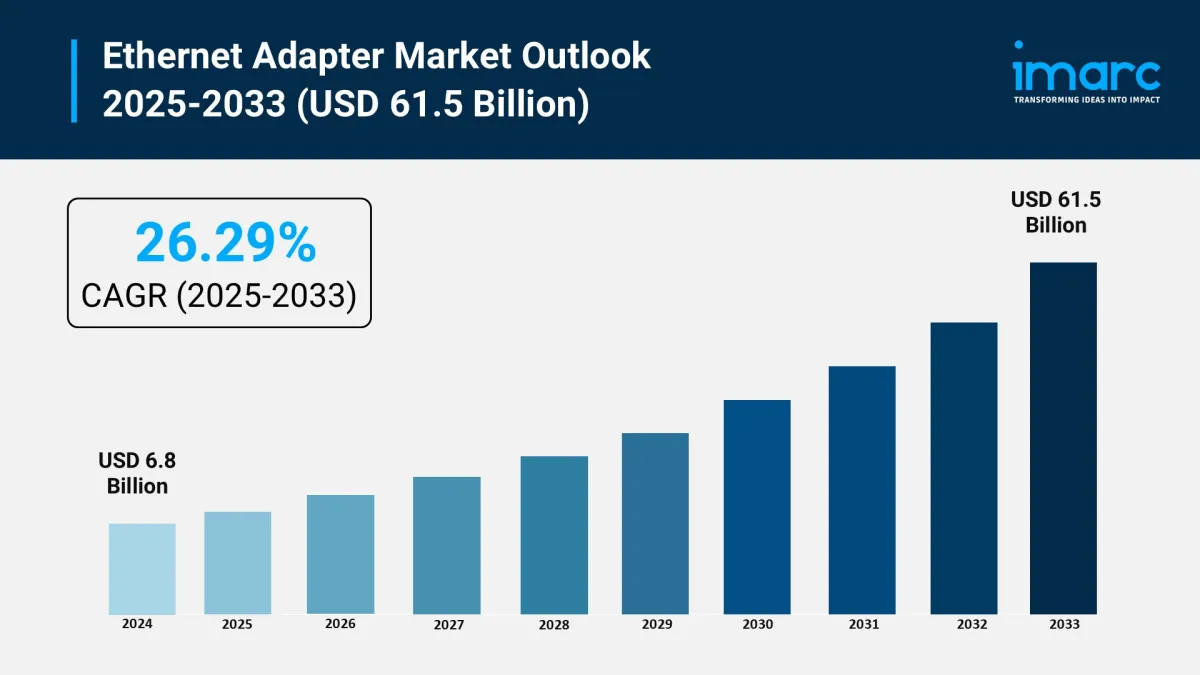

Ethernet Adapter Market Size To Reach USD 61.5 Billion By 2033 Grow CAGR By 26.29%

The ethernet adapter market is experiencing rapid growth, driven by surge in data center expansion, rise of iot and connected devices, and demand for high-speed internet connectivity. According to IMARC Group's latest research publication ,“ Ethernet Adapter Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033 “, The global ethernet adapter market size reached USD 6.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 61.5 Billion by 2033, exhibiting a growth rate (CAGR) of 26.29% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/ethernet-adapter-market/requestsample

Our report includes:

-

Market Dynamics

Market Trends And Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors Driving the Ethernet Adapter Industry

-

Surge in Data Center Expansion:

The boom in data centers is a huge driver for the ethernet adapter market. With businesses leaning hard into cloud computing, AI, and big data, the need for robust network infrastructure is skyrocketing. Data centers require high-speed ethernet adapters to handle massive data transfers with minimal latency. For instance, a major cloud provider recently reported handling over 100 petabytes of data daily, relying on advanced ethernet adapters for seamless connectivity. Government initiatives, like tax incentives for tech infrastructure in regions like Asia Pacific, are pushing companies to build more data centers. This demand fuels the need for adapters that support high-speed connections, like 100 GbE, ensuring stable and secure data flow across global networks.

-

Rise of IoT and Connected Devices:

The explosion of Internet of Things (IoT) devices is another big factor pushing ethernet adapter growth. From smart homes to industrial automation, billions of devices now need reliable, high-speed connections. A recent industry report noted over 15 billion IoT devices are active globally, each requiring stable networking solutions. Ethernet adapters provide the bandwidth and security these devices demand, unlike Wi-Fi, which can falter under heavy loads. Companies like Intel have launched new adapter lines specifically for IoT applications, ensuring low-latency data transfer for things like smart factory sensors. Government schemes promoting smart city projects, especially in India and China, are boosting demand for ethernet adapters to support interconnected urban systems, driving market growth as businesses and municipalities invest heavily in wired connectivity.

-

Demand for High-Speed Internet Connectivity:

Everyone's craving faster internet, and that's a massive boost for the ethernet adapter industry. With remote work, streaming, and online gaming on the rise, users need connections that don't lag or drop. Gigabit ethernet adapters, capable of speeds up to 1 Gbps, are now a go-to for homes and offices. A recent survey showed 70% of U.S. households prioritize wired connections for gaming and video calls due to their reliability. Companies like Broadcom are rolling out adapters supporting 10 GbE to meet this demand. Government broadband expansion programs, like those in the U.S. aiming for 93% broadband coverage, are pushing ethernet adapter adoption to ensure stable, high-speed access for both urban and rural users, fueling market growth.

Trends in the Global Ethernet Adapter Market

-

Power over Ethernet (PoE) Adoption:

Power over Ethernet (PoE) is taking off as a game-changer in the ethernet adapter market. PoE lets a single cable carry both data and power, simplifying setups for devices like IP cameras and smart lighting. Over 30% of new industrial installations now use PoE, according to industry insights, cutting costs and complexity. Companies like TP-Link have released PoE-enabled adapters that streamline deployments in offices and factories. This trend is especially big in smart buildings, where PoE supports energy-efficient systems. For example, a recent smart office project in Singapore used PoE adapters to power and connect 500+ devices, reducing wiring costs by 20%. As businesses prioritize efficiency, PoE's growth is reshaping how ethernet adapters are designed and deployed.

-

Integration with Advanced Security Protocols:

Security is a hot topic, and ethernet adapters are stepping up with built-in protections. With cyber threats spiking-over 2.6 billion personal records were exposed globally last year-adapters now include encryption and firewall features. Marvell's latest ethernet chips, for instance, embed advanced security protocols to safeguard data in industries like healthcare and finance. These adapters ensure secure data transfers for sensitive applications, like patient monitoring systems in hospitals, where real-time data sharing is critical. This trend is driven by the need for secure IoT and cloud connections, with businesses investing heavily in adapters that prevent breaches. As organizations prioritize data integrity, secure ethernet adapters are becoming a must-have, pushing innovation in the market.

-

Growth of Automotive Ethernet Applications:

Ethernet adapters are revving up in the automotive world, driven by connected and autonomous vehicles. Cars now use ethernet for in-vehicle networks, supporting features like advanced driver-assistance systems (ADAS). A single modern vehicle can require up to 10 ethernet adapters to manage data from cameras and sensors, with data rates hitting 1 GbE. Broadcom's automotive-grade adapters are being integrated into electric vehicles, enabling real-time communication for navigation and safety systems. For example, a leading carmaker recently deployed ethernet adapters in 100,000 vehicles to support 5G connectivity. As the automotive industry shifts toward smarter, connected cars, ethernet adapters are becoming critical, with manufacturers racing to develop rugged, high-speed solutions for this growing market.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=7494&flag=E

Ethernet Adapter Market Report Segmentation:

Breakup By Type:

-

External

Internal

Internal represents the largest segment due to its seamless integration with system hardware, offering higher performance and reliability compared to external options.

Breakup By Interface Type:

-

PCIe

OCP

USB

PCle holds the biggest market share owing to its low latency and superior bandwidth, making it the most widely used interface in Ethernet adapters.

Breakup By Port Configuration:

-

Single

Dual

Quad

Single represents the leading segment as it meets the basic connectivity needs of most users and applications without the added cost or complexity of multi-port configurations.

Breakup By Data Rate Per Port:

-

Up To 1 GbE

10 GbE

25 GbE

40 GbE

50 GbE

100 GbE

200 GbE

Up to 1 GbE accounts for the majority of the market share. It is popular for its affordability and sufficiency for the majority of general networking tasks.

Breakup By Application:

-

Servers

Embedded Systems

Consumer Applications

Routers and Switches

Desktop Systems

Others

Embedded systems exhibit a clear dominance in the market because Ethernet adapters are essential for integrating network connectivity in a wide range of industrial and consumer electronics.

Breakup By End Use:

-

Residential

Industrial

Commercial

Commercial represents the largest segment driven by the increasing number of businesses requiring high-performance networking solutions to support extensive information technology (IT) infrastructure and data-driven operations.

Breakup By Region:

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America's dominance in the ethernet adapter market is attributed to its advanced technological infrastructure, high cloud adoption rates, and strong presence of key market players.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment