Market Analysis Report On Lumber Tarps In The USA

|

Size (ft) |

Core Application Scenario |

Typical Material Weight |

Price Range (USD) |

Special Design |

|

16×28 |

Short-distance delivery, lightweight lumber |

10–14 oz |

$85–95 |

Flat top, heat-sealed edges |

|

20×28 |

Local construction lumber delivery |

14–18 oz |

$105–115 |

Optional dome top, double-stitched edges |

|

24×28 |

Large equipment, oversized lumber transport |

18 oz+ composite |

$132–142 |

Dome top, wind tubes, D-ring reinforcement |

II. Application Scenarios and Model Matching

Lumber Transport and Logistics

Long-Distance Cross-State Transport: 24 ft × 28 ft dome-top (18 oz+ composite), wind-resistant and reduces water pooling. Example: Forestry to processing plant routes.

Rail Intermodal: 20 ft × 28 ft heavy-duty (610 gsm), requires ASTM tear resistance certification for multi-handling friction.

Steel and Coiled Material Transport

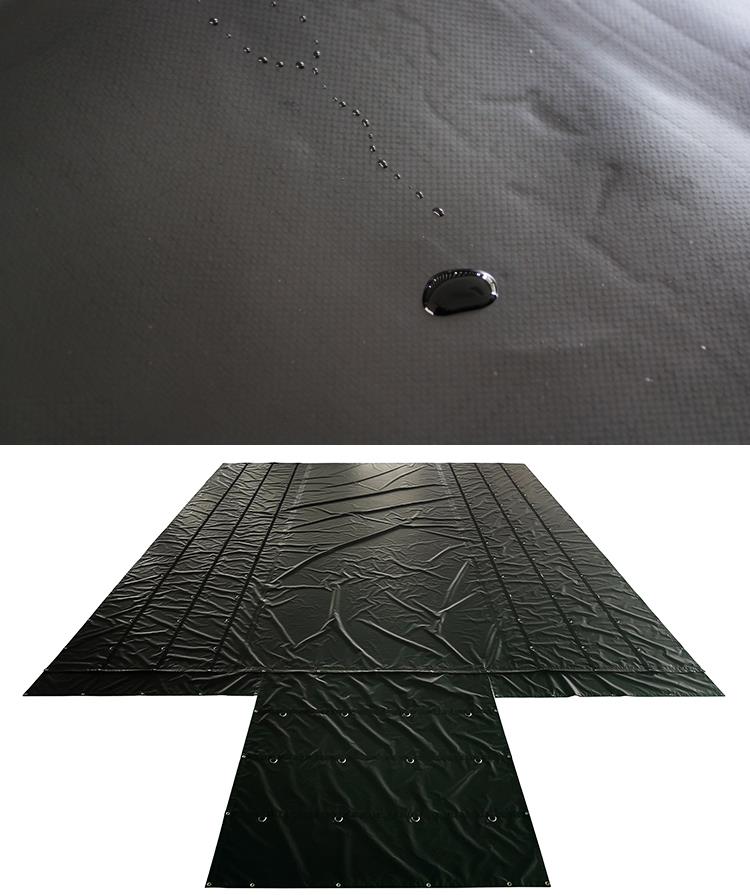

Steel Coils (Coil Tarp): 30 ft × 30 ft square design, 18×18 base fabric density, brass grommets for cable fixation to prevent rolling.

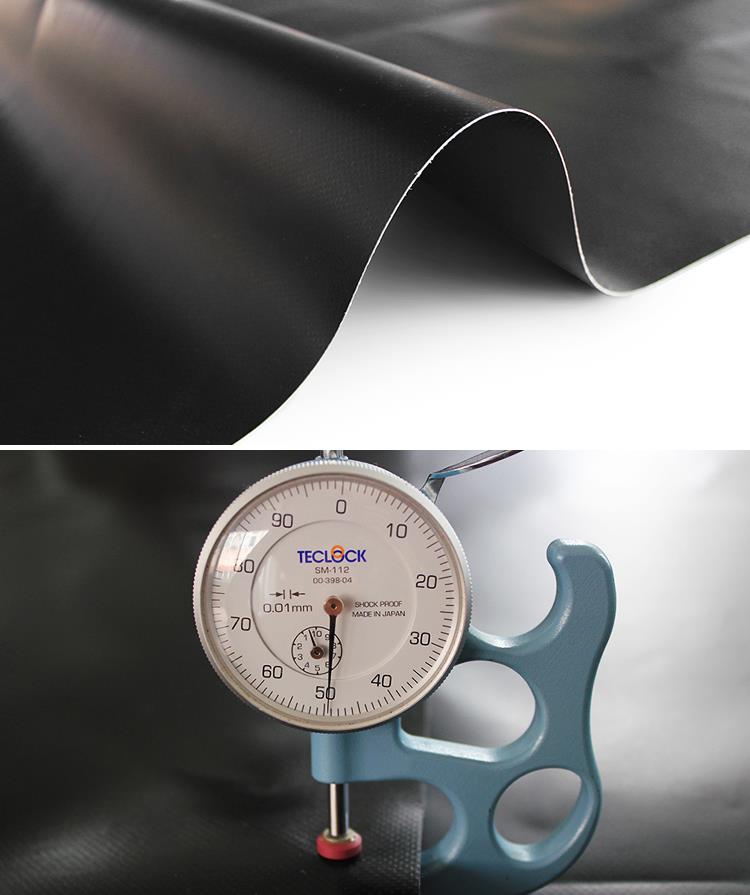

Heavy Machinery: Custom 12 ft × 24 ft vinyl tarp (20 mil thickness), heat-sealed seams for waterproofing, suitable for precision equipment.

Construction and Field Scenarios

Temporary Storage: Lightweight 16 ft × 28 ft tarp (10 oz) for open-yard coverage, lower cost than heavy-duty models.

Forestry Staging Areas: 18 oz green custom tarps (weatherproof labeling), adaptable to humid, multi-terrain environments.

III. Market Trends and Demand Drivers

Construction Industry Driving Standardization: Rising housing starts have made 16/20/28 ft sizes the industry default, accounting for over 60% of manufacturer capacity.

Growing Demand for High-Strength Materials: Due to high wear rates in hardwood transport, orders for 18 oz+ composite fabrics (e.g., 1000D×1300D polyester) are increasing by 15% annually.

Cost and Regulatory Pressures: Small transport firms prefer 11 oz ripstop and 14 oz basic models, while California mandates flame-resistant (NFPA-701) models with a 30% premium.

IV. Competitive Landscape

Leading Suppliers: Chinese manufacturers dominate the OEM market, with daily production capacity exceeding 200,000 sq. meters, favored by price-sensitive buyers.

Local Brand Differentiation: U.S. distributors focus on dome design + localized service, charging a 50% premium but offering rapid replacement guarantees.

Conclusion

The U.S. Lumber Tarp market's differentiation centers on scenario-driven model adaptation:

Size standardization (16/20/24×28 ft) meets basic lumber logistics, material upgrades (18 oz+ composites) address high-wear scenarios, and specialized designs (dome tops/grommets/flame resistance) cater to niche demands.

Future competition hinges on: 1. Production flexibility amid construction cycles; 2. Breakthroughs in high-end models (e.g., -40°C cold-resistant); 3. Localized distribution service integration; 4. Strength improvements in low-weight materials.

More about pvc tarpaulin manufacturer

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment