Brazil Carbon Credits Market: Tech-Driven Growth And Green Transition

KEY HIGHLIGHTS

-

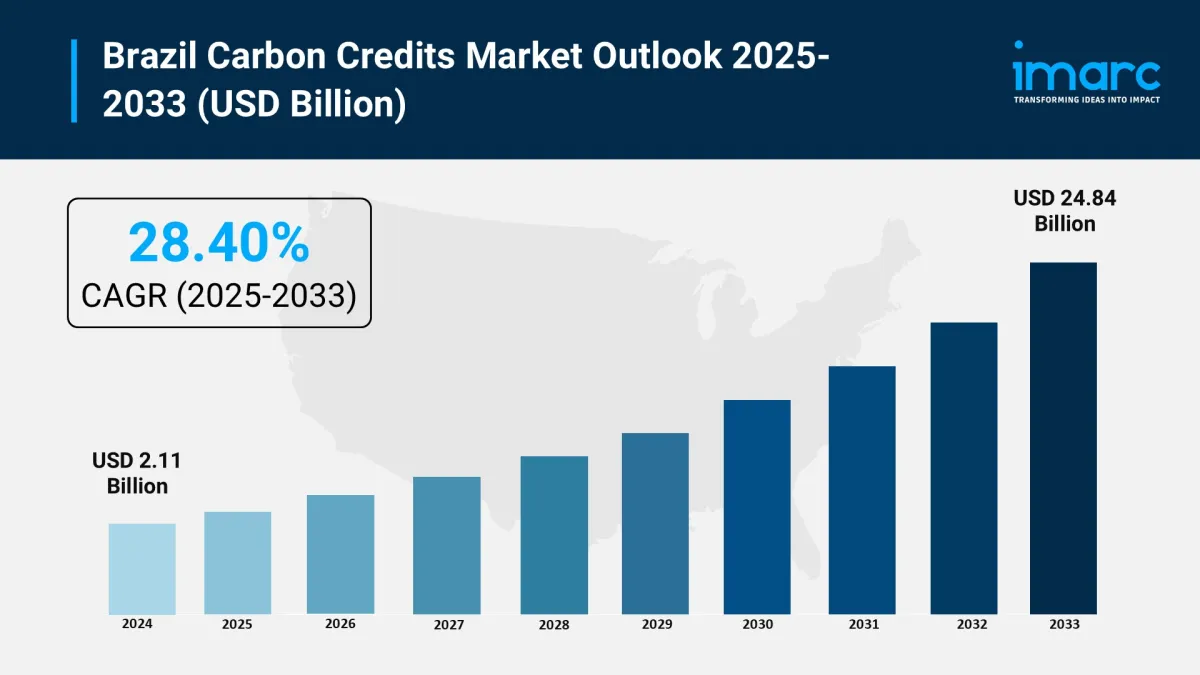

Market Size in 2024: USD 2.11 billion

Market Forecast in 2033: USD 24.84 billion

Market Growth Rate (2025-2033): 28.40%

Brazil is becoming a leader in the global carbon credits market due to its vast forests and renewable energy potential.

Strong government initiatives and engagement in climate agreements boost carbon trading activities.

The energy, manufacturing, and agriculture sectors need carbon offsets to meet sustainability goals.

Brazil's focus on reforestation and clean energy projects is creating a significant supply of credits.

Increased foreign investments and collaborations are driving market growth.

Advances in monitoring and verification technologies help ensure transparency in carbon credit projects.

Corporate ESG (Environmental, Social, and Governance) commitments are raising demand for voluntary carbon credits in Brazil.

Download a sample copy of the Report: https://www.imarcgroup.com/brazil-carbon-credits-market/requestsample

How Is AI Transforming the Brazil Carbon Credits Market?AI is reshaping the Brazil carbon credits market by enhancing accuracy and efficiency in carbon offset projects. AI tools monitor deforestation, assess carbon sequestration, and validate emission reduction efforts in real time. These technologies speed up verification processes and cut operational costs, making carbon credit trading more dependable. AI also helps companies predict market trends and optimize carbon credit portfolios, ensuring compliance with changing regulations. This integration positions Brazil as a leader in global carbon trading.

Key Impacts of AI on the Brazil Carbon Credits Market:

-

Real-time forest monitoring tracks deforestation and reforestation accurately.

Improved carbon measurement uses satellite imagery and predictive analytics.

Automated verification systems cut delays in credit certification.

Market trend forecasting leads to better pricing and trading strategies.

Enhanced data transparency boosts investor confidence and prevents fraud.

Optimized project selection relies on AI-driven environmental assessments.

The Brazil carbon credits market is growing quickly as the country utilizes its rainforest resources and regulatory measures to reduce carbon emissions. Global demand for high-quality carbon offsets, along with Brazil's commitment to sustainable forestry and renewable energy, drives this growth. Corporate net-zero targets, tougher environmental regulations, and rising interest in ESG practices also contribute. Furthermore, international partnerships and government programs enhance transparency, while innovations like satellite monitoring and blockchain improve credit verification and trading efficiency.

Key Trends and Drivers:

-

Global push for net-zero emissions increases demand for verified carbon credits.

Government regulations and climate policies support carbon offset projects.

Adoption of blockchain and AI enhances transparency and cuts fraud in trading.

Growing corporate ESG commitments lead to more investment in carbon markets.

Expansion of reforestation and renewable energy projects fosters sustainable credit generation.

International partnerships and funding speed up project development and certification.

Type Insights:

-

Compliance

Voluntary

The report analyzes the market based on these types.

Project Type Insights:

-

Avoidance/Reduction Projects

Removal/Sequestration Projects

-

Nature-based

Technology-based

End-Use Industry Insights:

-

Power

Energy

Aviation

Transportation

Buildings

Industrial

Others

Regional Insights:

-

Southeast

South

Northeast

North

Central-West

-

May 2025: AgriCapture launched its first rice carbon project in Brazil's Rio Grande do Sul with NatCap. It introduces methane-reducing irrigation methods, allowing local farmers to access international carbon markets and enhancing Brazil's role in nature-based credit generation.

December 2024: Brazil enacted Law 15,042/2024, creating the SBCE carbon market. This law targets 5,000 firms emitting over 10,000 tCO2/year, requiring emissions reporting and enabling carbon credit trading. It boosts regulatory clarity and positions Brazil as a key global player.

September 2024: Google purchased nature-based carbon removal credits from Brazilian startup Mombak. The goal is to buy 50,000 metric tons of carbon removal credits by 2030. Mombak collaborates with farmers to replant native species in the Amazon.

September 2024: Amazon and five other companies committed $180 million to buy carbon offset credits to protect the Amazon rainforest in Brazil's Para state. This investment will go through the LEAF Coalition, supporting forest conservation and local communities.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=32567&flag=C

About Us:

IMARC Group is a global management consulting firm helping ambitious changemakers make a lasting impact. We offer a wide range of market entry and expansion services, including market assessment, feasibility studies, company incorporation support, regulatory navigation, branding, marketing strategies, competitive analysis, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment