India Fasteners Market Size, Share, Trends, Industry Growth, Top Manufacturers And Report 2025-2033

-

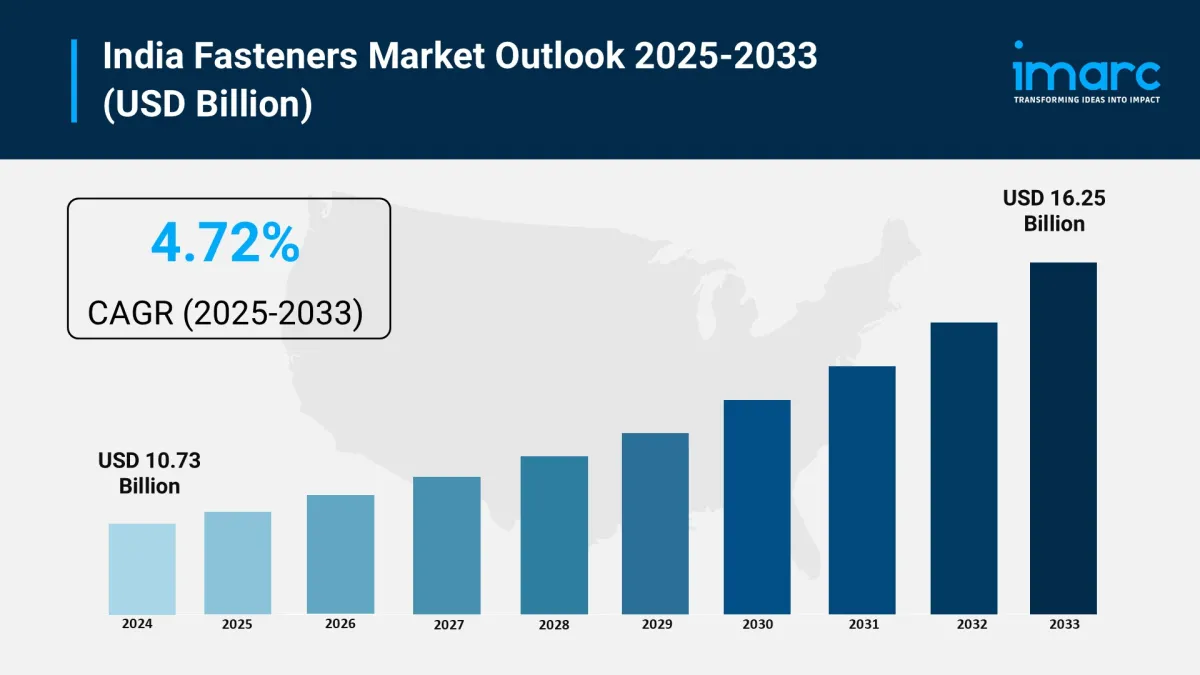

Market size (2024): USD 10.73 billion

Forecast (2033): USD 16.25 billion

CAGR (2025–2033): 4.72%

Driven by robust growth in the automotive, construction, and manufacturing industries.

Increasing demand for high-performance and lightweight fasteners .

Government support through initiatives like“ Make in India ” and Production Linked Incentive (PLI) schemes.

Growing focus on corrosion resistance and longevity in fastening solutions.

Request Free Sample Report: https://www.imarcgroup.com/india-fasteners-market/requestsample

How Is AI Transforming the Fasteners Market in India?

AI is increasingly being integrated into the fasteners market, primarily by optimizing manufacturing processes, enhancing product quality, and improving supply chain efficiency.

-

Automated Quality Control: AI vision systems and predictive analytics are used to identify micro-level defects in fasteners in real-time, significantly improving quality assurance and reducing waste.

Optimized Formulation and Design: AI can analyze material properties and simulate how different alloys and designs will perform, accelerating the development of new, high-performance, and lightweight fasteners (e.g., those made from aluminum, titanium, or composites).

Predictive Maintenance: AI leverages sensor data from manufacturing equipment to anticipate potential failures, reducing downtime and optimizing the maintenance schedules of machinery involved in fastener production.

Smart Fasteners: The emergence of“smart fasteners” with embedded sensors and IoT capabilities allows for real-time monitoring of tension, vibration, and environmental factors, enhancing safety and quality assurance in various applications.

Supply Chain and Inventory Optimization: AI tools are improving inventory management and logistics for fastener distributors by automating document processing (invoices, purchase orders), streamlining product categorization using AI-driven taxonomy, and providing real-time business insights.

-

Rapid Industrialization and Infrastructure Development: Massive investments in infrastructure projects (roads, railways, smart cities) and growth in the manufacturing sector are creating a strong demand for durable and high-strength fasteners.

Booming Automotive Sector: The increasing production of vehicles, particularly the growing demand for Electric Vehicles (EVs) , drives the need for specialized, lightweight, and high-performance fasteners.

“Make in India” Initiative and PLI Schemes: Government policies promoting domestic manufacturing are encouraging local production and increasing demand for industrial fasteners across various sectors.

Demand for High-Performance and Lightweight Materials: Industries like aerospace, automotive, and industrial machinery are increasingly adopting fasteners made from advanced materials (e.g., stainless steel, titanium, composites) for enhanced durability and fuel efficiency.

Focus on Corrosion Resistance: There's a rising emphasis on stainless steel and coated fasteners (zinc plating, hot-dip galvanization, polymer coatings) to ensure longevity and performance in challenging environments.

Automation and Precision Engineering: The shift towards automation and advanced manufacturing practices is driving the demand for sophisticated fastener solutions that offer precise assembly and high load-bearing capabilities.

Growth in Consumer Electronics and Appliances: The expanding consumer electronics and white goods industries are increasing the need for compact, application-specific, and aesthetically pleasing fasteners.

Organized Distribution Networks: The development of robust distribution channels and online platforms is improving the accessibility and availability of fasteners across different regions.

The report has segmented the market into the following categories:

Product Insights:

-

Internally Threaded

Non Threaded

Externally Threaded

Sales Channel Insights:

-

Online

Offline

End Use Insights:

-

Automotive

Building and Construction

Aerospace

Machinery

Electronics

Others

Regional Insights:

-

North India

South India

East India

West India

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=29864&flag=C

Latest Development in the Industry-

July 2025: India is increasingly emerging as a global fasteners manufacturing hub, driven by the surging demand for durable, precision-engineered fasteners across global markets and the country's ability to meet international standards at competitive prices.

March 2025: A five-year contract was signed for the supply of fasteners to a major aerospace OEM, highlighting the growing maturity and enhanced position of India's aerospace manufacturing sector in the global supply chain.

December 2024: India's Smart Cities Mission, a key driver for fastener demand in construction, reported that 91% of its projects, with an investment of approximately USD 17.7 billion, have been completed.

Early 2024: Fastener manufacturers are increasingly investing in advanced coating technologies and focusing on developing corrosion-resistant and environmentally friendly fasteners to meet evolving industrial demands and regulatory requirements.

Ongoing: The Indian government's continued focus on infrastructure development through various schemes is constantly increasing the need for high-quality fasteners in structural applications.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment