Data Center Generator Market Size, Share And Growth Forecast By 2033

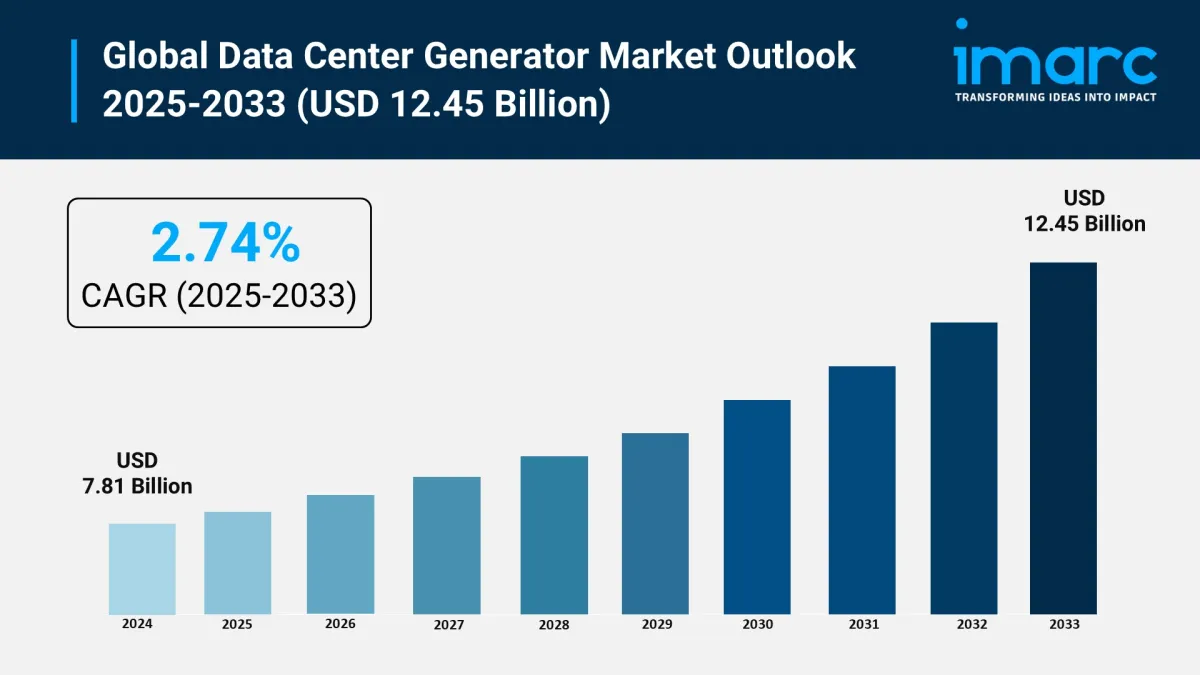

The data center generator market is experiencing robust growth, driven by the explosive rise in data consumption, increasing reliance on cloud computing, and the critical need for uninterrupted power supply in our digitally connected world. According to IMARC Group's latest research publication, “Data Center Generator Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033” , the global data center generator market size reached USD 7.81 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.45 Billion by 2033, exhibiting a growth rate of 4.77% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/data-center-generator-market/requestsample

Our report includes:

-

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Data Center Generator Market

-

Explosive Growth in Data Consumption and Digital Services

The exponential increase in data generation and consumption is fundamentally reshaping the data center generator landscape. With businesses and consumers creating massive amounts of digital content through streaming services, online gaming, social media, and remote working tools, data centers are under immense pressure to expand their capacity. By the end of 2024, more than 207 billion devices are projected to be connected to the worldwide Internet of Things (IoT) network, creating an unprecedented demand for data processing and storage. This surge in connected devices means data centers must operate continuously at peak performance, making reliable backup power systems absolutely essential. The shift toward digital-first business models has made downtime catastrophically expensive, with some enterprises losing millions of dollars for every hour of service interruption. Cloud infrastructure services spending alone rose 20% year-over-year to USD 86 billion in the fourth quarter of 2024, demonstrating the massive scale of digital transformation driving generator demand.

-

Massive Tech Company Investments and Infrastructure Expansion

Technology giants are pouring unprecedented amounts of capital into data center infrastructure, creating a golden opportunity for generator manufacturers. Leading companies like Amazon, Google, Microsoft, and Facebook are constantly expanding their data center capacity to meet ever-increasing demand for cloud services and data processing. The numbers tell an incredible story: in 2021, there were 209 data center deals worth more than USD 48 billion, representing a 40% increase from the previous year's USD 34 billion. Private equity buyers have dramatically increased their involvement, accounting for over 90% of deal value in the first half of 2022. These massive investments aren't just about building more facilities – they're focused on creating technologically advanced, sustainable data centers that require cutting-edge generator technologies. Companies are implementing next-generation generating systems that improve efficiency, reduce emissions, and integrate seamlessly with renewable energy sources.

-

Regulatory Compliance and Government Mandates

Government regulations and industry standards are becoming increasingly stringent, creating mandatory requirements for robust backup power systems in data centers. The UK government launched comprehensive consultations in 2023 to protect and enhance data infrastructure security and resilience, with new laws making minimum requirements mandatory for data center operators. Compliance with standards such as the Uptime Institute's Tier Classification System requires data centers to have dependable power backup solutions to achieve specific certification levels. These requirements ensure that facilities can withstand power disruptions and continue operations without interruption. Environmental regulations aimed at reducing carbon emissions are also promoting the adoption of more efficient and environmentally friendly generator systems. The regulatory landscape is pushing data centers to invest not just in any backup power solution, but in advanced systems that meet strict performance, efficiency, and environmental standards.

How AI is Reshaping the Future of Data Center Generator Market

Artificial intelligence is revolutionizing the data center generator industry by introducing unprecedented levels of intelligence, automation, and predictive capability. AI-powered systems are transforming how generators operate, maintain themselves, and integrate with broader data center infrastructure. Machine learning algorithms now enable predictive maintenance that can forecast component failures weeks or months before they occur, dramatically reducing the risk of unexpected downtime and maintenance costs. These intelligent systems continuously analyze performance data, environmental conditions, and operational patterns to optimize generator efficiency and reliability.

Smart generator systems equipped with AI can automatically adjust power output based on real-time data center loads, weather conditions, and grid stability. This dynamic optimization ensures maximum efficiency while minimizing fuel consumption and emissions. AI-driven monitoring systems provide data center operators with unprecedented visibility into generator performance, allowing for proactive management and immediate response to potential issues. The integration of Internet of Things sensors with AI analytics creates comprehensive monitoring networks that can detect everything from minor vibrations to fuel quality changes.

The emergence of AI-powered energy management platforms is enabling data centers to orchestrate complex interactions between generators, renewable energy sources, and grid power. These systems can predict power demand patterns, automatically switch between power sources, and even participate in grid stabilization programs. As data centers increasingly support AI workloads themselves, the power demands are becoming more variable and intensive, requiring generator systems that can respond instantly to rapid changes in energy requirements.

Key Trends in the Data Center Generator Market

-

Edge Computing Revolution and Distributed Power Solutions

The explosive growth of edge computing is fundamentally changing the data center generator landscape, creating demand for smaller, more distributed power solutions. As businesses seek to reduce latency and improve processing speeds by bringing data closer to end users, they're establishing micro data centers in remote and geographically dispersed locations. By 2026, the edge computing market is estimated to reach USD 317 billion, with its footprint expected to expand significantly. This trend is driving unprecedented demand for generators with capacities less than 1MW, which currently dominate the market with a 56.5% share. These smaller, more agile generator systems are perfectly suited for edge data centers that need reliable backup power in locations where grid stability may be questionable. The scalability and flexibility of compact generators make them ideal for edge environments, where quick deployment and cost-effectiveness are crucial factors.

-

Sustainability Drive and Clean Energy Integration

Environmental consciousness and regulatory pressure are pushing the data center generator industry toward cleaner, more sustainable solutions. Companies are increasingly focused on reducing their carbon footprint while maintaining operational reliability. This trend is driving innovation in generator technologies that can integrate seamlessly with renewable energy sources and operate on cleaner fuels. The European Union's ambitious renewable energy targets – increasing from 32% to at least 42.5% of total energy consumption by 2030 – are creating strong demand for backup power systems that can complement intermittent renewable sources. Generator manufacturers are responding by developing systems that can run on biofuels, hydrogen, and other low-emission alternatives. The focus on sustainability isn't just about fuel sources – it's also driving improvements in generator efficiency, noise reduction, and overall environmental impact.

-

Tier I and II Data Center Dominance and SME Growth

The dominance of Tier I and II data centers, which currently hold 52.3% of the market share, reflects the massive growth in small and medium-sized enterprises embracing digital transformation. Small businesses make up 90% of businesses globally and create two out of every three jobs worldwide, according to the World Economic Forum. This vast ecosystem of smaller organizations is driving demand for cost-effective, reliable data center solutions that don't require the complexity and expense of higher-tier facilities. Tier I and II data centers are particularly attractive to SMEs, educational institutions, and local government offices because of their reduced initial setup and operational costs. As digital infrastructure continues to expand, especially in emerging economies, these lower-tier data centers often serve as the foundation for regional digital transformation, creating sustained demand for appropriately sized generator solutions.

Recent News and Developments

The data center generator market has experienced a wave of significant developments that underscore the industry's rapid evolution and growing strategic importance. Major technology companies and infrastructure investors are making unprecedented commitments to data center expansion, directly impacting generator demand and technology requirements.

Investment activity has reached remarkable levels, with private equity firms increasingly recognizing data centers as attractive assets with utility-like cash flows and strong risk-adjusted returns. The first half of 2022 saw 87 deals worth USD 24 billion, demonstrating sustained investor confidence in the sector's growth prospects.

Cybersecurity concerns are driving additional generator demand, as targeted attacks have escalated dramatically. APT detections rose 136% during the first quarter of 2025 compared to the previous quarter, highlighting the critical importance of maintaining continuous power even during security incidents. This escalation in cyber threats is compelling data centers to invest in more robust backup power systems that can maintain operations during extended emergency situations.

Regulatory developments are also shaping market dynamics. The U.S. government's commitment to invest USD 65 billion in broadband and 5G connectivity enhancement, particularly in rural areas, is creating new opportunities for edge data centers and their associated power infrastructure. By early 2024, over 75% of U.S. subscribers had 5G access, with major carriers continuing to expand coverage.

International expansion continues to accelerate, with Brazil's V.tal announcing a USD 1 billion investment in its new subsidiary, Tecto Data Centers, to support telecom operators and technology companies. This investment will expand data center capabilities in Brazil and Colombia, with a specific focus on cloud and streaming services.

Ask analyst for customized report: https://www.imarcgroup.com/request?type=report&id=4755&flag=E

Leading Companies Operating in the Global Data Center Generator Market Industry:

-

ABB Ltd

Atlas Copco (India) Ltd.

Caterpillar Inc.

Cummins Inc.

Deutz AG

Generac Power Systems Inc.

HITEC Power Protection

Kirloskar Oil Engines Limited

Kohler Co.

Langley Holdings plc

Mitsubishi Motors Corporation

Rolls-Royce plc

Yanmar Holdings Co. Ltd.

Data Center Generator Market Report Segmentation:

Breakup by Product:

-

Diesel (72.6% market share)

Natural Gas

Others

Breakup by Capacity:

-

Less than 1MW (56.5% market share)

1MW–2MW

Greater than 2MW

Breakup by Tier:

-

Tier I and II (52.3% market share)

Tier III

Tier IV

Regional Insights:

-

North America (37.5% market share, with United States holding 87.60% of North American market)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1-201-971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment