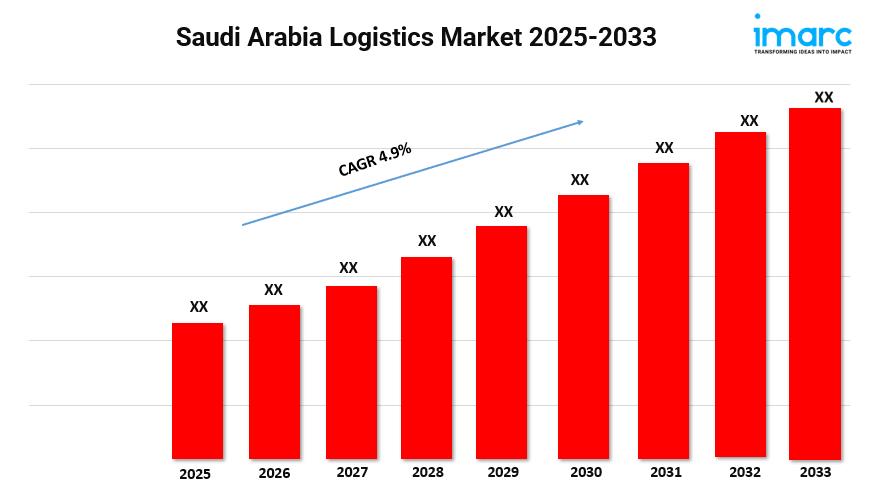

Saudi Arabia Logistics Market Size To Hit $81.2 Billion By 2033 At A CAGR Of 4.9%

Market Size in 2024: USD 52.7 Billion

Market Size in 2033: USD 81.2 Billion

Market Growth Rate 2025-2033: 4.9%

According to IMARC Group's latest research publication, “Saudi Arabia Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033” , The Saudi Arabia logistics market size was valued at USD 52.7Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 81.2 Billion by 2033, exhibiting a CAGR of 4.9% from 2025-2033.

Growth Factors in the Saudi Arabia Logistics Market

-

Strategic Infrastructure Investment

One of the biggest drivers powering Saudi Arabia's logistics industry is the country's massive investment in infrastructure. Consider this: new logistics centers are being built across more than 100million square meters nationwide, with over 21 centers currently underway and a total of 59 planned. These centers are strategically spread in regions like Riyadh, Makkah, and the Eastern Province, boosting not only cross-country connectivity but also trade. On top of that, Saudi ports and airports have seen expansions, like at Jeddah Islamic Port and King Salman International Airport, making the movement of goods faster and more efficient than ever. The unified logistics license has allowed more than 1,500 companies-local, regional, and international-to actively participate in the Saudi market, signaling continuous growth and diversification.

-

Vision 2030 and Proactive Government Policies

Saudi Arabia's Vision 2030 is at the heart of the logistics boom, fueling the industry with strong government-led reforms and incentives. The National Transport and Logistics Strategy (NTLS) is rolling out streamlined customs procedures, integrated digital solutions, and public-private partnerships aimed at propelling Saudi Arabia to the top 10 in the Logistics Performance Index. Recently, the government launched 15 new incentives through the Authorized Economic Operator (AEO) program, offering perks like access to industrial land, tax relief, and financing that covers up to 75% of project costs. These programs are simplifying business, attracting international players, and encouraging SMEs by providing long-term leases, fast customs clearance, and dedicated support-making the logistics sector more accessible and dynamic than ever.

-

E-Commerce Explosion and Tech Innovation

The rapid growth of e-commerce in Saudi Arabia is reshaping the logistics landscape. With the e-commerce market racing toward the $623billion mark, the demand for last-mile delivery, real-time tracking, and flexible warehousing has never been higher. Logistics providers are responding by embracing advanced tech, such as AI-powered sorting, automated warehouses, and IoT for real-time shipment visibility. In just one recent quarter, Saudi Arabia delivered over 50million parcels-a number that speaks volumes about both the industry's scale and digital transformation. These tech-fueled trends aren't just about speed and convenience; they're raising consumer expectations, driving operational efficiency, and bringing logistics companies and customers closer than ever.

Key Trends in the Saudi Arabia Logistics Market

-

Green Logistics and Sustainable Solutions

Sustainability has quickly become a top priority for the Saudi logistics sector. Companies are investing in energy-efficient vehicles, deploying electric trucks on key delivery routes, and introducing automated systems to reduce energy consumption in warehouses. Major ports like King Abdullah Port now operate with automated handling, helping cut emissions and lower operational costs. These green moves are closely tied to Vision 2030's pledge for responsible growth, with logistics companies integrating recycling programs, solar panels, and sustainable packaging into their daily operations. The result isn't just an environmental win but a boost to the Kingdom's global image and appeal for eco-conscious trade partners.

-

Rise of Integrated Logistics Zones and Hubs

Integrated logistics zones are transforming how the industry moves and stores goods. Take the new Tawreed distribution hub in the Riyadh Integrated Logistics Zone, which spans over 39,000sqm and offers bonded storage, high-volume operations, and seamless links to neighboring GCC countries. These hubs are designed to cut delivery times, optimize inventory, and enhance service for both online and offline retailers. The incentives that come with these zones-like 50-year tax relief, zero corporate income tax, and full foreign ownership-are drawing major global brands and regional champions, helping Saudi Arabia cement its position as a true logistics powerhouse.

-

Digitalization and Automation Across the Supply Chain

The logistics sector is seeing a digital revolution, with companies deploying AI, big data analytics, and blockchain for smarter, more secure supply chains. Automation is now everywhere, from sorting parcels to route optimization and customs approval, resulting in lower costs and lightning-fast deliveries. Companies are rolling out advanced solutions like real-time tracking for all shipments, temperature-controlled logistics for pharmaceuticals, and automated billing to remove human bottlenecks. These digital improvements make it possible to handle surges in e-commerce demand and position Saudi logistics firms at the cutting edge of global supply chain management.

Saudi Arabia Logistics Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Model Type:

-

2 PL

3 PL

4 PL

Analysis by Transportation Mode:

-

Roadways

Seaways

Railways

Airways

Analysis by End Use:

-

Manufacturing

Consumer Goods

Retail

Food and Beverages

IT Hardware

Healthcare

Chemicals

Construction

Automotive

Telecom

Oil and Gas

Others

Regional Analysis:

-

Northern and Central Region

Western Region

Eastern Region

Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Future Outlook

Looking ahead, Saudi Arabia's logistics industry is set to go from strength to strength, thanks to a winning blend of bold government vision, advanced infrastructure, and digital transformation. As investments pour into logistics centers, green solutions, and next-gen tech, the sector is poised to scale new heights, supporting everything from e-commerce giants to small manufacturers. With comprehensive incentives and a focus on sustainability, Saudi Arabia is actively working to bridge the gap with leading global players, all while generating thousands of new jobs and drawing international brands into its logistics ecosystem. By embracing innovation and collaboration, the industry isn't just keeping pace with global trends-it's well on its way to making the Kingdom a global trade and supply chain leader.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment