Contract Lifecycle Management Software Market: Driving Efficiency In Business Operations

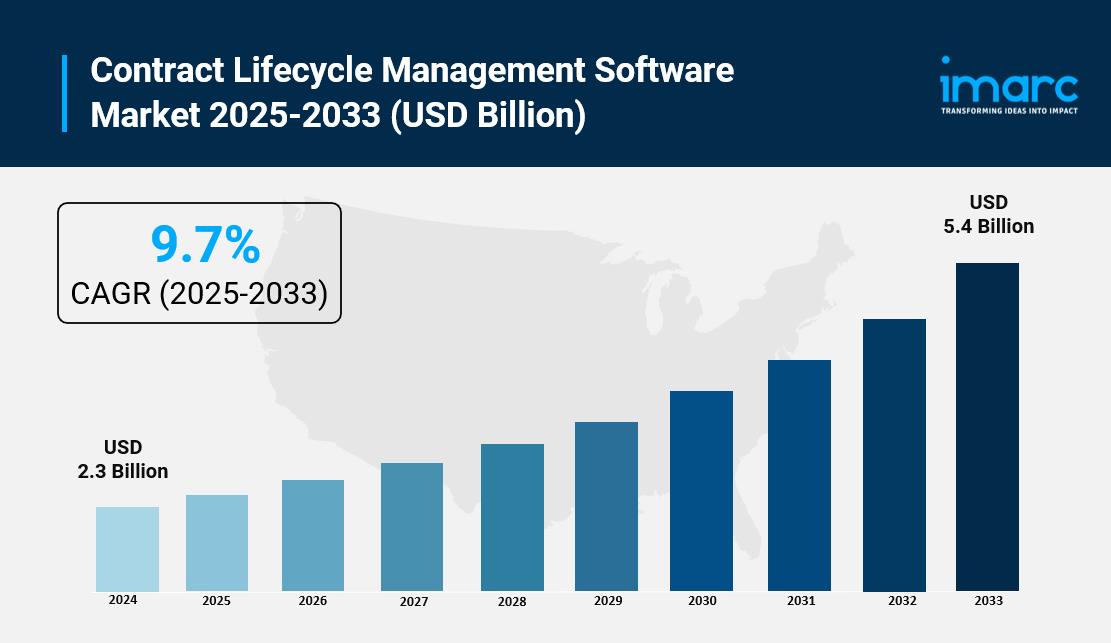

The global contract lifecycle management (CLM) software market is experiencing rapid growth, valued at USD 2.3 billion in 2024 and projected to reach USD 5.4 billion by 2033 , expanding at a strong CAGR of 9.7% during 2025–2033 . This growth is fueled by increasing complexity in contractual operations, the rising need for regulatory compliance, and the widespread adoption of AI- and ML-powered solutions that automate processes, mitigate risks, and enhance operational efficiency.

Key Stats

-

Market Value (2024): USD 2.3 Billion

Projected Value (2033): USD 5.4 Billion

CAGR (2025–2033): 9.7%

Leading Segment (2025): Cloud-based CLM solutions

Top Region: North America

Major Players: IBM Corporation, Icertis, SAP SE, Oracle Corporation, DocuSign, Wolters Kluwer, Coupa Software Inc., Zycus Infotech, and others.

Request for a sample copy of this report: https://www.imarcgroup.com/contract-lifecycle-management-software-market/requestsample

Growth Drivers

Advancements in TechnologyThe integration of AI and ML into CLM platforms is revolutionizing contract management by enabling real-time analytics, predictive insights, and intelligent automation. These technologies accelerate contract lifecycles, improve compliance, and reduce operational errors.

Compliance and Risk Mitigation

Growing regulatory complexity is pushing businesses to adopt CLM solutions with centralized repositories, automated compliance checks, audit trails, and real-time monitoring capabilities.

Operational Efficiency

Organizations leverage CLM platforms to streamline workflows, enhance transparency, and ensure faster approvals . Seamless integration with ERP, CRM, and other enterprise systems further amplifies productivity and decision-making.

AI and Technology Impact

AI-driven CLM solutions are transforming contract management from a reactive process into a strategic business function . Automated clause extraction, intelligent search, risk assessment, and predictive analytics enable enterprises to optimize negotiations and proactively manage obligations. Cloud-native CLM platforms enhance scalability, remote accessibility, and collaboration across global teams.

Segmental Analysis

By Deployment Model:

-

Cloud-Based (Dominant): Offers scalability, remote access, and cost efficiency.

On-Premises: Chosen by businesses requiring strict data control and compliance.

By CLM Offerings:

-

Licensing and Subscription (Leading): Preferred for predictable costs and flexibility.

Services: Includes implementation, consulting, training, and support.

By Enterprise Size:

-

Large Enterprises (Dominant): Manage complex, high-volume contracts globally.

Small & Medium Enterprises (SMEs): Adopt cost-effective solutions to improve efficiency.

By Industry:

-

Manufacturing (Leading): Utilizes CLM for procurement, quality control, and vendor management.

Automotive: Manages extensive supplier contracts and logistics.

Pharmaceutical: Ensures regulatory compliance in R&D and clinical trials.

Retail & E-Commerce: Handles dynamic vendor and customer agreements.

BFSI: Manages compliance-driven contracts in finance and banking.

Others: Includes education, healthcare, and public institutions.

Regional Insights

North America (Leading)

Home to advanced IT infrastructure, strict compliance frameworks, and top CLM providers. The U.S. and Canada are driving adoption due to mature enterprise ecosystems.

Asia Pacific (Fastest Growing)

Countries like China, India, and Japan are rapidly embracing digital transformation and cloud-based CLM platforms, supported by expanding industrial sectors and compliance requirements.

Europe

Strong demand driven by GDPR compliance , robust enterprise digitalization, and cross-border trade agreements.

Latin America & Middle East & Africa

Emerging markets with increasing adoption of cloud solutions, enterprise digitalization initiatives, and growing awareness of contract compliance.

Market Dynamics

Drivers

-

Rising demand for AI- and ML-powered contract management

Increasing regulatory requirements across industries

Growing adoption of cloud-based enterprise solutions

Restraints

-

Data security concerns in cloud deployments

High implementation costs for SMEs

Key Trends

-

Shift toward subscription-based and cloud-native models

Rapid AI integration for contract analytics and automation

Growing adoption in SMEs and emerging markets

Leading Companies

-

Wolters Kluwer N.V.

IBM Corporation

Icertis, Inc.

SAP SE

Oracle Corporation

DocuSign, Inc.

Coupa Software Inc.

Zycus Infotech Private Limited

Optimus BT

Ivalua Inc.

Symfact AG

Contract Logix, LLC

ESM Solutions Corporation

These companies are focusing on AI integration, strategic partnerships, acquisitions, and global expansions to strengthen their market positions.

Recent Developments

-

CLM vendors are enhancing AI-powered contract review and negotiation features .

Rising adoption of cloud-native, subscription-based solutions.

Expansion of ML-driven risk management modules .

Strategic partnerships to integrate CLM with ERP and CRM platforms.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1177&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company offers a complete range of market entry and expansion services , including market assessment, feasibility studies, company incorporation, factory setup, regulatory compliance, branding, sales strategies, competitive benchmarking, pricing research, and procurement solutions .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment