India Laptop Market Size, Share, Price Trends, Industry Growth, Analysis And Outlook 2025-2033

-

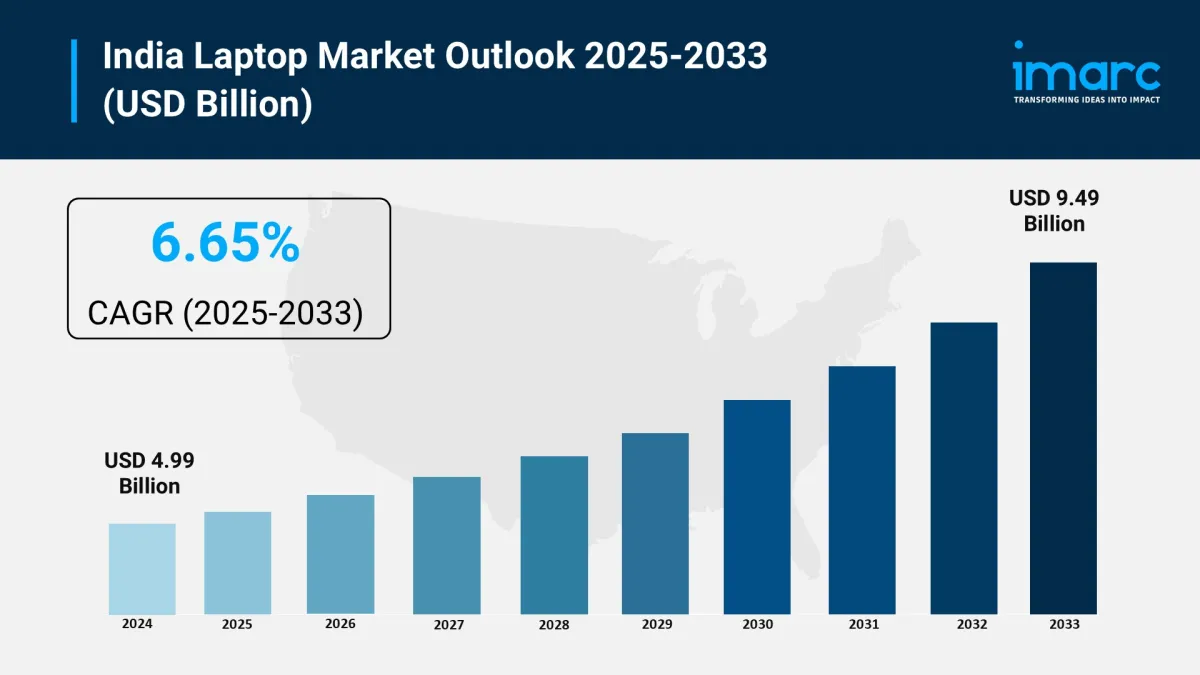

Market size (2024): USD 4.99 billion

Forecast (2033): USD 9.49 billion

CAGR (2025–2033): 6.65%

Driven by the surge in remote work and online education .

Increasing digital literacy and internet penetration across diverse regions.

Government initiatives supporting access to affordable technology .

Growing consumer interest in gaming and content creation requiring high-performance devices.

Key companies operating in the India Laptop market include Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Inc., HP Development Company L.P., Lenovo Group Limited, and Samsung Electronics Co. Ltd.

Request Free Sample Report: https://www.imarcgroup.com/india-laptop-market/requestsample

How Is AI Transforming the Laptop Market in India?AI is fundamentally changing how users interact with their laptops, enhancing performance, battery life, and overall user experience.

-

AI-Powered Performance Optimization: AI automatically manages CPU and GPU workloads, ensuring maximum power during demanding tasks (like gaming or video editing) and saving energy during lighter use, leading to improved efficiency and adaptability.

Extended Battery Life: AI-enabled battery management systems adapt to individual usage patterns, optimizing power consumption and preserving overall battery health.

Enhanced Security Features: AI drives improvements in adaptive facial recognition and biometric authentication, boosting accuracy, speed, and reliability for protecting sensitive information.

Personalized User Interface: AI customizes settings like screen brightness and audio levels by learning user preferences and adapting to the environment, enabling features like voice-activated assistants and instant language translation.

AI PCs with NPUs: The emergence of“ AI PCs ” equipped with Neural Processing Units (NPUs) allows for low-latency, on-device AI processing, extending battery life and enabling advanced AI features (e.g., historical search, automatic photo enhancement).

Impact on Resale Market: AI-powered features are influencing laptop resale trends through smart pricing algorithms and demand forecasting, optimizing the value of used devices.

-

Remote Work and Hybrid Learning Models: The permanent shift towards remote work and e-learning has made laptops indispensable for professionals and students, boosting demand for powerful and portable devices.

Digital India Initiatives: Government efforts promoting digital literacy and providing affordable computing devices in schools and rural areas are consistently generating demand.

Growth of Gig Economy and Freelancing: The rise of freelancing and online businesses is stimulating demand for high-performance laptops that support multitasking, creative usage, and cloud-based applications.

Expanding Gaming and Content Creation Segments: Increasing interest in online gaming and content creation fuels demand for laptops with improved graphics, high-speed processors, and better thermal performance.

Increased Internet and OTT Penetration: Widespread internet access and the popularity of Over-The-Top (OTT) platforms are driving demand for mid-segment laptops for entertainment and productivity.

Affordability and Financing Options: E-commerce growth and attractive financing offers (e.g., zero-cost EMIs, exchange offers) are making laptops more accessible to a broader consumer base.

Product Innovation: Manufacturers are continually introducing models with high battery life, enhanced graphics, thinner form factors, touchscreens, and India-specific features to cater to diverse consumer needs.

The report has segmented the market into the following categories:

Type Insights:

-

Traditional Laptop

2-in-1 Laptop

Design Insights:

-

Ultrabook

Notebook

Others

Screen Size Insights:

-

Up to 10.9′′

11′′ to 12.9′′

13′′ to 14.9′′

15.0′′ to 16.9′′

More than 17′′

Price Insights:

-

Less than INR 40,000

INR 40,000 to INR 80,000

More than INR 80,000

End Use Insights:

-

Personal

Business

Gaming

Others

Regional Insights:

-

North India

West and Central India

South India

East and Northeast India

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=20959&flag=C

Latest Development in the Industry-

Q1 2025: India's PC market experienced robust growth of 8.1% year-over-year , driven primarily by surging notebook demand and the emerging adoption of AI-powered computers, with AI notebooks showing impressive 185.1% growth .

August 2025: Dell Technologies launched a new lineup of“ AI PCs ” featuring Neural Processing Units (NPUs) designed to enhance performance, battery life, and user experience, signaling a major shift in computing.

July 2025: Maruti Suzuki announced plans to set up a network of charging stations across 100 cities to ease customer anxiety, indicating a broader shift towards digital solutions impacting overall tech consumption. (Note: While this specific development is for EVs, it reflects the general trend of digital infrastructure expansion that supports laptop demand).

May 2025: HP maintained its market leadership in the Indian PC market with a 29.1% share , excelling in both consumer and commercial segments, followed by Lenovo and Dell.

March 2025: Cashify highlighted how AI-powered features are changing laptop resale trends, using smart pricing algorithms and demand forecasting to optimize the value of used devices.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment