Exploring Brazil Food Delivery Market - Key Players, Trends & Demand Drivers

Key Highlights

-

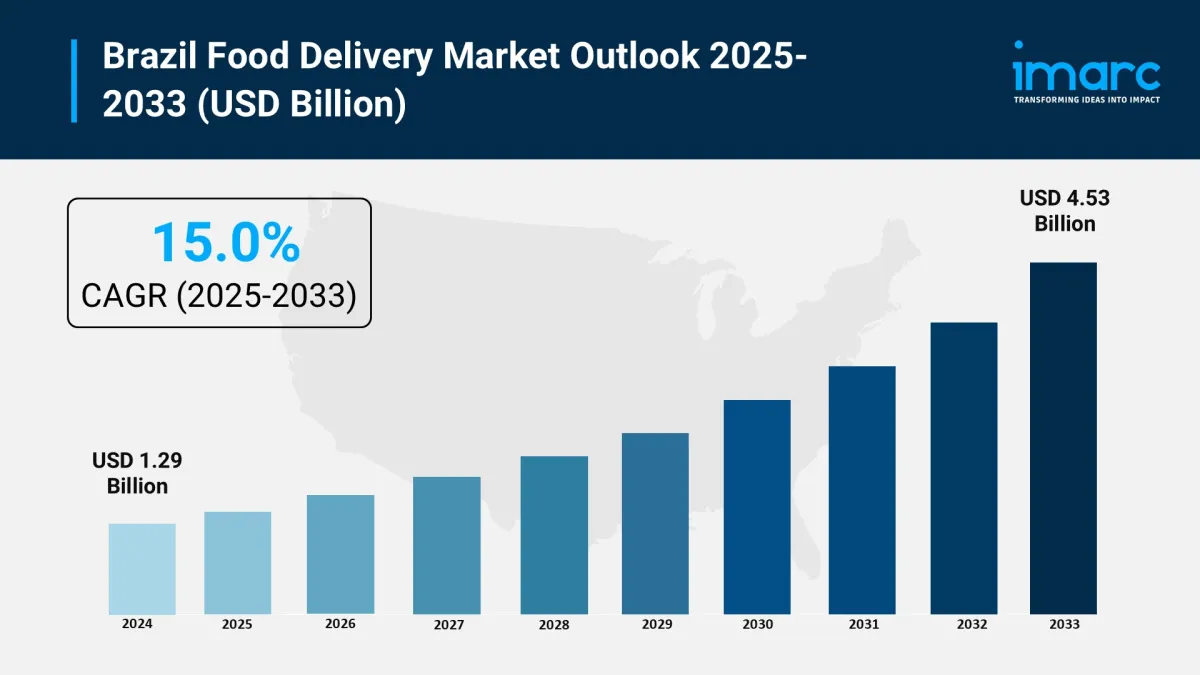

Market Size (2024) : USD 1.29 billion

Market Forecast (2033) : USD 4.53 billion

CAGR (2025-2033) : 15.0%

Digital Penetration: By 2025, 92.5% of homes will have internet access. Also, 88% will own smartphones. There will be 55 million active delivery app users.

Consumer Trends : 53.12% of consumers use delivery apps weekly. Gen Z prefers fast food and traditional Brazilian dishes like pizza and açaí.

Tech Advances: AI tools like geolocated ads and real-time tracking boost user experience. Cloud kitchens are expected to grow at a 16% CAGR from 2024 to 2029.

Competitive Landscape: New players such as Meituan's Keeta and Didi's 99Food are now in the mix. They compete with iFood, Uber Eats, and Rappi. iFood is investing R$17 billion through 2026 to enhance competition.

Health-Conscious Menus: Over half (53%) of middle-class consumers want organic or low-preservative foods. So, delivery platforms are adding healthier options.

Artificial Intelligence (AI) is transforming Brazil food delivery market . It improves operations, enhances customer experiences, and drives competition. Valued at USD 1.29 billion in 2024, the market is projected to reach USD 4.53 billion by 2033, growing at a CAGR of 15.0%.

AI innovations include:

-

Predictive analytics for demand forecasting.

Dynamic pricing

Faster delivery routes.

iFood, with an 87% market share, uses AI. This helps personalize menus and improve order tracking. It serves 55 million active delivery app users. AI also aids cloud kitchens by streamlining operations and reducing costs. Challenges like data privacy and rural infrastructure need attention. They are crucial for ongoing growth.

Key Highlights of AI Transformation

-

Predictive Analytics: AI predicts demand. This helps platforms like iFood manage inventory and staffing. It also cuts down on waste.

Route Optimization: AI makes delivery routes better. It can cut times by up to 20% and solve logistical problems.

Personalized Customer Experience: AI suggests menus based on what users like. About 53.12% of consumers order weekly.

Dynamic Pricing: AI changes prices in real time based on demand. This helps platforms like Uber Eats and Rappi increase revenue.

Cloud Kitchen Efficiency: AI automates order processing and manages resources. This helps cloud kitchens grow at a 16% CAGR from 2024 to 2029.

Chatbots and Automation: AI chatbots quickly answer customer questions. This speeds up response times and boosts satisfaction for 12.1 million users each week.

Health-Conscious Menus: AI looks at trends to show healthier choices. This matches the 53% of middle-class consumers who prefer organic foods.

Challenges: We need ethical AI practices. These will help with data privacy rules and improve slow internet in rural areas. We also need investment for fair growth.

The Brazil food delivery market is booming. This growth comes from new consumer habits and tech advances. Valued at USD 1.29 billion in 2024, it is expected to reach USD 4.53 billion by 2033, with a CAGR of 15.0%. By 2025, 92.5% of households will be online. Smartphone use will reach 88%. iFood leads the market with an 87% share and serves 55 million active users.

Cloud kitchens and health-focused menus show what consumers want: convenience and nutrition. 53% of middle-class Brazilians choose organic options. AI innovations like route optimization and personalized menus enhance user experiences. New entrants like Meituan's Keeta increase competition. This growth shows skill in digital solutions and market trends. It relies on trustworthy data from industry reports.

Urbanization and busy lifestyles drive the Brazil food delivery market forward. 53.12% of consumers use apps weekly. Gen Z especially favors fast food and traditional dishes like açaí and pizza. iFood's strong digital infrastructure drives its growth. With 12.1 million weekly users, it shows its authority. Social media promotions and government backing for digital economies enhance trust.

Cloud kitchens are expected to grow by 16% each year from 2024 to 2029. They help reduce restaurant costs. This makes delivery more affordable for everyone. Challenges still exist. Cold chain issues and high fees can hit small businesses hard. They can take up to 70% of sales. This analysis uses recent market data. It shows how urbanization and technology shape food delivery in Brazil.

Health awareness is changing Brazil's food delivery market, just like in other countries. Consumers, especially the middle class, seek healthier options. Fifty-three percent prefer low-preservative or organic meals. Platforms are reacting by providing healthy menus. AI insights help them understand what consumers want. Brazil's rich biodiversity allows for unique offerings, like superfood dishes.

iFood's R$17 billion investment by 2026 shows commitment. It also strengthens its authority in the industry. Real-time tracking and chatbots help build trust and satisfaction. They also address issues like rural delivery gaps. Trusted sources show how health trends and technology affect Brazil's food delivery market.

Download a sample copy of the report: https://www.imarcgroup.com/brazil-food-delivery-market/requestsample

Brazil Food Delivery Market Report SegmentationBusiness Model Insights:

-

Order Focused

Logistics Based

Full Service

The report offers a detailed analysis of the market based on business models.

Order Type Insights:

-

Online

Offline

The report breaks down the market by order types.

Payment Method Insights:

-

Online

Cash On Delivery

The report includes a detailed analysis based on payment methods.

Platform Type Insights:

-

Mobile Application

Websites

Others

The report also analyzes the market based on platform types.

Regional Insights:

-

Southeast

South

Northeast

North

Central-West

The report provides a comprehensive analysis of major regional markets.

Latest Developments in the Industry-

May 2025: Meituan announced a $1 billion investment. This will help launch its Keeta food delivery app in Brazil. This move signals Meituan's global expansion.

May 2025 : Uber and iFood formed a strategic partnership in Brazil. Users can access each other's services within their apps.

About Us

IMARC Group is a global consulting firm. We help changemakers make a lasting impact.

We offer market entry and expansion services. These include:

-

Market assessments

Feasibility studies

Incorporation assistance

Factory setup support

Regulatory approvals

Branding

Marketing strategies

Competitive analysis

Procurement research

Each service helps businesses grow and succeed in new markets.

Contact Us

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment