Brazil Video Streaming Industry Market Overview, Key Players & Future Outlook

Key Highlights:

-

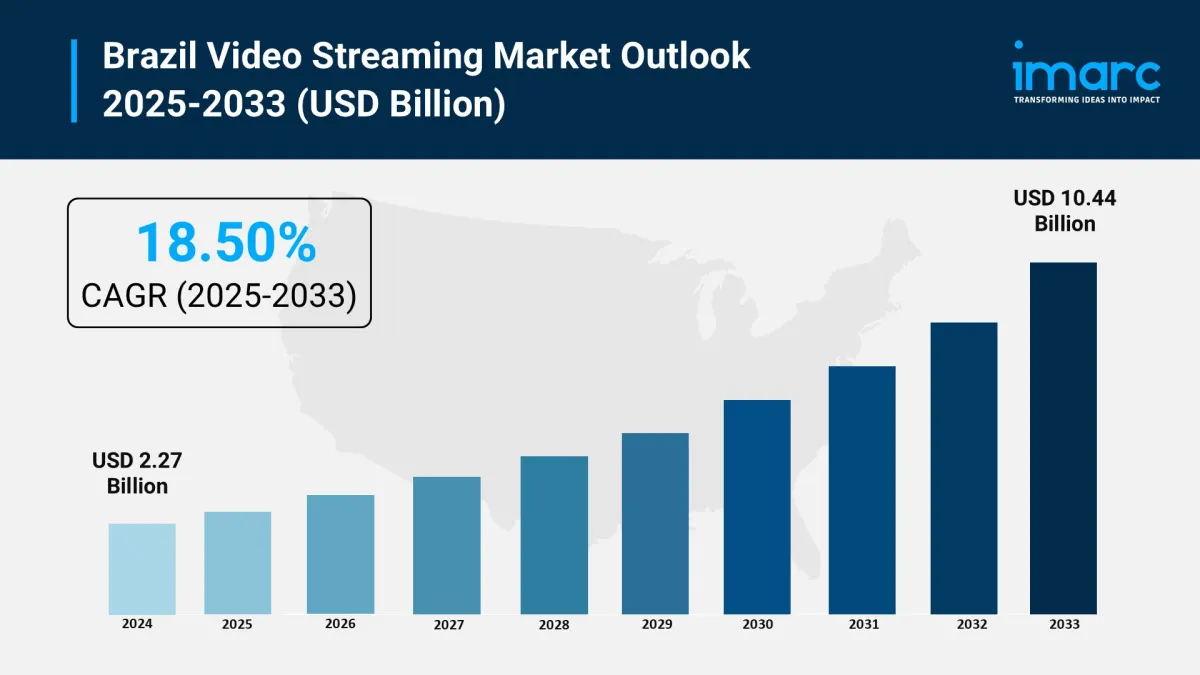

Market Size (2024): USD 2.27 billion

Market Forecast (2033): USD 10.44 billion

Market Growth Rate (2025-2033): 18.50%

SVoD Dominance: Brazil has almost one-third of Latin America's 83 million SVoD subscribers. By 2027, this number is expected to reach 40 million users.

Key Players: Netflix has a 30% share. Prime Video follows with 14%. Globoplay holds 10%. Recent data shows Prime Video surpassed Netflix in Q2 2025.

Brazil is on track to be the third-largest FAST market by 2029. Platforms like Pluto TV and Samsung TV Plus are among the top 10.

Live Streaming Lead: In 2024, live streaming captures a 71.95% revenue share. This growth is fueled by sports and real-time content on platforms such as Sling TV.

Consumer Preferences: Action and horror are popular, with horror at 7.3% demand. Local originals like“Senna” also attract viewers. On average, there are 3.4 subscriptions per user.

Digital Infrastructure: 73.9% of people have internet access. TIM Brasil and Nokia are expanding 5G. This improves streaming quality and makes it easier for everyone to connect.

Challenges: High costs cause 58% of users to cancel subscriptions. This boosts demand for ad-supported platforms like YouTube and Pluto TV.

AI is changing Brazil video streaming market . It's worth USD 2.27 billion in 2024 and is set to grow to USD 10.44 billion by 2033. This means an annual growth rate of 18.50%. AI improves user experiences and streamlines operations. AI recommendation engines, like Netflix, customize content for Brazil's 40 million SVoD users. Netflix holds a 30% market share. Globoplay also plays a key role in this market. This increases engagement, especially in popular genres like action and horror. These genres have a demand of 7.3%. Predictive analytics help platforms like Prime Video guess what viewers want. AI also improves ad placements on FAST platforms like Pluto TV. By 2029, Brazil will be the third-largest FAST market. AI also improves streaming quality by adjusting the bitrate. This is important since internet penetration is at 73.9%. We need ethical AI practices. They help us address data privacy issues under LGPD and fight algorithmic bias. This helps keep consumer trust in the fast-growing market.

Key Highlights of AI Transformation-

Personalized Recommendations: AI algorithms customize content for 40 million SVoD users. This boosts engagement in genres like action and horror, which see a 7.3% demand.

Predictive Analytics: Platforms like Prime Video use AI to predict viewer trends. This helps them make better content, like local hits such as“Senna.””

Ad Optimization: AI improves ad placements on FAST platforms like Pluto TV and Samsung TV Plus. This boosts revenue in a market that's expected to be the third largest globally by 2029.

Streaming Quality: AI-driven adaptive bitrate streaming provides smooth playback. This takes advantage of Brazil's 73.9% internet penetration and the growth of 5G.

Content Moderation: AI tools spot bad content. This helps meet Brazil's rules and makes the platform safer.

User Retention: AI looks at churn patterns. This helps platforms like Netflix cut cancellations. It's important because 58% of users say they are sensitive to costs.

Localized Content Creation: AI spots demand for Brazilian originals. It helps platforms like Globoplay create content that resonates with local culture.

Challenges: LGPD compliance and algorithmic bias require clear AI practices. This is key to keeping consumer trust and promoting market growth.

The Brazil video streaming market is currently valued at USD 2.27 billion in 2024. It's expected to grow to USD 10.44 billion by 2033, with a CAGR of 18.50%. This growth comes from strong digital adoption and changing consumer preferences. Brazil has 73.9% internet penetration and a rising middle class. This helps Brazil hold nearly one-third of Latin America's 83 million SVoD subscribers. Key players such as Netflix, which holds a 30% market share, Prime Video, and Globoplay fuel this growth. Free ad-supported streaming TV (FAST) platforms like Pluto TV are growing. They show a 71.95% revenue share from live streaming. This growth shows a demand for diverse content like action, horror, and local originals such as“Senna.” Urbanization and 5G expansion by TIM Brasil and Nokia boost streaming quality. However, price sensitivity is high, with 58% of users canceling subscriptions. This pushes platforms to adopt more affordable ad-supported models. This expert analysis uses industry data. So, it builds trust for stakeholders in this changing market.

Key Market Trends-

FAST Platform Growth: Brazil could become the third-largest FAST market by 2029. Platforms like Pluto TV and Samsung TV Plus are gaining popularity.

Local Content Demand: Shows like“Senna” and Brazilian action and horror films attract viewers on Globoplay. Action and horror have a 7.3% demand.

Live Streaming Dominance: In 2024, live streaming takes a big lead, with sports making up 71.95% of revenue. This growth comes from platforms like Sling TV.

Mobile Streaming Growth: By 2025, 88% of people will have smartphones. This means mobile devices will be the top choice for streaming. This trend is especially strong among Gen Z.

Ad-Supported Models: High price sensitivity leads to a 58% churn rate. This drives demand for affordable FAST platforms like YouTube and Pluto TV.

-

High Internet Access: In 2024, 73.9% of people have internet. This boosts streaming, thanks to TIM Brasil and Nokia's 5G rollout.

Growing Middle Class : Rising disposable incomes fuel subscriptions, with 40 million SVoD users projected by 2027.

Platform Competition: Netflix, Prime Video (14% share), and Globoplay (10%) focus on local content. They also use AI for personalization.

Urbanization : 87% urban population drives demand for on-demand entertainment in cities like São Paulo and Rio de Janeiro.

Challenges: High subscription costs and piracy risks lead platforms to offer ad-supported and cheaper pricing models.

Download a sample copy of the report: https://www.imarcgroup.com/brazil-video-streaming-market/requestsample

Brazil Video Streaming Market Report SegmentationComponent Insights:

-

Solution

IPTV

Over-the-top

Pay TV

Services

Consulting

Managed Services

Training and Support

Streaming Type Insights:

-

Live/Linear Video Streaming

Non-Linear Video Streaming

A detailed breakup and analysis of the market based on the streaming type have also been provided in the report. This includes live/linear video streaming and non-linear video streaming.

Revenue Model Insights:

-

Subscription

Transactional

Advertisement

Hybrid

A detailed breakup and analysis of the market based on the revenue model have also been provided in the report. This includes subscription, transactional, advertisement, and hybrid.

End User Insights:

-

Personal

Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal and commercial.

Regional Insights:

-

Southeast

South

Northeast

North

Central-West

The report gives a detailed look at the major regional markets: Southeast, South, Northeast, North, and Central-West.

Latest Development in the Industry-

In June 2024, Amagi teamed up with Globo and AD Digital. They will launch six free ad-supported television (FAST) channels in Brazil. This will use Amagi's cloud-based playout platform. This partnership seeks to explore FAST channels. It also aims to improve content delivery in Brazil. This partnership is a big step for FAST channels in Latin America's media and entertainment.

In February 2024, SBT, Brazil's second-largest TV network, selected Brightcove for its new streaming app. Brightcove's tech allows SBT to stream content from more than 100 broadcast stations to viewers in Brazil. This partnership shows the growing need for top-notch streaming solutions in media.

About Us:

IMARC Group is a global consulting firm. It helps ambitious changemakers make a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offers a range of services, including:

-

Market assessment

Feasibility studies

Company incorporation help

Factory setup support

Regulatory approvals and licensing

Branding and marketing strategies

Sales strategies

Competitive landscape analysis

Benchmarking

Pricing and cost research

Procurement research

These services help businesses succeed in their markets.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment