

- BILLY 'The Mascot Of BASE' Is Now Trading Live On BASE Chain

Comments

No comment